Best AI tools for< Analyze Financial Data >

20 - AI tool Sites

Levelup Intelligence

Levelup Intelligence is an advanced financial reporting tool designed for SMB portfolios. It provides a comprehensive dashboard to view and analyze financial data, offering real-time insights and customizable KPIs. The tool integrates with major accounting platforms, such as Quickbooks and Xero, to streamline data organization and analysis. With AI-powered standardization, Levelup ensures financial transparency and accuracy, making it a valuable resource for accounting firms and financial institutions.

Datafitai

Datafitai is a community platform for ChatGPT prompting, where users can find and share top-rated prompts for various topics such as marketing, coding, finance, writing, gaming, and art. The platform aims to improve the accuracy of ChatGPT responses by providing high-quality prompts. Users can explore, share, and contribute to a wide range of prompts to enhance their ChatGPT experience.

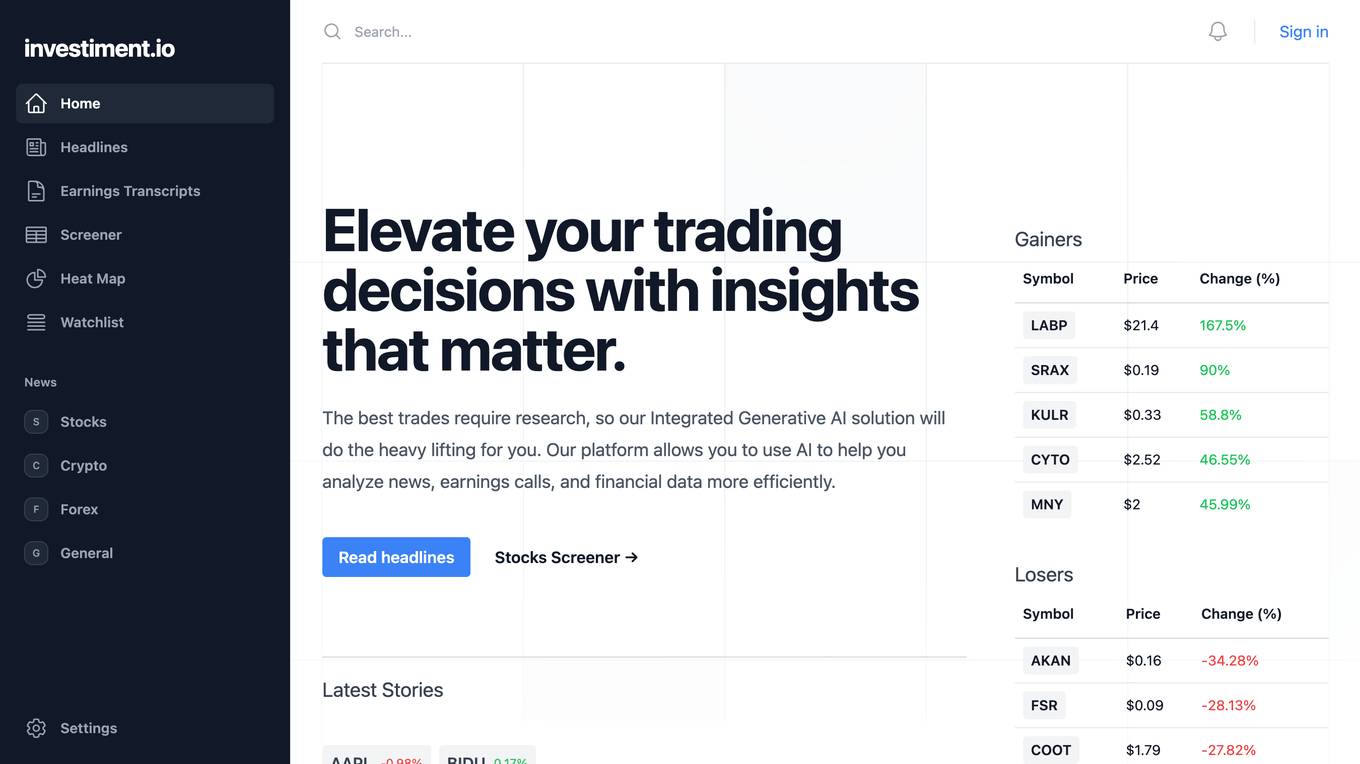

Investiment.io

Investiment.io is a financial news and data platform that uses AI to help investors make better decisions. The platform provides access to real-time news, earnings transcripts, and financial data, as well as AI-powered insights and analysis. Investiment.io is designed to help investors of all levels, from beginners to experienced professionals.

Envestnet | Yodlee

Envestnet | Yodlee is an AI-powered Conversational Banking platform that provides financial institutions and FinTech innovators with powerful data solutions. It offers a range of products and APIs for data aggregation, account verification, transaction data enrichment, financial wellness, and conversational AI. The platform enables personalized financial advice, secure account verification, and deep insights into customer needs, driving meaningful interactions. Envestnet | Yodlee revolutionizes the digital customer experience by leveraging natural language processing and machine learning to create seamless, personalized banking experiences across various channels.

Quill AI

Quill is an AI-powered SEC filing platform that allows users to extract key information from filings, answer questions about public investor materials, access historical financial data, and receive real-time SEC filings and earnings call transcripts. The platform leverages financially-tuned AI to provide accurate and up-to-date information, making it a valuable tool for analysts and professionals in the finance industry.

Castello.ai

Castello.ai is a financial analysis tool that uses artificial intelligence to help businesses make better decisions. It provides users with real-time insights into their financial data, helping them to identify trends, risks, and opportunities. Castello.ai is designed to be easy to use, even for those with no financial background.

Reportify

Reportify is an AI platform for investment research that provides detailed analysis and insights on various companies, filings, transcripts, reports, and news. Users can explore financial data, performance metrics, and market trends to make informed investment decisions. The platform offers a comprehensive view of the investment landscape, including company histories, financial reports, and industry analysis.

CityFALCON

CityFALCON is a financial and business due diligence platform that provides a range of solutions for the needs of a wide audience, including retail investors, retail traders, daily business news readers, brokers, students, professors, academia, wealth managers, financial advisors, P2P crowdfunding, VC, PE, institutional investors, treasury, consultancy, legal, accounting, central banks, and regulatory agencies. The platform offers a variety of features and content, including a CityFALCON Score, watchlists, similar stories, grouping news on charts, key headlines, sentiment content translation, content news premium publications, insider transactions, official company filings, investor relations, ESG content, and languages.

Receipt OCR API

Receipt OCR API by ReceiptUp is an advanced tool that leverages OCR and AI technology to extract structured data from receipt and invoice images. The API offers high accuracy and multilingual support, making it ideal for businesses worldwide to streamline financial operations. With features like multilingual support, high accuracy, support for multiple formats, accounting downloads, and affordability, Receipt OCR API is a powerful tool for efficient receipt management and data extraction.

FinChat.io

FinChat.io is a comprehensive AI-powered stock research platform that provides institutional-quality data and insights to investors. With FinChat.io, you can access accurate financial data on over 100,000 global public companies, as well as company revenue and profit segments, KPIs, analyst estimates, price targets, and ratings. FinChat.io also utilizes cutting-edge AI to build summaries, models, and visualizations, making it easy to understand complex financial data. Additionally, FinChat.io offers a customizable terminal, allowing you to track what matters most to you and auto-save your research. With FinChat.io, you can work faster than ever and make better investment decisions.

Fama.one

Fama.one is an AI-powered platform that helps businesses automate their financial processes. It uses machine learning to analyze financial data and identify patterns, which can then be used to automate tasks such as invoice processing, expense management, and financial reporting. Fama.one also provides businesses with insights into their financial performance, which can help them make better decisions.

PropelRx

PropelRx is an AI-powered corporate finance automation tool that streamlines financial processes for businesses. It leverages artificial intelligence to automate tasks such as financial analysis, forecasting, and reporting, enabling organizations to make data-driven decisions efficiently. With PropelRx, users can save time and resources by reducing manual work and human errors in financial operations.

Novus Writer

Novus Writer is a customizable, on-premise AI and LLM solution designed to enhance efficiency in various business functions, including sales, finance, customer support, and more. It offers a range of features such as plagiarism detection, long-form generation, proofreading, fact checking, and custom AI agents. Novus Writer is trusted by enterprises for its streamlined processes, advanced data analysis capabilities, and compliance with industry standards.

Monexa

Monexa is a professional-grade financial analysis platform that offers institutional-grade market insights, news, and data analysis in one powerful platform. It provides comprehensive market analysis, AI-powered insights, rich data visualizations, research and analysis tools, advanced screener, rich financial history, automated SWOT analysis, comprehensive reports, interactive performance analytics, institutional investment tracking, company intelligence, dividend analysis, earnings call analysis, portfolio analytics, strategy explorer, real-time market intelligence, and more. Monexa is designed to help users make data-driven investment decisions with a comprehensive suite of analytical capabilities.

Potato.trade

Potato.trade was a service that has been closed down as the company evolved into an AI Finance solutions company called Telescope. The website is no longer active, and users are encouraged to explore the new direction in AI-powered financial solutions at telescope.co.

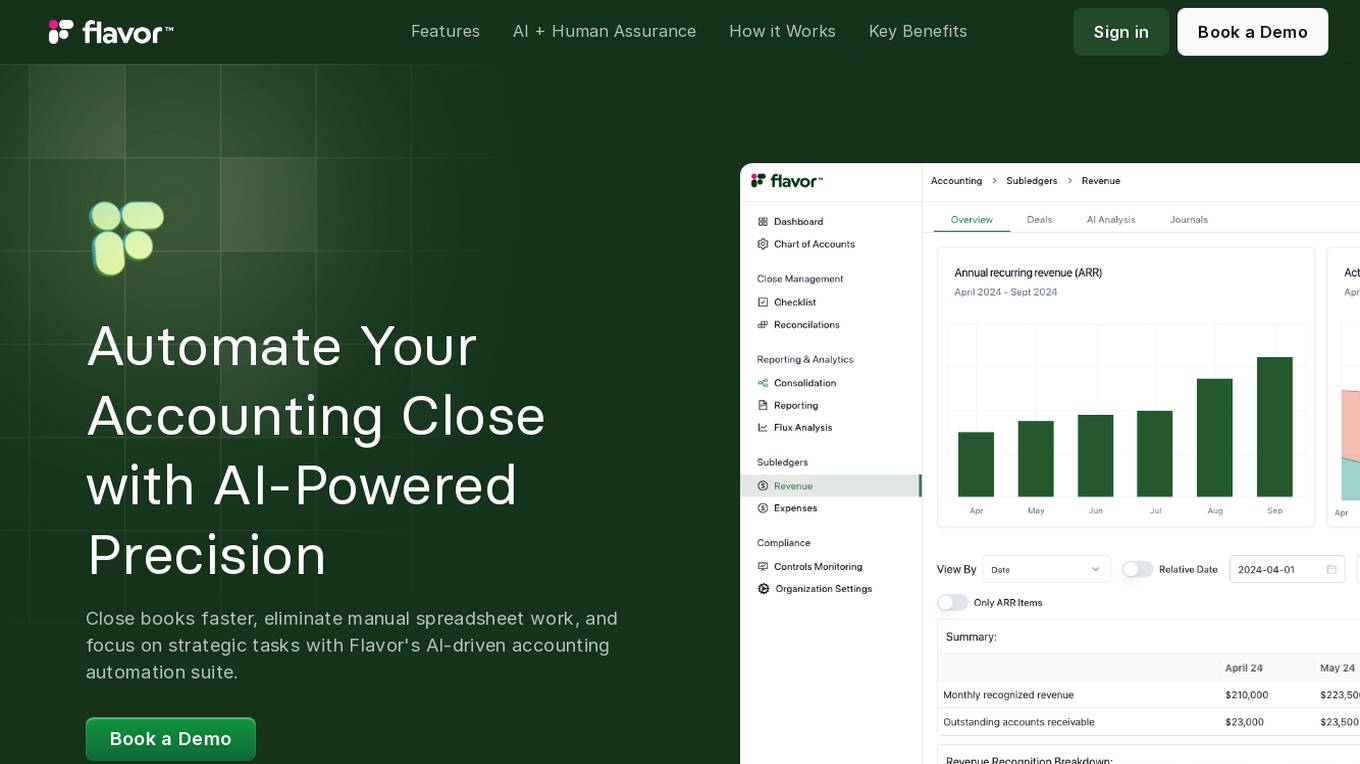

Flavor

Flavor is an AI-powered accounting automation tool that revolutionizes the month-end close process. It automates tasks such as book closure management, general ledger reconciliations, consolidation & reporting, financial analysis, and accruals management. Flavor combines AI technology with human validation to ensure accurate, compliant, and audit-ready financial records. The tool offers customizable checklists, real-time insights, and dynamic reports for faster decision-making. With Flavor, users can reduce manual workload, eliminate errors, and focus on strategic growth initiatives.

PrometAI

PrometAI is an AI-powered business plan generator that helps entrepreneurs and businesses create comprehensive and professional business plans. It offers a range of features and tools to guide users through each step of the planning process, including strategy development, financial analysis, and valuation. PrometAI's platform is designed to simplify and streamline the business planning process, making it accessible to users of all levels of experience.

AI Agents for SMBs

The website is an AI tool designed to assist Small and Medium Businesses (SMBs) in various aspects of their operations. It utilizes AI agents to provide intelligent solutions and support to SMBs, helping them streamline processes, make data-driven decisions, and enhance overall efficiency. The tool aims to empower SMBs with advanced technology typically available to larger enterprises, enabling them to compete effectively in the market.

Meysey

Meysey is an AI fraud protection application designed for accountants and IT managed service providers. It offers automated fraud scanning using financial and operational data to help organizations prosper against the evolving fraud landscape. Meysey provides scalable solutions with seamless deployment and tailored pricing, enabling users to gain visibility of bribery and corruption risk, identify conflicts of interest, baseline financial patterns, and comply with fraud legislation. The application integrates with finance and business operations tools to analyze data across the commercial landscape, providing actionable insights to enhance business resilience and reduce fraud risk.

Accountancy Age

Accountancy Age is an AI-powered platform that offers cutting-edge accounting solutions and insights for businesses. It provides a wide range of resources, news articles, and rankings related to accounting firms, audit, consulting, tax, and business recovery. With a focus on AI and cloud-centric strategies, Accountancy Age helps businesses navigate complex financial landscapes and regulatory environments. The platform aims to redefine accounting practices by leveraging advanced technologies to enhance efficiency and accuracy in financial management.

0 - Open Source AI Tools

20 - OpenAI Gpts

Financial Reporting Advisor

Enhances financial decision-making by analyzing, interpreting and reporting financial data.

Financial Reporting Advisor

Enhances financial decision-making by analyzing, interpreting and presenting financial data.

Strategic Planning Advisor

Guides financial strategy through data analysis and forecasting.

Quotient

Investment Co-Pilot: Portfolio backtesting and access to in-depth financial data and historical closing prices of US-listed companies. (Pulse formerly)

Performance Controlling Advisor

Drives financial performance improvement via strategic analysis and advice.

wallstreetbets advisor

Analyzes r/wallstreetbets for top topics, trends, and potential financial advice.

Financial Accounting Professor

Expert in financial accounting, clarifying complex concepts with academic sources.

Financial Modeling GPT

Expert in financial modeling for valuation, budgeting, and forecasting.

SherLock Investor

The Sign of Money: A SherLockian Quest for Decoding the Financial Market’s Mysteries

Corporate Finance Advisor

Guides financial decisions by monitoring and enforcing policies and procedures.