Best AI tools for< Identify Financial Fraud >

20 - AI tool Sites

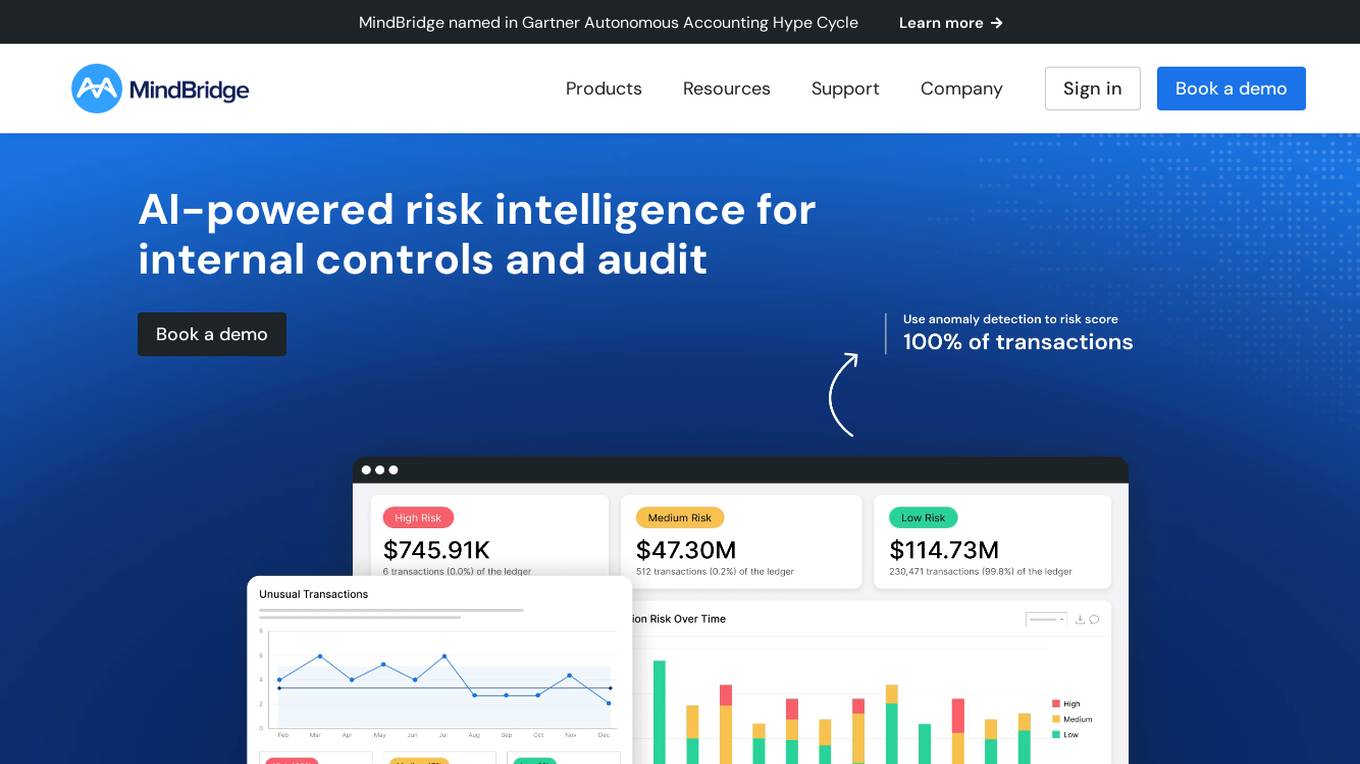

MindBridge

MindBridge is a global leader in financial risk discovery and anomaly detection. The MindBridge AI Platform drives insights and assesses risks across critical business operations. It offers various products like General Ledger Analysis, Company Card Risk Analytics, Payroll Risk Analytics, Revenue Risk Analytics, and Vendor Invoice Risk Analytics. With over 250 unique machine learning control points, statistical methods, and traditional rules, MindBridge is deployed to over 27,000 accounting, finance, and audit professionals globally.

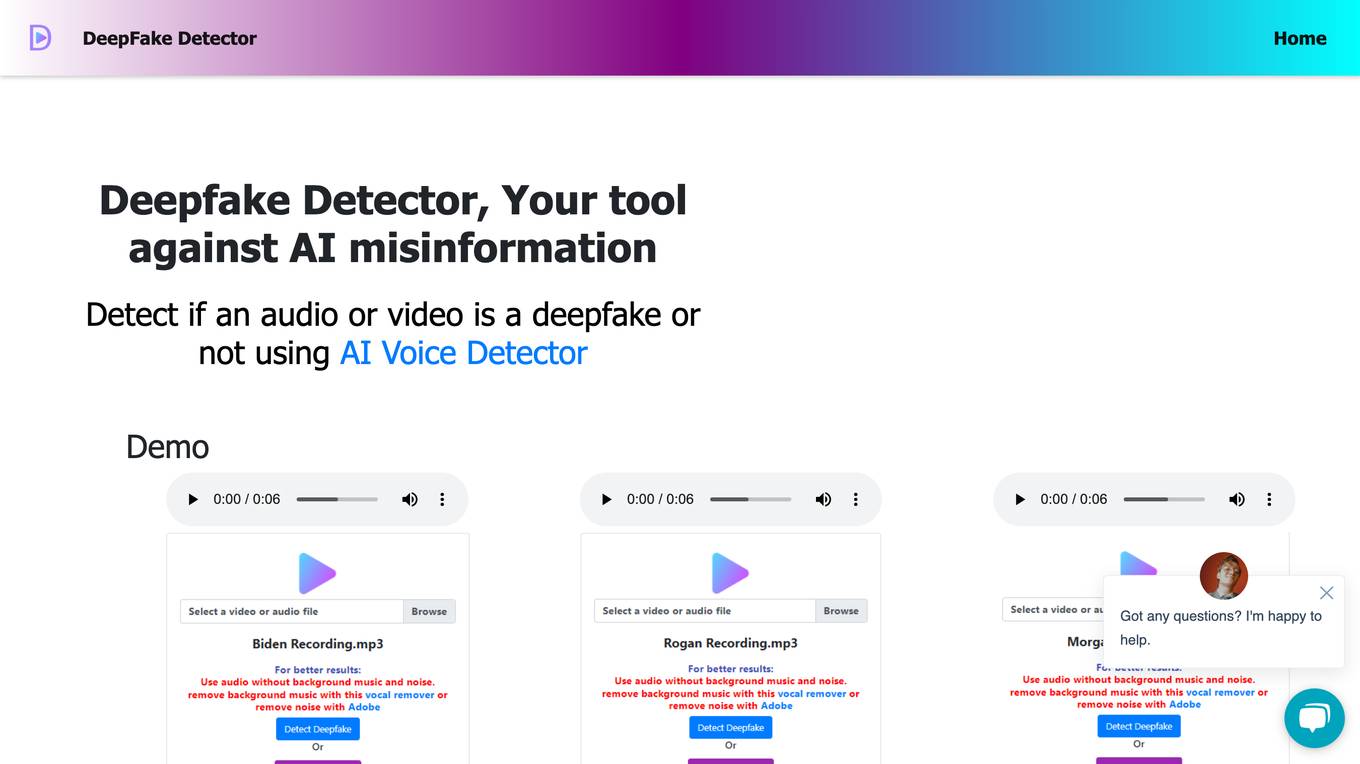

Deepfake Detector

Deepfake Detector is an AI tool designed to identify deepfakes in audio and video files. It offers features such as background noise and music removal, audio and video file analysis, and browser extension integration. The tool helps individuals and businesses protect themselves against deepfake scams by providing accurate detection and filtering of AI-generated content. With a focus on authenticity and reliability, Deepfake Detector aims to prevent financial losses and fraudulent activities caused by deepfake technology.

Greip

Greip is an AI-powered fraud prevention tool that offers a range of services to detect and prevent fraudulent activities in payments, validate card and IBAN details, detect profanity in text, identify VPN/proxy connections, provide IP location intelligence, and more. It combines AI-driven transaction analysis with advanced technology to safeguard financial security and enhance data integrity. Greip's services are trusted by businesses worldwide for secure and reliable protection against fraud.

Meysey

Meysey is an AI fraud protection application designed for accountants and IT managed service providers. It offers automated fraud scanning using financial and operational data to help organizations prosper against the evolving fraud landscape. Meysey provides scalable solutions with seamless deployment and tailored pricing, enabling users to gain visibility of bribery and corruption risk, identify conflicts of interest, baseline financial patterns, and comply with fraud legislation. The application integrates with finance and business operations tools to analyze data across the commercial landscape, providing actionable insights to enhance business resilience and reduce fraud risk.

iSEM.ai

iSEM.ai is an end-to-end AI-powered AML and Fraud Detection solution that empowers users to identify risks, investigate anomalies, and streamline reporting. The platform combines human intelligence with machine technology to adapt, reduce risks, and enhance efficiency in combating financial crimes. iSEM.ai offers tailored solutions to manage client data, onboard monitoring, client profile management, watchlist monitoring, transaction monitoring, transaction screening, and fraud monitoring. The application is designed to help businesses comply with regulations, detect suspicious activities, and ensure seamless protection at every step.

ThetaRay

ThetaRay is an AI-powered transaction monitoring platform designed for fintechs and banks to detect threats and ensure trust in global payments. It uses unsupervised machine learning to efficiently detect anomalies in data sets and pinpoint suspected cases of money laundering with minimal false positives. The platform helps businesses satisfy regulators, save time and money, and drive financial growth by identifying risks accurately, boosting efficiency, and reducing false positives.

Aura

Aura is an all-in-one digital safety platform that uses artificial intelligence (AI) to protect your family online. It offers a wide range of features, including financial fraud protection, identity theft protection, VPN & online privacy, antivirus, password manager & smart vault, parental controls & safe gaming, and spam call protection. Aura is easy to use and affordable, and it comes with a 60-day money-back guarantee.

DataVisor

DataVisor is a modern, end-to-end fraud and risk SaaS platform powered by AI and advanced machine learning for financial institutions and large organizations. It provides a comprehensive suite of capabilities to combat a variety of fraud and financial crimes in real time. DataVisor's hyper-scalable, modern architecture allows you to leverage transaction logs, user profiles, dark web and other identity signals with real-time analytics to enrich and deliver high quality detection in less than 100-300ms. The platform is optimized to scale to support the largest enterprises with ultra-low latency. DataVisor enables early detection and adaptive response to new and evolving fraud attacks combining rules, machine learning, customizable workflows, device and behavior signals in an all-in-one platform for complete protection. Leading with an Unsupervised approach, DataVisor is the only proven, production-ready solution that can proactively stop fraud attacks before they result in financial loss.

VisionLabs

VisionLabs is a leading provider of facial recognition technology that enhances digital identity experiences. Their Artificial Intelligence and Machine Learning technology, based on neural network algorithms, ensures a safer and more secure world, enabling seamless navigation in the digital realm. With applications in over 60 countries across various industries, VisionLabs aims to facilitate better and safer interactions through facial recognition technology.

Sardine

Sardine is an AI-powered platform for fraud prevention and compliance. It offers a comprehensive suite of products to help banks, retailers, and fintechs detect fraud patterns, prevent money laundering, and stop sophisticated scams. Sardine combines deep device intelligence, behavior biometrics, and identity signals to provide a precise risk score for every customer interaction. The platform also features machine learning models, a rules engine, network graph analysis, anomaly detection, and generative AI capabilities to fight modern threats. Sardine helps reduce fraud rates, decrease false positives, and streamline risk operations with its fully integrated solutions.

Onfido

Onfido is a digital identity verification provider that helps businesses verify the identities of their customers online. It offers a range of products and services, including document verification, biometric verification, data verification, and fraud detection. Onfido's solutions are used by businesses in a variety of industries, including financial services, gaming, healthcare, and retail.

Trust Stamp

Trust Stamp is an AI-powered digital identity solution that focuses on mitigating fraud through biometrics, privacy, and cybersecurity. The platform offers secure authentication and multi-factor authentication using biometric data, along with features like KYC/AML compliance, tokenization, and age estimation. Trust Stamp helps financial institutions, healthcare providers, dating platforms, and other industries prevent identity theft and fraud by providing innovative solutions for account recovery and user security.

Ocrolus

Ocrolus is an intelligent document automation software that leverages AI-driven document processing automation with Human-in-the-Loop. It offers capabilities such as classifying, capturing, detecting, and analyzing documents, with use cases in cash flow, income, address, employment, and identity verification. Ocrolus caters to various industries like small business lending, mortgage, consumer finance, and multifamily housing. The platform provides resources for developers, including guides on income verification, fraud detection, and business process automation. Users can explore the API to build innovative customer experiences and make faster and more accurate financial decisions.

Instnt

Instnt is an AI-powered fraud prevention solution that helps businesses increase approval rates while significantly reducing fraud risk. It eliminates financial risk by shifting fraud losses to A-rated insurers, allowing businesses to grow fearlessly and protect effortlessly. Instnt combines seamless fraud prevention and KYC checks to validate users from day one, ensuring businesses stay protected. The platform offers a comprehensive solution with advanced fraud prevention technology, performance-based pricing, and up to $100M in fraud loss insurance. Instnt is suitable for various industries such as finance, government, e-commerce, crypto, gaming, and healthcare.

Castello.ai

Castello.ai is a financial analysis tool that uses artificial intelligence to help businesses make better decisions. It provides users with real-time insights into their financial data, helping them to identify trends, risks, and opportunities. Castello.ai is designed to be easy to use, even for those with no financial background.

Qdeck

Qdeck is an AI-powered platform designed to assist financial professionals, such as financial advisors and institutional asset managers, in streamlining and enhancing client communication, research, and marketing efforts. The platform leverages generative AI technology to provide real-time market insights, personalized communications, and hyper-personalized content creation. With access to over 50,000 data sources daily, Qdeck aims to revolutionize wealth management practices by analyzing extensive data from multiple sources and enhancing client service through seamless CRM integration.

Dark Pools

Dark Pools is a leading provider of AI-powered solutions for the financial industry. Our mission is to empower our clients with the tools and insights they need to make better decisions, improve their performance, and stay ahead of the competition. We offer a range of products and services that leverage AI to automate tasks, optimize workflows, and generate actionable insights. Our solutions are used by a wide range of financial institutions, including hedge funds, asset managers, and banks.

Investiment.io

Investiment.io is a financial news and data platform that uses AI to help investors make better decisions. The platform provides access to real-time news, earnings transcripts, and financial data, as well as AI-powered insights and analysis. Investiment.io is designed to help investors of all levels, from beginners to experienced professionals.

Fama.one

Fama.one is an AI-powered platform that helps businesses automate their financial processes. It uses machine learning to analyze financial data and identify patterns, which can then be used to automate tasks such as invoice processing, expense management, and financial reporting. Fama.one also provides businesses with insights into their financial performance, which can help them make better decisions.

Venture Planner

Venture Planner is an AI-powered platform designed to help users generate professional business plans effortlessly. By answering a series of multiple-choice questions, users can create detailed financial forecasts without the need for typing. The platform is fully bespoke to each user's business, offering automated projections, professional quality plans, and strategy suggestions. With over 50,000 users across 74 industries in 22 countries, Venture Planner leverages cutting-edge AI technology to outpace competitors and provide data-driven insights for informed decision-making.

0 - Open Source AI Tools

20 - OpenAI Gpts

Bank Statement Analyst

Multilingual financial expert for PDF bank statement analysis ->> Latest Update: Mar 12th, 2024

Financial Reporting Advisor

Enhances financial decision-making by analyzing, interpreting and reporting financial data.

1 Main Insight Summary for Cash Flow Statement

Comprehensive analysis of cash flow statements, covering a wide array of financial metrics.

Performance Controlling Advisor

Drives financial performance improvement via strategic analysis and advice.

Strategic Planning Advisor

Guides financial strategy through data analysis and forecasting.

Safaricom Financial Analyst

Analyzes Safaricom's HY and FY financials, with detailed insights on different years.

Financial Sentiment Analyst

A sentiment analysis tool for evaluating management-related texts.

Financial Statement Analyzer

Analyze Financial Statements step by step to Predict Earnings Direction

Disclosure-Analysis

Upload disclosure documents, and I will summarize what's going on, identify red flag areas to look closer at, and answer all Q&A!

Startup Critic

Apply gold-standard startup valuation and assessment methods to identify risks and gaps in your business model and product ideas.

Sheets Expert

Master the art of Google Sheets with an assistant who can do everything from answer questions about basic features, explain functions in an eloquent and succinct manner, simplify the most complex formulas into easy steps, and help you identify techniques to effectively visualize your data.

wallstreetbets advisor

Analyzes r/wallstreetbets for top topics, trends, and potential financial advice.

Capital Companion

A savvy guide for financial insights and strategies, including fundamental, technical, and sentiment analysis for investing and trading.