TaxGPT

Your AI Tax Assistant

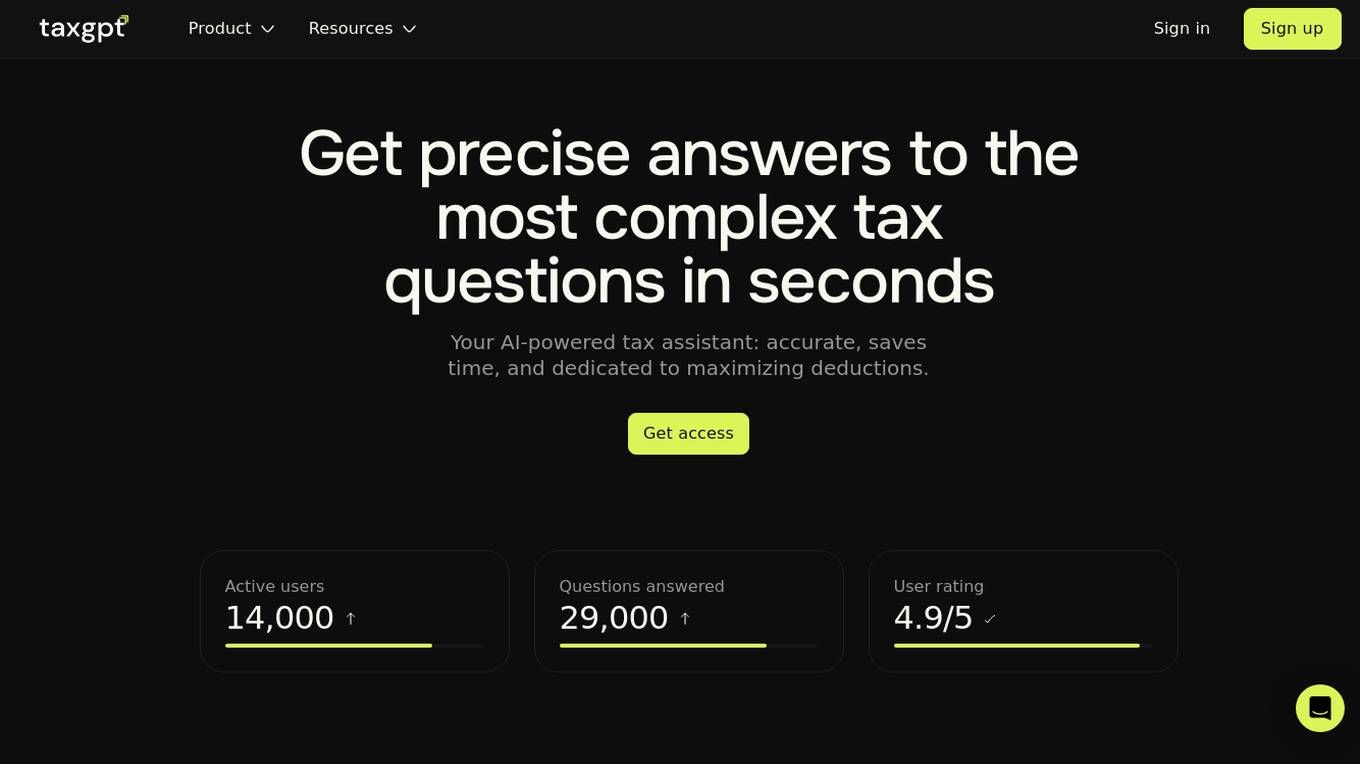

TaxGPT is an AI-powered tax assistant that provides accurate and up-to-date answers to tax-related questions. It is designed for individuals, business owners, and tax professionals, offering personalized answers, maximized deductions, and time-saving features. TaxGPT utilizes advanced AI algorithms and a proprietary hallucination control system to ensure reliable and accurate information. With TaxGPT, users can navigate complex tax situations, make informed decisions, and streamline their tax filing process.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for TaxGPT

Similar sites

TaxGPT

TaxGPT is an AI-powered tax assistant that provides accurate and up-to-date answers to tax-related questions. It is designed for individuals, business owners, and tax professionals, offering personalized answers, maximized deductions, and time-saving features. TaxGPT utilizes advanced AI algorithms and a proprietary hallucination control system to ensure reliable and accurate information. With TaxGPT, users can navigate complex tax situations, make informed decisions, and streamline their tax filing process.

TaxGPT

TaxGPT is an AI-powered tax assistant application that offers personalized tax solutions for individuals, businesses, and tax professionals. It provides accurate and up-to-date responses to tax queries, maximizes deductions, and simplifies the tax filing process. With features like secure data encryption, AI-powered answers, and a user-friendly interface, TaxGPT aims to revolutionize the way taxes are managed. Trusted by over 15,000 tax professionals, TaxGPT is designed to save time, reduce errors, and provide unlimited tax support for users.

CanTax.ai

CanTax.ai is an AI-powered platform offering instant tax help for Canadians. It provides personalized tax advice tailored to individual financial needs, ensuring privacy and security with industry-leading encryption protocols. The platform's artificial intelligence is proficiently trained on federal and provincial tax legislation, offering comprehensive knowledge and 24/7 availability. CanTax aims to simplify the tax filing process and empower Canadians with expert-level tax guidance.

Accountable

Accountable is an AI-powered assistant designed to help individuals manage their taxes and finances effortlessly. The application offers a comprehensive solution for handling tax declarations error-free and stress-free. Users can rely on the AI Assistant to answer tax-related questions, ensure accurate tax returns, and provide personalized tax tips. Accountable also assists in organizing paperwork, generating professional invoices, scanning receipts for tax deductions, and offering insights on tax savings. With a user-friendly interface and top-notch customer support, Accountable simplifies tax management for freelancers, entrepreneurs, and small business owners.

FlyFin

FlyFin is the world's #1 A.I. and CPA tax filing service designed for freelancers, self-employed individuals, business owners, and 1099 & W-2 workers. The platform leverages artificial intelligence to find every tax deduction, making tax filing faster, cheaper, and more accurate. FlyFin offers a dedicated CPA to handle tax preparation from start to finish, ensuring maximum refunds and full audit insurance. With features like A.I. deduction tracker, quarterly tax calculator, and annual 1040 tax filing, FlyFin simplifies tax processes for users, providing a seamless experience for managing taxes efficiently and effectively.

TaxTim

TaxTim is an AI-powered tax filing application designed to help individuals and businesses in South Africa easily and accurately complete their tax returns. The platform offers a user-friendly interface where users can answer simple questions to generate a fully completed tax return ready for submission to the South African Revenue Service (SARS). TaxTim is integrated with SARS to import IRP5 data, ensuring accurate and timely filing. With a focus on security and maximum refunds, TaxTim is a reliable solution for tax compliance.

AiTax

AiTax is an AI-based tax-preparation software that leverages Artificial Intelligence and Machine Learning to help individuals and entrepreneurs prepare and file their taxes accurately and efficiently. The software eliminates the risk of human error, ensures the lowest possible tax amount, prioritizes data security, and offers free audit and legal defense support. AiTax aims to simplify the tax-filing process, maximize potential refunds, and minimize the chances of an audit, providing users with a reliable and secure solution for their tax needs.

Blue J

Blue J is a legal technology company founded in 2015, dedicated to enhancing tax research with the power of AI. Their AI-powered tool, Ask Blue J, provides fast and verifiable answers to tax questions, enabling tax professionals to work more efficiently. Blue J's generative AI technology helps users find authoritative sources quickly, expedite drafting processes, and cater to junior staff's research needs. The tool is trusted by hundreds of leading firms and offers a comprehensive database of curated tax content.

Ask Blue J

Ask Blue J is a generative AI tool designed specifically for tax experts. It provides fast, verifiable answers to complex tax questions, helping professionals work smarter and more efficiently. With its extensive database of curated tax content and industry-leading AI technology, Ask Blue J enables users to conduct efficient research, expedite drafting, and enhance their overall productivity.

Deferred.com

Deferred.com is a free AI tool designed to assist users with 1031 exchanges, a tax-deferral strategy in real estate investment. The platform offers a range of resources, including an exchange calculator, expert answers, and matching with 1031 professionals. Users can optimize tax savings, find the right intermediary, and access essential reading materials on tax deferral and exchange rules. With a focus on simplifying the complex process of 1031 exchanges, Deferred.com aims to empower real estate investors to make informed decisions and maximize their financial benefits.

VIDUR

VIDUR is an AI agent designed for Corporate, Tax & Regulatory Laws. It provides expert-verified responses, updates, advisory, and drafts in a simple language format. The application is built by Ex Big4 and Tier 1 Law Firm Professionals, offering up-to-date knowledge from 250+ experts and Bharat Laws. VIDUR streamlines research processes, saves time, and ensures accuracy by harnessing proprietary access to knowledge and delivering high-quality, reliable results across diverse domains such as Income Tax, GST, Companies Act, and more.

Intuit Assist

Intuit Assist is a generative AI-powered financial assistant designed to help you achieve financial confidence. It is a comprehensive platform that offers a wide range of financial tools and services, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. Intuit Assist can help you with a variety of financial tasks, such as filing your taxes, managing your credit, tracking your expenses, and invoicing your clients. It is a valuable tool for anyone who wants to take control of their finances and achieve financial success.

Finance Brain

Finance Brain is an AI-powered assistant that provides instant answers for finance and accounting questions. It offers unlimited access for a monthly fee of $20 and allows new users to ask 3 free questions. The platform also supports uploading video files for analysis.

DoNotPay

DoNotPay is an AI-powered platform that helps consumers fight big corporations, protect their privacy, find hidden money, and beat bureaucracy. It offers a wide range of tools and services to help users with tasks such as disputing traffic tickets, canceling subscriptions, and getting refunds. DoNotPay is not a law firm and is not licensed to practice law. It provides a platform for legal information and self-help.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

Eve

Eve is an AI-powered tool designed for labor and employment lawyers to streamline their casework, increase efficiency, and boost revenue. It acts as a 'second brain' and an extra set of hands, tailored to the lifecycle of cases. Eve assists in case intake and evaluation, drafting documents and letters, propounding discovery, responding to discovery, and more. The tool is trusted by thousands of forward-thinking plaintiff lawyers and offers features like powerful analytics, shared team inboxes, instant customer service, and easy-to-use reports.

For similar tasks

FlyFin

FlyFin is the world's #1 A.I. and CPA tax filing service designed for freelancers, self-employed individuals, business owners, and 1099 & W-2 workers. The platform leverages artificial intelligence to find every tax deduction, making tax filing faster, cheaper, and more accurate. FlyFin offers a dedicated CPA to handle tax preparation from start to finish, ensuring maximum refunds and full audit insurance. With features like A.I. deduction tracker, quarterly tax calculator, and annual 1040 tax filing, FlyFin simplifies tax processes for users, providing a seamless experience for managing taxes efficiently and effectively.

CanTax.ai

CanTax.ai is an AI-powered platform offering instant tax help for Canadians. It provides personalized tax advice tailored to individual financial needs, ensuring privacy and security with industry-leading encryption protocols. The platform's artificial intelligence is proficiently trained on federal and provincial tax legislation, offering comprehensive knowledge and 24/7 availability. CanTax aims to simplify the tax filing process and empower Canadians with expert-level tax guidance.

ChatNRA

ChatNRA is an innovative platform dedicated to assisting non-US residents in various aspects of launching and managing a US company. Their comprehensive suite of services is designed to streamline the process of establishing a US business presence and navigating the complexities of the American market. They offer services such as LLC and INC formation, tax filing, annual compliance, bookkeeping, and beneficial ownership information. ChatNRA aims to simplify the process for individuals looking to start and manage a US-based business, providing expert guidance and support throughout the journey.

Reconcile

Reconcile is a finance app designed specifically for multipreneurs, individuals with multiple businesses or income streams. It automates bookkeeping, connects users with tax professionals, and provides financial insights to help users focus on growth. Reconcile's AI assistant tracks expenses, maximizes write-offs, and provides personalized recommendations to help users make more profitable decisions.

TaxGPT

TaxGPT is an AI-powered tax assistant that provides accurate and up-to-date answers to tax-related questions. It is designed for individuals, business owners, and tax professionals, offering personalized answers, maximized deductions, and time-saving features. TaxGPT utilizes advanced AI algorithms and a proprietary hallucination control system to ensure reliable and accurate information. With TaxGPT, users can navigate complex tax situations, make informed decisions, and streamline their tax filing process.

Intuit Assist

Intuit Assist is a generative AI-powered financial assistant designed to help you achieve financial confidence. It is a comprehensive platform that offers a wide range of financial tools and services, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. Intuit Assist can help you with a variety of financial tasks, such as filing your taxes, managing your credit, tracking your expenses, and invoicing your clients. It is a valuable tool for anyone who wants to take control of their finances and achieve financial success.

Canopy

Canopy is an all-in-one practice management software for accounting and tax firms. It helps firms manage their clients, documents, workflow, time and billing, and more. Canopy is designed to help firms work more efficiently and effectively, so they can focus on providing better client experiences.

TaxGPT

TaxGPT is an AI-powered tax assistant application that offers personalized tax solutions for individuals, businesses, and tax professionals. It provides accurate and up-to-date responses to tax queries, maximizes deductions, and simplifies the tax filing process. With features like secure data encryption, AI-powered answers, and a user-friendly interface, TaxGPT aims to revolutionize the way taxes are managed. Trusted by over 15,000 tax professionals, TaxGPT is designed to save time, reduce errors, and provide unlimited tax support for users.

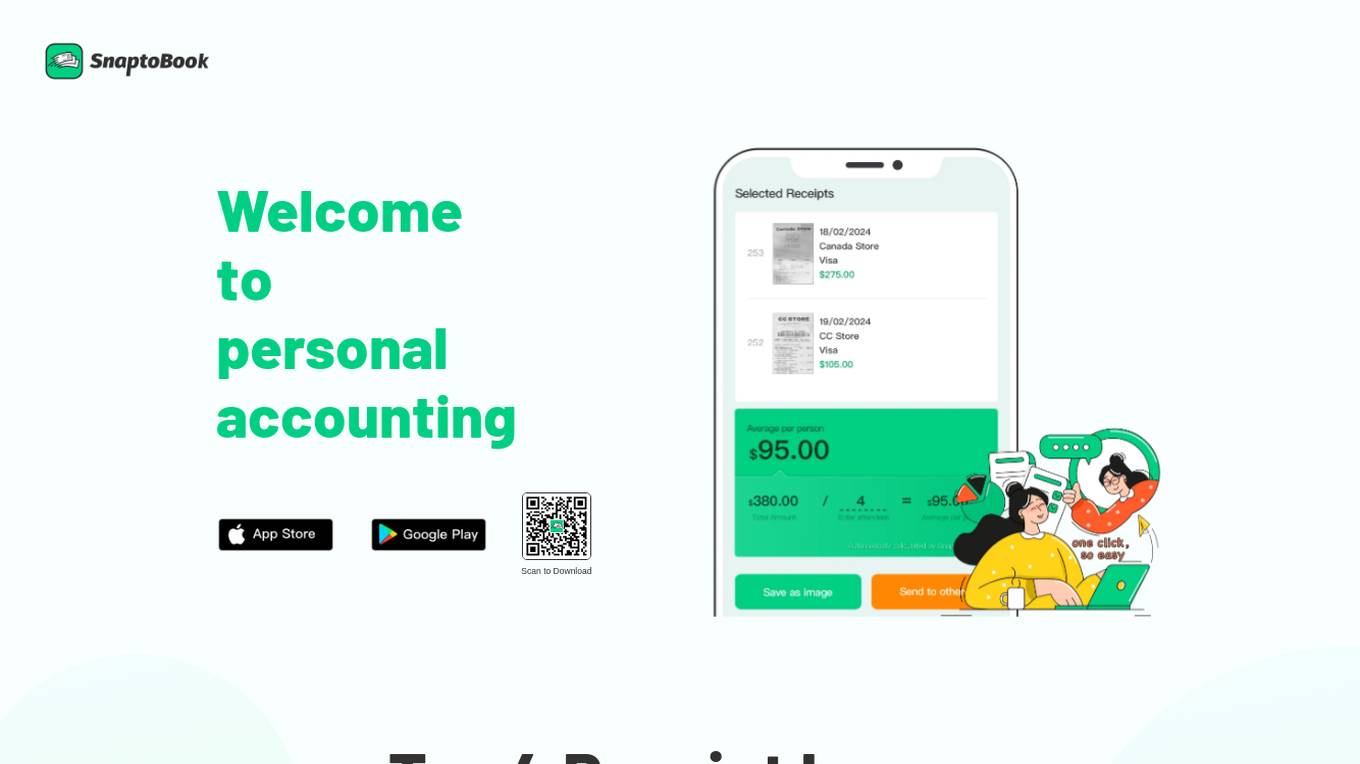

SnaptoBook

SanptoBook is a personal accounting software designed to help individuals manage their finances efficiently. It offers features such as invoice and receipt management, reimbursement facilitation, tax filing assistance, bill splitting, and project tracking. The application aims to simplify financial tasks and improve overall financial organization for users. With AI-powered efficiency, SnaptoBook provides state-of-the-art receipt recognition technology and secure cloud storage for all receipts.

TaxTim

TaxTim is an AI-powered tax filing application designed to help individuals and businesses in South Africa easily and accurately complete their tax returns. The platform offers a user-friendly interface where users can answer simple questions to generate a fully completed tax return ready for submission to the South African Revenue Service (SARS). TaxTim is integrated with SARS to import IRP5 data, ensuring accurate and timely filing. With a focus on security and maximum refunds, TaxTim is a reliable solution for tax compliance.

Thomson Reuters

Thomson Reuters is a leading provider of business information services. The company provides a wide range of products and services to professionals in the legal, tax, accounting, and risk management industries. Thomson Reuters' products and services include news and information, research and analysis, software and technology, and education and training. The company has a global presence with operations in over 100 countries.

Accountancy Age

Accountancy Age is an AI-powered platform that offers cutting-edge accounting solutions and insights for businesses. It provides a wide range of resources, news articles, and rankings related to accounting firms, audit, consulting, tax, and business recovery. With a focus on AI and cloud-centric strategies, Accountancy Age helps businesses navigate complex financial landscapes and regulatory environments. The platform aims to redefine accounting practices by leveraging advanced technologies to enhance efficiency and accuracy in financial management.

Blue J

Blue J is a legal technology company founded in 2015, dedicated to enhancing tax research with the power of AI. Their AI-powered tool, Ask Blue J, provides fast and verifiable answers to tax questions, enabling tax professionals to work more efficiently. Blue J's generative AI technology helps users find authoritative sources quickly, expedite drafting processes, and cater to junior staff's research needs. The tool is trusted by hundreds of leading firms and offers a comprehensive database of curated tax content.

For similar jobs

Lemon Squeezy

Lemon Squeezy is an all-in-one platform designed for software companies to handle payments, subscriptions, global tax compliance, fraud prevention, and more. It offers features like global tax compliance, borderless SaaS payments, instant payment methods, local currency support, AI fraud prevention, and failed payment recovery. The platform also provides tools for ecommerce, marketing, reporting, and developer integration. Lemon Squeezy aims to simplify running a software business by offering a comprehensive solution for various business needs.

Soon

Soon is a fully automated crypto investing platform that makes it easy for anyone to invest in crypto, regardless of their experience level. With Soon, you can set up simple buying and selling schedules, automatically reinvest your profits, and even track your capital gains taxes. Soon also provides a robust set of investing features, such as auto-pilot selling, reimburse spending, and stop loss, to give you powerful tools in a simple, intuitive app.

TaxGPT

TaxGPT is an AI-powered tax assistant that provides accurate and up-to-date answers to tax-related questions. It is designed for individuals, business owners, and tax professionals, offering personalized answers, maximized deductions, and time-saving features. TaxGPT utilizes advanced AI algorithms and a proprietary hallucination control system to ensure reliable and accurate information. With TaxGPT, users can navigate complex tax situations, make informed decisions, and streamline their tax filing process.

Wolters Kluwer

Wolters Kluwer is a global provider of professional information, software solutions, and services for various industries, including healthcare, tax and accounting, ESG, finance, compliance, and legal. The company's solutions combine domain expertise with advanced technology to help professionals make informed decisions, optimize processes, and achieve better outcomes. Wolters Kluwer's offerings include clinical decision support tools, tax and accounting software, ESG reporting solutions, regulatory compliance solutions, and legal research databases.

Thomson Reuters

Thomson Reuters is a leading provider of business information services. The company provides a wide range of products and services to professionals in the legal, tax, accounting, and risk management industries. Thomson Reuters' products and services include news and information, research and analysis, software and technology, and education and training. The company has a global presence with operations in over 100 countries.

Betterment

Betterment is an automated investing platform that helps you build wealth, grow your savings, and plan for retirement. With Betterment, you can invest in a diversified portfolio of stocks and bonds, earn interest on your cash, and get personalized advice from financial experts. Betterment is a fiduciary, which means we act in your best interest. We'll help you set financial goals and set you up with investment portfolios for each goal.

TruePrep

TruePrep is an AI software designed for tax accounting firms and CPAs to streamline tax planning, projections, and research processes. The AI Assistant within TruePrep helps accountants and financial advisors to quickly identify clients affected by tax changes, create tax projections, and answer complex tax questions in real time. By leveraging AI technology, TruePrep aims to save time, increase accuracy, and improve revenue generation for tax professionals.

AiTax

AiTax is an AI-based tax-preparation software that leverages Artificial Intelligence and Machine Learning to help individuals and entrepreneurs prepare and file their taxes accurately and efficiently. The software eliminates the risk of human error, ensures the lowest possible tax amount, prioritizes data security, and offers free audit and legal defense support. AiTax aims to simplify the tax-filing process, maximize potential refunds, and minimize the chances of an audit, providing users with a reliable and secure solution for their tax needs.

Taxly

Taxly is a user-friendly online platform designed to automate the process of UAE corporate tax filing for small and medium enterprises (SMEs), free zone entities, and accountants. The application simplifies tax compliance by allowing users to upload their financial data and receive FTA-ready tax returns. Taxly provides real-time tax insights, instant tax projections, and built-in compliance assistance to help users navigate the complexities of UAE tax regulations. With a focus on simplicity and efficiency, Taxly aims to streamline the tax filing process for businesses in the UAE.

Kintsugi Vertex

Kintsugi Vertex is an AI-powered sales tax automation tool designed to help companies globally in monitoring, filing, and optimizing sales tax. It automates compliance in three simple steps: connecting and monitoring billing, payment, and HR systems; registering and collecting the right tax with precise rules; and remitting and filing taxes seamlessly. The tool eliminates manual tax calculations, compliance headaches, and unexpected fees, making tax reporting and filing a breeze. It offers white glove support and accurate Nexus tracking to ensure compliance without the complexity of tax requirements. Kintsugi Vertex is trusted by leading businesses worldwide for its end-to-end tax compliance solutions.

AI Bank Statement Converter

The AI Bank Statement Converter is an industry-leading tool designed for accountants and bookkeepers to extract data from financial documents using artificial intelligence technology. It offers features such as automated data extraction, integration with accounting software, enhanced security, streamlined workflow, and multi-format conversion capabilities. The tool revolutionizes financial document processing by providing high-precision data extraction, tailored for accounting businesses, and ensuring data security through bank-level encryption. It also offers Intelligent Document Processing (IDP) using AI and machine learning techniques to process structured, semi-structured, and unstructured documents.

CanTax.ai

CanTax.ai is an AI-powered platform offering instant tax help for Canadians. It provides personalized tax advice tailored to individual financial needs, ensuring privacy and security with industry-leading encryption protocols. The platform's artificial intelligence is proficiently trained on federal and provincial tax legislation, offering comprehensive knowledge and 24/7 availability. CanTax aims to simplify the tax filing process and empower Canadians with expert-level tax guidance.

ChatNRA

ChatNRA is an innovative platform dedicated to assisting non-US residents in various aspects of launching and managing a US company. Their comprehensive suite of services is designed to streamline the process of establishing a US business presence and navigating the complexities of the American market. They offer services such as LLC and INC formation, tax filing, annual compliance, bookkeeping, and beneficial ownership information. ChatNRA aims to simplify the process for individuals looking to start and manage a US-based business, providing expert guidance and support throughout the journey.

Boast

Boast is an AI-driven platform that simplifies the process of claiming R&D tax credits for companies in Canada and the US. By combining technical expertise with AI technology, Boast helps businesses maximize their returns by identifying and claiming eligible innovation funding opportunities. The platform offers complete transparency and control, ensuring that users are well-informed at every step of the claim process. Boast has successfully helped over 1000 companies across North America to secure higher R&D tax credit claims with less effort and peace of mind.

Blue J

Blue J is a legal technology company founded in 2015, dedicated to enhancing tax research with the power of AI. Their AI-powered tool, Ask Blue J, provides fast and verifiable answers to tax questions, enabling tax professionals to work more efficiently. Blue J's generative AI technology helps users find authoritative sources quickly, expedite drafting processes, and cater to junior staff's research needs. The tool is trusted by hundreds of leading firms and offers a comprehensive database of curated tax content.

Financial Planning

The Financial Planning website is a comprehensive platform that offers insights and resources on various aspects of financial planning, including tax investing, wealth management, estate planning, retirement planning, practice management, regulation and compliance, technology, industry news, and opinion pieces. The site covers a wide range of topics relevant to financial advisors and professionals in the wealth management industry. It also features articles on emerging trends, investment strategies, industry updates, and expert opinions to help readers stay informed and make informed decisions.

AccountingSolverAI

AccountingSolverAI is a free online AI accountant assistant application that helps users analyze and solve accounting problems from prompts, text, data docs, or images. Users can input their accounting problem data in text or documents with a question, and the AI tool will provide solutions. The application is powered by pmfm.ai and offers a pricing model of free for 5 messages, then $5 per 250 messages. AccountingSolverAI simplifies accounting tasks and provides quick solutions for users.

TaxTim

TaxTim is an AI-powered tax filing application designed to help individuals and businesses in South Africa easily and accurately complete their tax returns. The platform offers a user-friendly interface where users can answer simple questions to generate a fully completed tax return ready for submission to the South African Revenue Service (SARS). TaxTim is integrated with SARS to import IRP5 data, ensuring accurate and timely filing. With a focus on security and maximum refunds, TaxTim is a reliable solution for tax compliance.

Deferred.com

Deferred.com is a free AI tool designed to assist users with 1031 exchanges, a tax-deferral strategy in real estate investment. The platform offers a range of resources, including an exchange calculator, expert answers, and matching with 1031 professionals. Users can optimize tax savings, find the right intermediary, and access essential reading materials on tax deferral and exchange rules. With a focus on simplifying the complex process of 1031 exchanges, Deferred.com aims to empower real estate investors to make informed decisions and maximize their financial benefits.

Karbon

Karbon is an AI-powered practice management software designed for accounting firms to increase visibility, control, automation, efficiency, collaboration, and connectivity. It offers features such as team collaboration, workflow automation, project management, time & budgets tracking, billing & payments, reporting & analysis, artificial intelligence integration, email management, shared inbox, calendar integration, client management, client portal, eSignatures, document management, and enterprise-grade security. Karbon enables firms to automate tasks, work faster, strengthen connections, and drive productivity. It provides services like group onboarding, guided implementation, and enterprise resources including articles, ebooks, and videos for accounting firms. Karbon also offers live training, customer support, and a practice excellence scorecard for firms to assess their performance. The software is known for its AI and GPT integration, helping users save time and improve efficiency.

Blue Dot

Blue Dot is a leading AI tax compliance platform that offers solutions for global tax management and VAT recovery. The platform provides a comprehensive view of employee-driven transactions, ensuring tax compliance and reducing vulnerabilities. Blue Dot's technology leverages AI and ML to optimize VAT outcomes and automate the review process for taxable employee benefits. The platform is fully integrated with expense management systems, helping organizations streamline compliance efforts and improve data integrity.

Jyotax.ai

Jyotax.ai is an AI-powered tax solution that revolutionizes tax compliance by simplifying the tax process with advanced AI solutions. It offers comprehensive bookkeeping, payroll processing, worldwide tax returns and filing automation, profit recovery, contract compliance, and financial modeling and budgeting services. The platform ensures accurate reporting, real-time compliance monitoring, global tax solutions, customizable tax tools, and seamless data integration. Jyotax.ai optimizes tax workflows, ensures compliance with precise AI tax calculations, and simplifies global tax operations through innovative AI solutions.

Accountancy Age

Accountancy Age is an AI-powered platform that offers cutting-edge accounting solutions and insights for businesses. It provides a wide range of resources, news articles, and rankings related to accounting firms, audit, consulting, tax, and business recovery. With a focus on AI and cloud-centric strategies, Accountancy Age helps businesses navigate complex financial landscapes and regulatory environments. The platform aims to redefine accounting practices by leveraging advanced technologies to enhance efficiency and accuracy in financial management.

VIDUR

VIDUR is an AI agent designed for Corporate, Tax & Regulatory Laws. It provides expert-verified responses, updates, advisory, and drafts in a simple language format. The application is built by Ex Big4 and Tier 1 Law Firm Professionals, offering up-to-date knowledge from 250+ experts and Bharat Laws. VIDUR streamlines research processes, saves time, and ensures accuracy by harnessing proprietary access to knowledge and delivering high-quality, reliable results across diverse domains such as Income Tax, GST, Companies Act, and more.