Best AI tools for< Manage Credit >

20 - AI tool Sites

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

UseCredits

UseCredits is a hassle-free credit-based billing integration that allows you to easily add credit-based billing to your Stripe or Paddle accounts. With UseCredits, you can set credits for your products, get automatic account top-ups, transparent account statements, analytics, and much more. UseCredits is flexible and un-opinionated, making it suitable for a variety of use cases, including generative AI SaaS, email or SMS API, and games and entertainment.

Intuit Assist

Intuit Assist is a generative AI-powered financial assistant designed to help you achieve financial confidence. It is a comprehensive platform that offers a wide range of financial tools and services, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. Intuit Assist can help you with a variety of financial tasks, such as filing your taxes, managing your credit, tracking your expenses, and invoicing your clients. It is a valuable tool for anyone who wants to take control of their finances and achieve financial success.

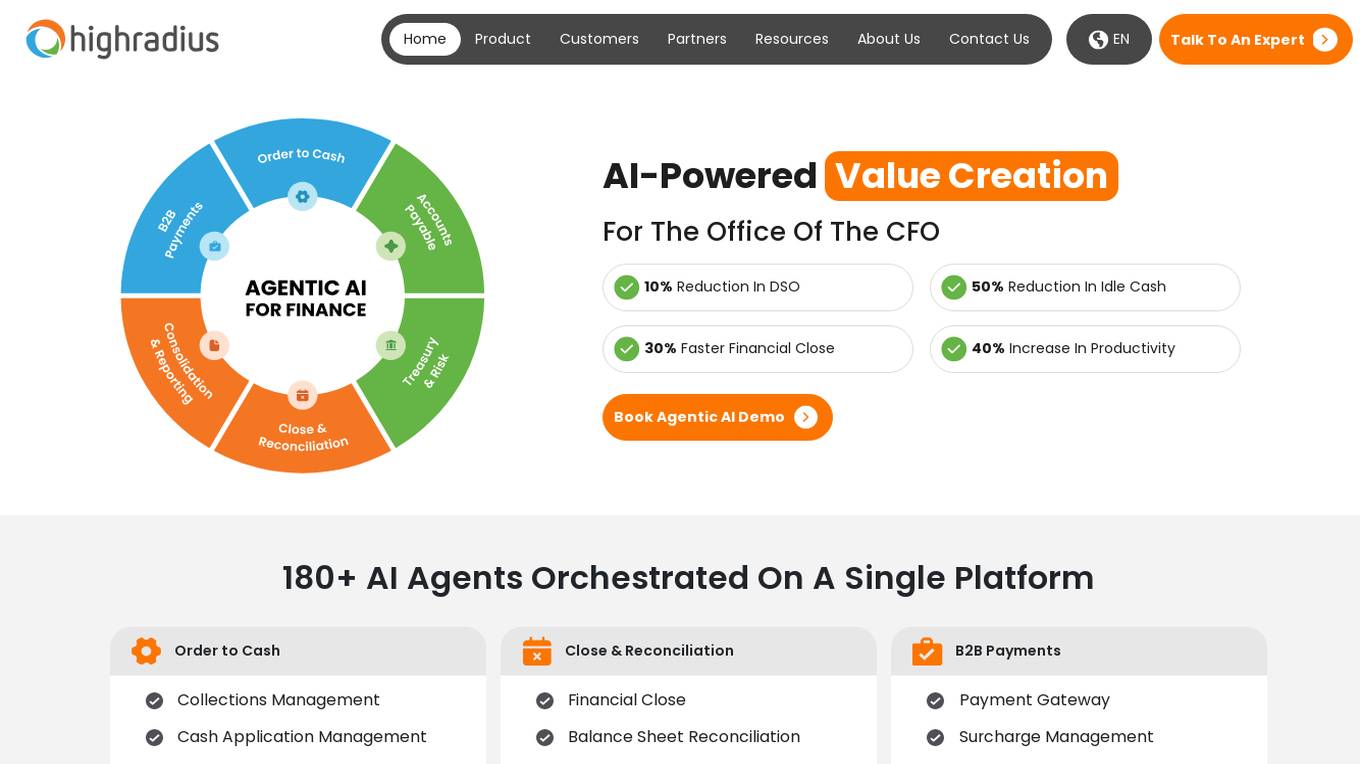

HighRadius

HighRadius is an AI-powered platform that offers Autonomous Finance solutions for Order to Cash (O2C), Treasury, and Record-to-Report (R2R) processes. It provides a single platform for various financial functions such as Accounts Payable, B2B Payments, Cash Management, and Financial Reporting. HighRadius leverages Generative AI and a No-Code AI Platform to automate data analysis and streamline financial operations for the Office of the CFO. The platform aims to enhance productivity, reduce manual work, and improve financial decision-making through advanced AI capabilities.

GetAudify

GetAudify is an AI-powered tool that allows users to summarize large content and convert it into voice using text-to-voice technology. With features like multilingual support, customized tone, and instant summarization, GetAudify aims to enhance communication and content management. Users can easily manage credits, generate API keys, and access summarization features through the extension and dashboard. The tool is beneficial for students, researchers, content creators, and individuals looking to efficiently summarize and understand lengthy content.

SocialBee

SocialBee is an AI-powered social media management tool that helps businesses and individuals manage their social media accounts efficiently. It offers a range of features, including content creation, scheduling, analytics, and collaboration, to help users plan, create, and publish engaging social media content. SocialBee also provides insights into social media performance, allowing users to track their progress and make data-driven decisions.

SocialBee

SocialBee is an AI-powered social media management tool that helps businesses and individuals manage their social media accounts efficiently. It offers a range of features, including content creation, scheduling, analytics, and collaboration, to help users plan, create, and track their social media campaigns. SocialBee also provides access to a team of social media experts who can help users with their social media strategy and execution.

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

Cushion

Cushion is an AI-powered tool designed to simplify bill management and credit building. It securely connects to your accounts, organizes bills, and offers insights to help you budget better. With features like automatic bill tracking, virtual Cushion card payments, and credit history building, Cushion aims to make bill payments painless and credit building seamless.

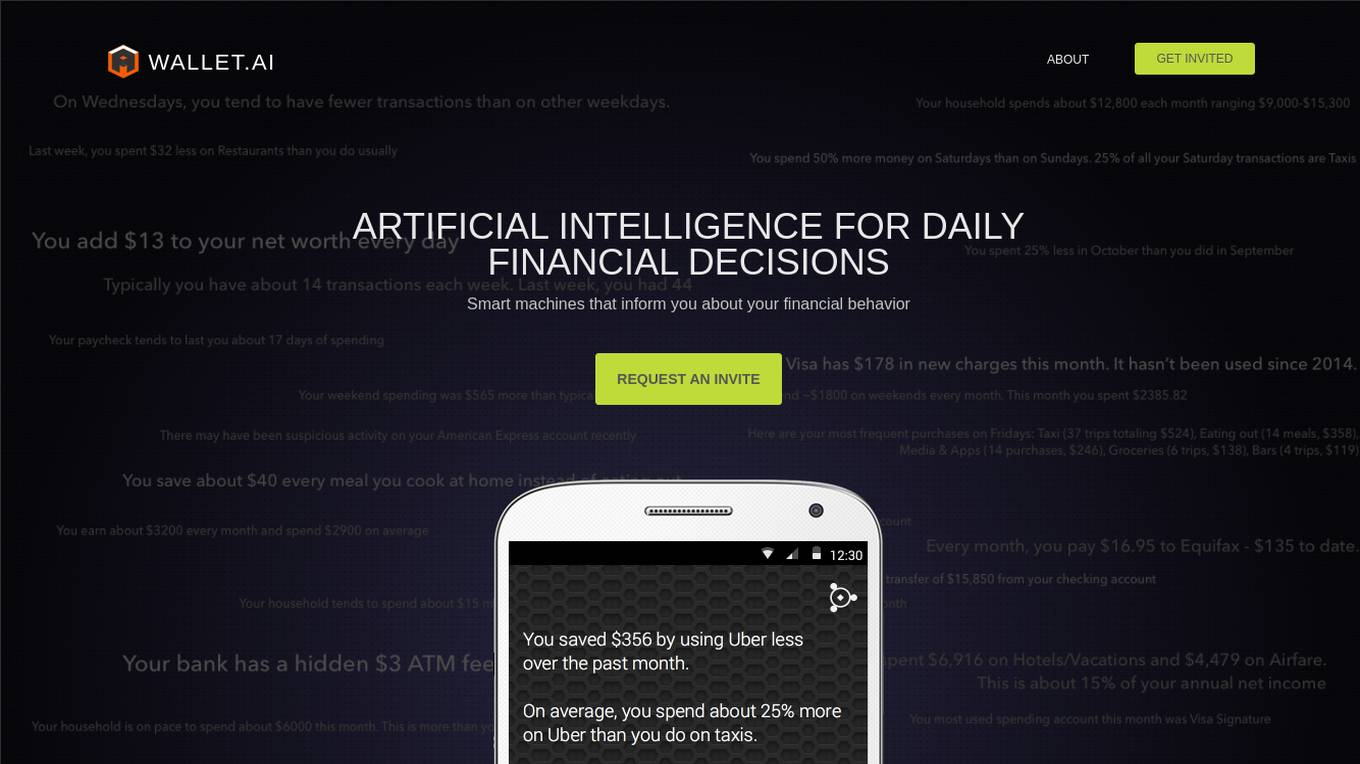

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to help users make better daily financial decisions. The application aims to assist people in making informed financial choices by leveraging artificial intelligence technology.

WiziShop

WiziShop is an e-commerce solution that helps businesses create and manage their online stores. It offers a range of features, including an intuitive website builder, powerful SEO tools, and access to a network of partners and apps. WiziShop is designed to be easy to use, even for beginners, and it offers a variety of resources to help businesses succeed online.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

BCT Digital

BCT Digital is an AI-powered risk management suite provider that offers a range of products to help enterprises optimize their core Governance, Risk, and Compliance (GRC) processes. The rt360 suite leverages next-generation technologies, sophisticated AI/ML models, data-driven algorithms, and predictive analytics to assist organizations in managing various risks effectively. BCT Digital's solutions cater to the financial sector, providing tools for credit risk monitoring, early warning systems, model risk management, environmental, social, and governance (ESG) risk assessment, and more.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

Evolup

Evolup is an AI-powered platform dedicated to creating affiliate stores effortlessly. It offers a comprehensive solution for individuals and businesses to set up and manage their affiliate sites with ease. With state-of-the-art tools and powerful artificial intelligence, Evolup simplifies the process of affiliate marketing, allowing users to focus on promoting products and generating commissions. The platform is designed to streamline the creation of online stores, optimize SEO, and provide seamless integration with affiliate programs, particularly Amazon. Evolup aims to revolutionize the affiliate marketing industry by offering a user-friendly interface, automatic updates, and AI-driven content generation.

OpenResty

The website appears to be displaying a '403 Forbidden' error message, which typically means that the user is not authorized to access the requested page. This error is often encountered when trying to access a webpage without the necessary permissions. The message 'openresty' suggests that the website may be using the OpenResty web platform. OpenResty is a web platform based on NGINX and Lua that is commonly used for building dynamic web applications. It provides a powerful and flexible environment for developing and deploying web services.

Leiga

Leiga is an AI-powered project management tool designed for product teams to enhance productivity in planning, tracking, collaboration, and decision-making. It features a natural language AI assistant that helps in generating reports, analyzing projects, interacting with AI-powered bots, generating subtasks, writing PRD documents, team management, sprint tracking, risk assessment, workflow automation, usage reports, and more. Leiga aims to streamline project management processes and improve team efficiency through AI-driven functionalities.

Brand2Social

Brand2Social is an AI-powered social media management tool that helps users automate scheduling, optimize content, analyze performance, and engage across multiple platforms. It offers features like post publishing, cross-posting, auto post, analytics, auto DM, and more. With Brand2Social, users can save time, maximize reach, and grow their brand effortlessly. The platform is trusted by agencies and businesses worldwide for its seamless scheduling, detailed analytics, and collaborative tools.

Closely

Closely is an AI-powered LinkedIn automation tool designed for lead generation and outreach. It offers a comprehensive suite of features to streamline prospecting efforts, including LinkedIn scraping, email extraction, multichannel campaigns, meetings scheduling, and more. With a focus on seamless automation and integrated analytics, Closely aims to enhance sales operations and increase efficiency for individuals and teams. The platform is GDPR-compliant and provides extensive support for managing access levels within teams.

0 - Open Source AI Tools

20 - OpenAI Gpts

Credit & Collections Advisor

Manages credit risk and implements effective collection strategies.

Credit Card Companion

Balanced guidance on credit cards for young people, with a mix of formal and casual tones

Credit Card Advisor

Expert on credit cards, offering advice on choosing and using them wisely.

Couples Financial Planner

Aids couples in managing joint finances, budgeting for future goals, and navigating financial challenges together.

Debt Dodger

Avoid Debt Accumulation with Credit Card Interest Insights. Find out how much interest you will pay before you make that purchase with your credit card.

Finance Guide

Multilingual advisor on microfinance, focusing on clarity and educational content.

Debt Management Advisor

Advises on debt management strategies to improve financial stability.

Pay Later

Explains 'buy now, pay later' and recommends providers in a financial, informative tone.

Wettelijke rente berekenen

✅ Bereken de wettelijke rente in Nederland voor handelstransacties: 12 % per 1 juli 2023 en de wettelijke rente voor consumententransacties: 6 % per 1 juli 2023 hier:

Personal Finance Canada GPT

A GPT designed to provide everyday financial advice and tools to Canadians, primarily inspired by the subreddit Personal Finance Canada.