Best AI tools for< Assess Financial Impact >

20 - AI tool Sites

Darrow

Darrow is an AI-powered justice intelligence platform that helps lawyers discover high-value, impactful cases. It uses AI to sift through publicly available information and connect relevant data points to detect legal violations, predict their outcomes, and assess their financial impact. This helps lawyers streamline business development and focus on what they do best: fight for justice.

Quantifind

Quantifind is an AI-powered financial crimes automation platform that specializes in Anti-Money Laundering (AML) and Know Your Customer (KYC) solutions. It offers end-to-end automation impact, best-in-class accuracy, and powerful APIs and applications for risk screening, investigations, and compliance in the financial services and public sector industries. Quantifind's Graphyte platform leverages AI and external data to streamline AML-KYC processes, providing comprehensive data coverage, dynamic risk typologies, and seamless integrations with case management systems.

ThroughPut AI

ThroughPut AI is a supply chain decision intelligence and analytics platform designed for outcome-driven supply chain decision-makers. It provides accurate demand forecasting, capacity planning, logistics management, and financial insights to drive business results. ThroughPut AI offers a single source of truth for supply chain professionals, enabling them to make faster, better, and confident decisions. The platform helps unlock efficiency, profitability, and growth in day-to-day operations by providing intelligent data-driven recommendations.

LunarCrush

LunarCrush is a social media analytics and investment research platform that helps investors make better decisions. It tracks social media activity across multiple platforms to identify trends and sentiment around cryptocurrencies and other digital assets. LunarCrush also provides a variety of research tools, including charting, technical analysis, and news feeds.

b-cube.ai

b-cube.ai is an AI application that provides services related to crypto-assets. The platform is currently impacted by the EU's MiCA regulation, leading to a halt in new registrations and a planned cessation of operations. Existing users can access unstaking services until the platform shuts down. The company is considering operating under a new regulatory framework outside the EU. b-cube.ai s.r.l holds the rights to the platform from 2022 to 2025.

MindBridge

MindBridge is a global leader in financial risk discovery and anomaly detection. The MindBridge AI Platform drives insights and assesses risks across critical business operations. It offers various products like General Ledger Analysis, Company Card Risk Analytics, Payroll Risk Analytics, Revenue Risk Analytics, and Vendor Invoice Risk Analytics. With over 250 unique machine learning control points, statistical methods, and traditional rules, MindBridge is deployed to over 27,000 accounting, finance, and audit professionals globally.

Opesway

Opesway is an AI-powered financial planning platform that offers a comprehensive solution to help users achieve financial freedom and manage their wealth effectively. The platform provides tools for retirement planning, investment assessment, budget management, debt analysis, and various forecasting tools. Opesway uses AI technology to simplify financial management, make budgeting and investment decisions, and provide personalized insights. Users can connect to financial institutions, import spending data, customize budgets, forecast retirement, and compare financial plans. The platform also features a personalized AI chatbot powered by OpenAI's ChatGPT model.

Flagright Solutions

Flagright Solutions is an AI-native AML Compliance & Risk Management platform that offers real-time transaction monitoring, automated case management, AI forensics for screening, customer risk assessment, and sanctions screening. Trusted by financial institutions worldwide, Flagright's platform streamlines compliance workflows, reduces manual tasks, and enhances fraud detection accuracy. The platform provides end-to-end solutions for financial crime compliance, empowering operational teams to collaborate effectively and make reliable decisions. With advanced AI algorithms and real-time processing, Flagright ensures instant detection of suspicious activities, reducing false positives and enhancing risk detection capabilities.

Castello.ai

Castello.ai is a financial analysis tool that uses artificial intelligence to help businesses make better decisions. It provides users with real-time insights into their financial data, helping them to identify trends, risks, and opportunities. Castello.ai is designed to be easy to use, even for those with no financial background.

Pascal

Pascal is an AI-powered risk-based KYC & AML screening and monitoring platform that offers users the ability to assess findings faster and more accurately than other compliance tools. It utilizes AI, machine learning, and Natural Language Processing to analyze open-source and client-specific data, interpret adverse media in multiple languages, simplify onboarding processes, provide continuous monitoring, reduce false positives, and enhance compliance decision-making.

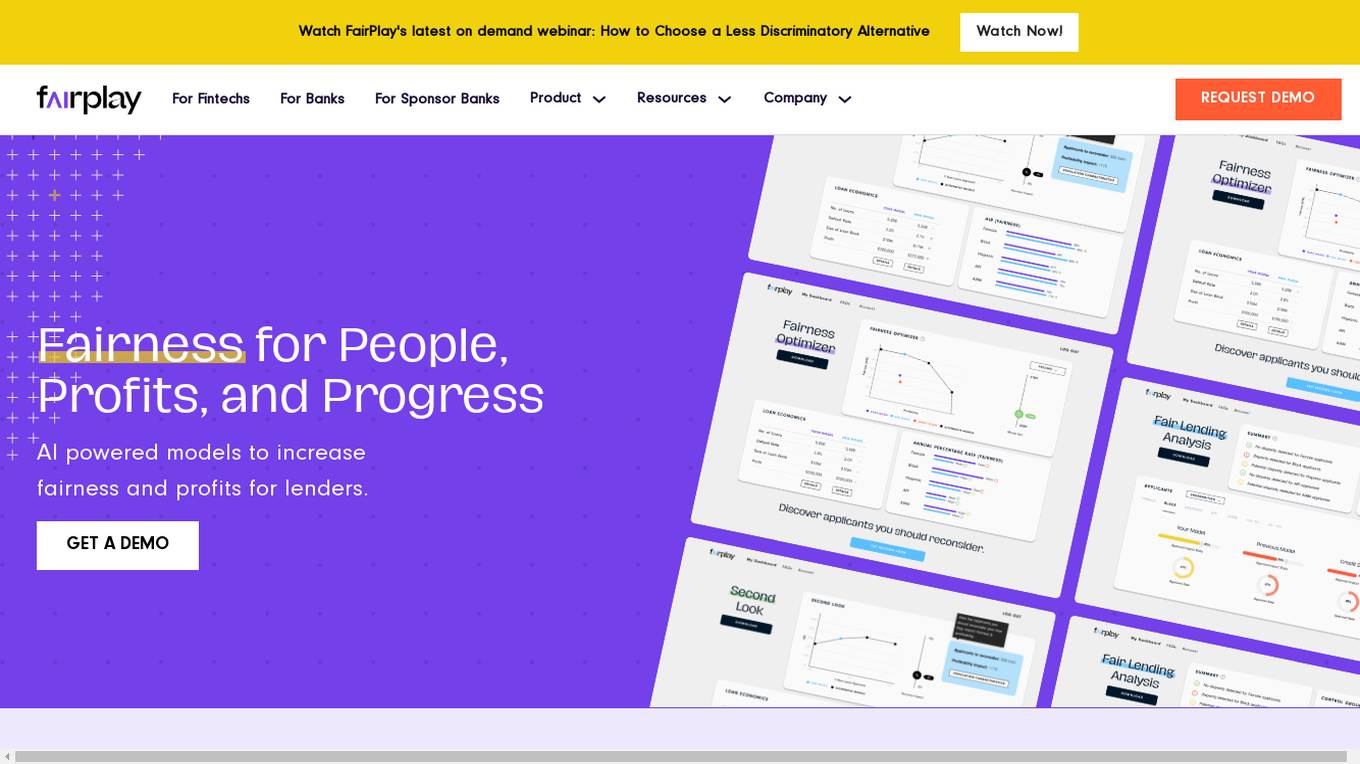

FairPlay

FairPlay is a Fairness-as-a-Service solution designed for financial institutions, offering AI-powered tools to assess automated decisioning models quickly. It helps in increasing fairness and profits by optimizing marketing, underwriting, and pricing strategies. The application provides features such as Fairness Optimizer, Second Look, Customer Composition, Redline Status, and Proxy Detection. FairPlay enables users to identify and overcome tradeoffs between performance and disparity, assess geographic fairness, de-bias proxies for protected classes, and tune models to reduce disparities without increasing risk. It offers advantages like increased compliance, speed, and readiness through automation, higher approval rates with no increase in risk, and rigorous Fair Lending analysis for sponsor banks and regulators. However, some disadvantages include the need for data integration, potential bias in AI algorithms, and the requirement for technical expertise to interpret results.

StrataReports

StrataReports is an AI-driven tool that specializes in transforming lengthy condo documents into comprehensive insights for real estate professionals, insurance brokers, and property buyers and sellers. By leveraging cutting-edge AI technology, the platform reads, analyzes, and summarizes complex documents to provide rapid yet in-depth understanding of building positives and drawbacks. With customizable reporting options and an interactive chatbot, StrataReports empowers users to make informed decisions with confidence in the Canadian real estate market.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

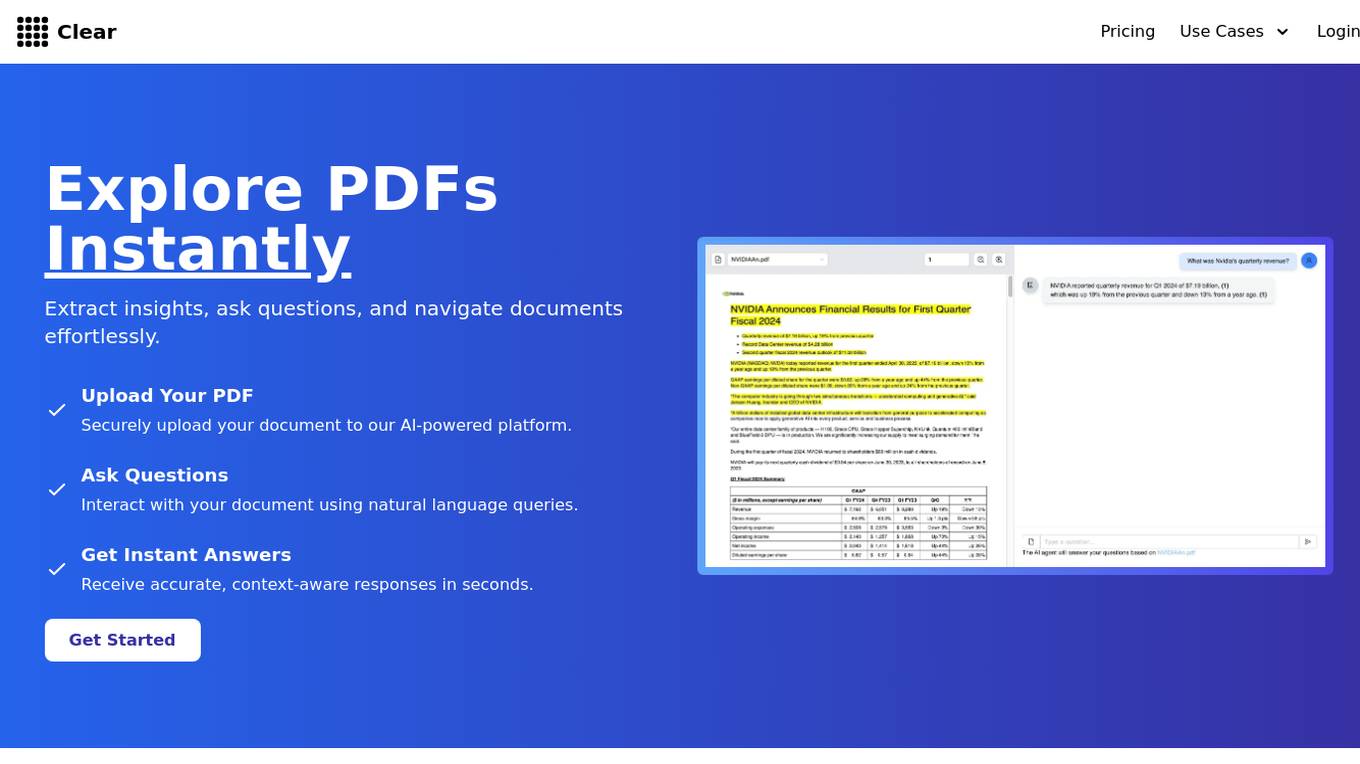

ClearAI

ClearAI is an AI-powered platform that offers instant extraction of insights, effortless document navigation, and natural language interaction. It enables users to upload PDFs securely, ask questions, and receive accurate responses in seconds. With features like structured results, intelligent search, and lifetime access offers, ClearAI simplifies tasks such as analyzing company reports, risk assessment, audit support, contract review, legal research, and due diligence. The platform is designed to streamline document analysis and provide relevant data efficiently.

AInvest

AInvest is an AI-powered stock analysis platform that provides users with comprehensive insights, news, and tools for making informed investment decisions. The platform utilizes advanced AI algorithms to analyze market trends, identify investment opportunities, and offer personalized recommendations to users. AInvest aims to empower investors with deep research, real-time news updates, and market analysis to help them navigate the complexities of the stock market effectively.

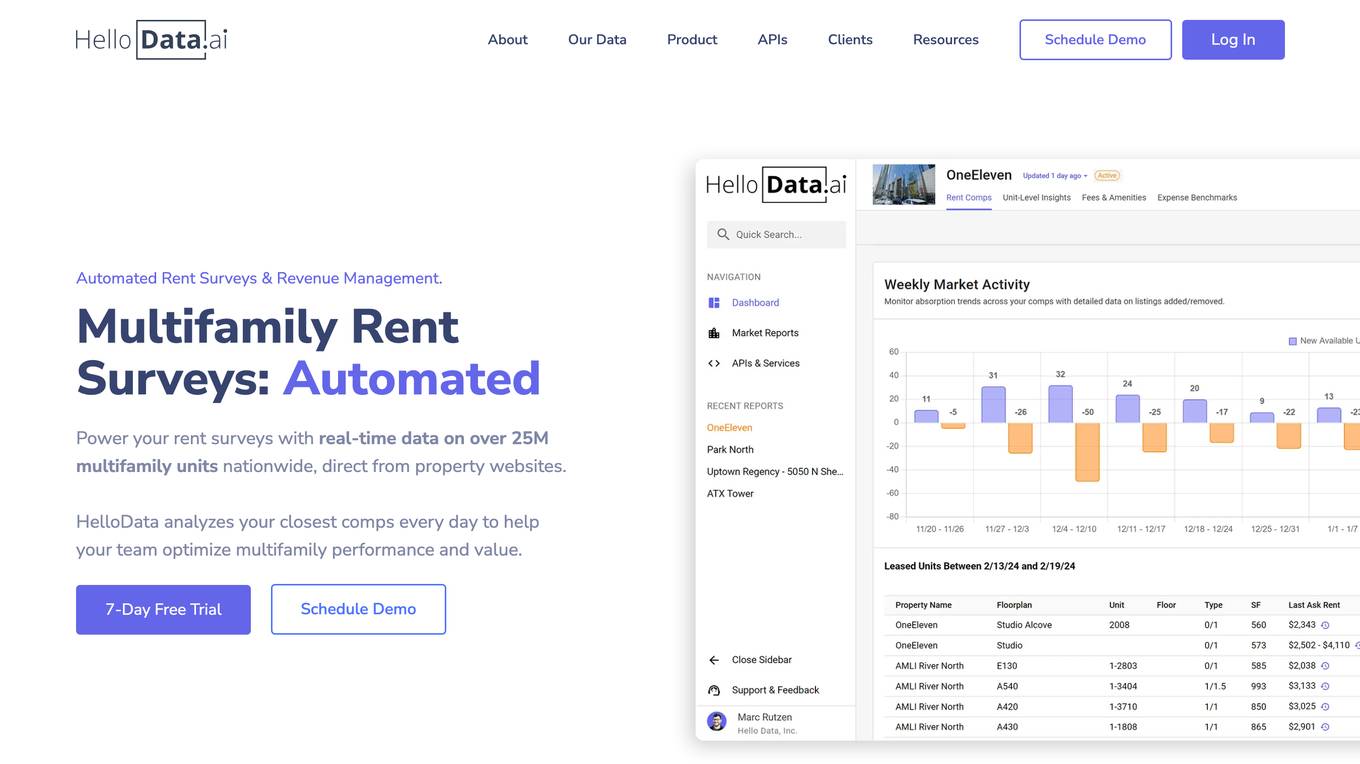

HelloData

HelloData is an AI-powered multifamily market analysis platform that automates market surveys, unit-level rent analysis, concessions monitoring, and development feasibility reports. It provides financial analysis tools to underwrite multifamily deals quickly and accurately. With custom query builders and Proptech APIs, users can analyze and download market data in bulk. HelloData is used by over 15,000 multifamily professionals to save time on market research and deal analysis, offering real-time property data and insights for operators, developers, investors, brokers, and Proptech companies.

Ohai.ai

Ohai.ai is an AI-powered platform that offers personalized career guidance and job search assistance. It uses advanced algorithms to analyze user profiles, skills, and preferences to provide tailored job recommendations and professional development advice. The platform aims to help individuals make informed career decisions and enhance their job search efficiency by leveraging the power of artificial intelligence.

BCT Digital

BCT Digital is an AI-powered risk management suite provider that offers a range of products to help enterprises optimize their core Governance, Risk, and Compliance (GRC) processes. The rt360 suite leverages next-generation technologies, sophisticated AI/ML models, data-driven algorithms, and predictive analytics to assist organizations in managing various risks effectively. BCT Digital's solutions cater to the financial sector, providing tools for credit risk monitoring, early warning systems, model risk management, environmental, social, and governance (ESG) risk assessment, and more.

AIHire

AIHire is an AI-powered platform designed to streamline and enhance the job search process. By leveraging advanced artificial intelligence algorithms, AIHire offers users personalized job recommendations, resume optimization, interview preparation tips, and career guidance. The platform aims to revolutionize the way individuals find and secure employment opportunities by providing tailored support and insights based on their unique skills and preferences. With AIHire, users can save time, increase their chances of landing their dream job, and stay ahead in today's competitive job market.

FOCAL

FOCAL is an AI-driven platform designed for AML compliance and anti-fraud purposes. It offers solutions for verification, customer due diligence, fraud prevention, and financial insights. The platform leverages AI technology to streamline onboarding processes, enhance trust through advanced customer screening, and detect and prevent fraud using advanced AI algorithms. FOCAL is tailored to meet industry-specific needs, provides seamless integration with existing systems, and offers localized expertise with global standards for regulatory compliance.

0 - Open Source AI Tools

20 - OpenAI Gpts

Financial Statement Analyzer

Analyze Financial Statements step by step to Predict Earnings Direction

1 Main Summary Insight for Income Statement

Analyzes income statements to provide a key insight on spending and financial health.

1 Main Insight Summary for Cash Flow Statement

Comprehensive analysis of cash flow statements, covering a wide array of financial metrics.

Стратегічний експерт НБУ

Помічник у публічних стратегічних документах Національного банку України

Credit Analyst

Analyzes financial data to assess creditworthiness, aiding in lending decisions and solutions.

Safaricom Financial Analyst

Analyzes Safaricom's HY and FY financials, with detailed insights on different years.

WealthWiz

Forward-thinking financial mentor, blending cutting-edge solutions with principles that have stood the test of time

Legal Tax Minimizer

Interactive questionnaire-based guide for assessing tax residency, liability, and legal minimization strategies.

Outsourcing-assistenten (finans)

Dansk vejledning i outsourcing regler for kreditinstitutter og datacentraler

Lifeeventprobabilityanalyzer

Map or simulate a scenario real time analyze probability of a life event coming true based on circumstances

Warren

The intelligent investor. Analyse stocks using Warren Buffet's favourite investment framework, outlined in Benjamin Graham's famous book. Warren takes no responsibility for investment risk.

Crowd Equity Analyst

Analyzes crowdfunding ventures for market potential and business viability, aiding investment decisions. by neuralvault