Best AI tools for< Tax Consultant >

Infographic

21 - AI tool Sites

AiTax

AiTax is an AI-based tax-preparation software that leverages Artificial Intelligence and Machine Learning to help individuals and entrepreneurs prepare and file their taxes accurately and efficiently. The software eliminates the risk of human error, ensures the lowest possible tax amount, prioritizes data security, and offers free audit and legal defense support. AiTax aims to simplify the tax-filing process, maximize potential refunds, and minimize the chances of an audit, providing users with a reliable and secure solution for their tax needs.

Taxly

Taxly is a user-friendly online platform designed to automate the process of UAE corporate tax filing for small and medium enterprises (SMEs), free zone entities, and accountants. The application simplifies tax compliance by allowing users to upload their financial data and receive FTA-ready tax returns. Taxly provides real-time tax insights, instant tax projections, and built-in compliance assistance to help users navigate the complexities of UAE tax regulations. With a focus on simplicity and efficiency, Taxly aims to streamline the tax filing process for businesses in the UAE.

Kintsugi Vertex

Kintsugi Vertex is an AI-powered sales tax automation tool designed to help companies globally in monitoring, filing, and optimizing sales tax. It automates compliance in three simple steps: connecting and monitoring billing, payment, and HR systems; registering and collecting the right tax with precise rules; and remitting and filing taxes seamlessly. The tool eliminates manual tax calculations, compliance headaches, and unexpected fees, making tax reporting and filing a breeze. It offers white glove support and accurate Nexus tracking to ensure compliance without the complexity of tax requirements. Kintsugi Vertex is trusted by leading businesses worldwide for its end-to-end tax compliance solutions.

AI Bank Statement Converter

The AI Bank Statement Converter is an industry-leading tool designed for accountants and bookkeepers to extract data from financial documents using artificial intelligence technology. It offers features such as automated data extraction, integration with accounting software, enhanced security, streamlined workflow, and multi-format conversion capabilities. The tool revolutionizes financial document processing by providing high-precision data extraction, tailored for accounting businesses, and ensuring data security through bank-level encryption. It also offers Intelligent Document Processing (IDP) using AI and machine learning techniques to process structured, semi-structured, and unstructured documents.

CanTax.ai

CanTax.ai is an AI-powered platform offering instant tax help for Canadians. It provides personalized tax advice tailored to individual financial needs, ensuring privacy and security with industry-leading encryption protocols. The platform's artificial intelligence is proficiently trained on federal and provincial tax legislation, offering comprehensive knowledge and 24/7 availability. CanTax aims to simplify the tax filing process and empower Canadians with expert-level tax guidance.

ChatNRA

ChatNRA is an innovative platform dedicated to assisting non-US residents in various aspects of launching and managing a US company. Their comprehensive suite of services is designed to streamline the process of establishing a US business presence and navigating the complexities of the American market. They offer services such as LLC and INC formation, tax filing, annual compliance, bookkeeping, and beneficial ownership information. ChatNRA aims to simplify the process for individuals looking to start and manage a US-based business, providing expert guidance and support throughout the journey.

TaxGPT

TaxGPT is an AI-powered tax assistant that provides accurate and up-to-date answers to tax-related questions. It is designed for individuals, business owners, and tax professionals, offering personalized answers, maximized deductions, and time-saving features. TaxGPT utilizes advanced AI algorithms and a proprietary hallucination control system to ensure reliable and accurate information. With TaxGPT, users can navigate complex tax situations, make informed decisions, and streamline their tax filing process.

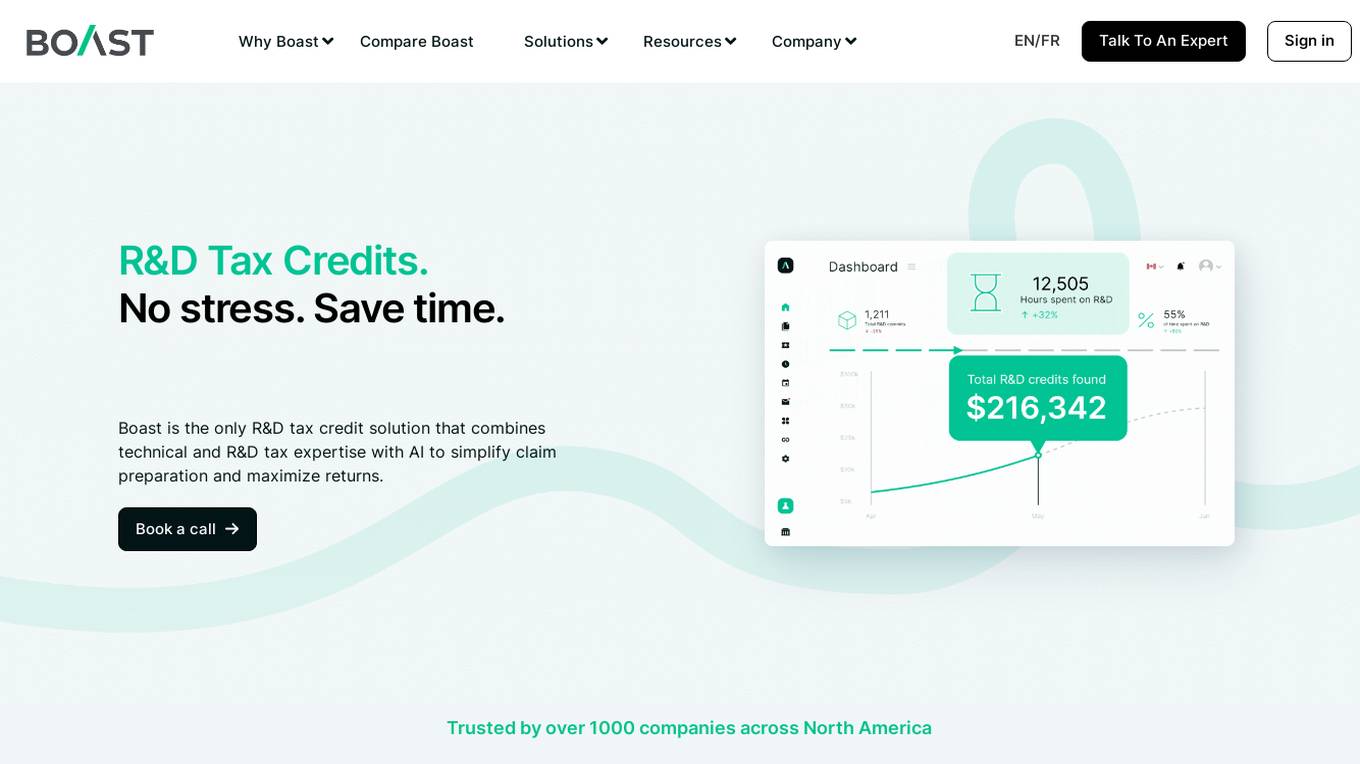

Boast

Boast is an AI-driven platform that simplifies the process of claiming R&D tax credits for companies in Canada and the US. By combining technical expertise with AI technology, Boast helps businesses maximize their returns by identifying and claiming eligible innovation funding opportunities. The platform offers complete transparency and control, ensuring that users are well-informed at every step of the claim process. Boast has successfully helped over 1000 companies across North America to secure higher R&D tax credit claims with less effort and peace of mind.

Blue J

Blue J is a legal technology company founded in 2015, dedicated to enhancing tax research with the power of AI. Their AI-powered tool, Ask Blue J, provides fast and verifiable answers to tax questions, enabling tax professionals to work more efficiently. Blue J's generative AI technology helps users find authoritative sources quickly, expedite drafting processes, and cater to junior staff's research needs. The tool is trusted by hundreds of leading firms and offers a comprehensive database of curated tax content.

Financial Planning

The Financial Planning website is a comprehensive platform that offers insights and resources on various aspects of financial planning, including tax investing, wealth management, estate planning, retirement planning, practice management, regulation and compliance, technology, industry news, and opinion pieces. The site covers a wide range of topics relevant to financial advisors and professionals in the wealth management industry. It also features articles on emerging trends, investment strategies, industry updates, and expert opinions to help readers stay informed and make informed decisions.

AccountingSolverAI

AccountingSolverAI is a free online AI accountant assistant application that helps users analyze and solve accounting problems from prompts, text, data docs, or images. Users can input their accounting problem data in text or documents with a question, and the AI tool will provide solutions. The application is powered by pmfm.ai and offers a pricing model of free for 5 messages, then $5 per 250 messages. AccountingSolverAI simplifies accounting tasks and provides quick solutions for users.

TaxTim

TaxTim is an AI-powered tax filing application designed to help individuals and businesses in South Africa easily and accurately complete their tax returns. The platform offers a user-friendly interface where users can answer simple questions to generate a fully completed tax return ready for submission to the South African Revenue Service (SARS). TaxTim is integrated with SARS to import IRP5 data, ensuring accurate and timely filing. With a focus on security and maximum refunds, TaxTim is a reliable solution for tax compliance.

Deferred.com

Deferred.com is a free AI tool designed to assist users with 1031 exchanges, a tax-deferral strategy in real estate investment. The platform offers a range of resources, including an exchange calculator, expert answers, and matching with 1031 professionals. Users can optimize tax savings, find the right intermediary, and access essential reading materials on tax deferral and exchange rules. With a focus on simplifying the complex process of 1031 exchanges, Deferred.com aims to empower real estate investors to make informed decisions and maximize their financial benefits.

TruePrep

TruePrep is an AI software designed for tax accounting firms and CPAs to streamline tax planning, projections, and research processes. The AI Assistant within TruePrep helps accountants and financial advisors to quickly identify clients affected by tax changes, create tax projections, and answer complex tax questions in real time. By leveraging AI technology, TruePrep aims to save time, increase accuracy, and improve revenue generation for tax professionals.

Karbon

Karbon is an AI-powered practice management software designed for accounting firms to increase visibility, control, automation, efficiency, collaboration, and connectivity. It offers features such as team collaboration, workflow automation, project management, time & budgets tracking, billing & payments, reporting & analysis, artificial intelligence integration, email management, shared inbox, calendar integration, client management, client portal, eSignatures, document management, and enterprise-grade security. Karbon enables firms to automate tasks, work faster, strengthen connections, and drive productivity. It provides services like group onboarding, guided implementation, and enterprise resources including articles, ebooks, and videos for accounting firms. Karbon also offers live training, customer support, and a practice excellence scorecard for firms to assess their performance. The software is known for its AI and GPT integration, helping users save time and improve efficiency.

Blue Dot

Blue Dot is a leading AI tax compliance platform that offers solutions for global tax management and VAT recovery. The platform provides a comprehensive view of employee-driven transactions, ensuring tax compliance and reducing vulnerabilities. Blue Dot's technology leverages AI and ML to optimize VAT outcomes and automate the review process for taxable employee benefits. The platform is fully integrated with expense management systems, helping organizations streamline compliance efforts and improve data integrity.

Jyotax.ai

Jyotax.ai is an AI-powered tax solution that revolutionizes tax compliance by simplifying the tax process with advanced AI solutions. It offers comprehensive bookkeeping, payroll processing, worldwide tax returns and filing automation, profit recovery, contract compliance, and financial modeling and budgeting services. The platform ensures accurate reporting, real-time compliance monitoring, global tax solutions, customizable tax tools, and seamless data integration. Jyotax.ai optimizes tax workflows, ensures compliance with precise AI tax calculations, and simplifies global tax operations through innovative AI solutions.

Accountancy Age

Accountancy Age is an AI-powered platform that offers cutting-edge accounting solutions and insights for businesses. It provides a wide range of resources, news articles, and rankings related to accounting firms, audit, consulting, tax, and business recovery. With a focus on AI and cloud-centric strategies, Accountancy Age helps businesses navigate complex financial landscapes and regulatory environments. The platform aims to redefine accounting practices by leveraging advanced technologies to enhance efficiency and accuracy in financial management.

VIDUR

VIDUR is an AI agent designed for Corporate, Tax & Regulatory Laws. It provides expert-verified responses, updates, advisory, and drafts in a simple language format. The application is built by Ex Big4 and Tier 1 Law Firm Professionals, offering up-to-date knowledge from 250+ experts and Bharat Laws. VIDUR streamlines research processes, saves time, and ensures accuracy by harnessing proprietary access to knowledge and delivering high-quality, reliable results across diverse domains such as Income Tax, GST, Companies Act, and more.

Instafill.ai

Instafill.ai is an AI-powered PDF form filler tool designed to streamline the process of filling out tax forms like W-9 and TR-205. It offers an easy-to-use interface that guides users through each step, automated form validation for accuracy and compliance, and real-time assistance powered by advanced AI technology. Users can quickly fill out and validate their tax forms with minimal hassle, ensuring completeness and correctness of submissions.

CPA Pilot

CPA Pilot is an AI tax planning assistant designed for CPAs, Enrolled Agents, and U.S. tax firms. It acts as a digital tax advisor, automating tasks such as 1040 research, drafting client emails, generating marketing content, and staff onboarding. The tool aims to streamline tax preparation processes, improve client communication, and enhance overall efficiency for tax professionals.

0 - Open Source Tools

37 - OpenAI Gpts

Impôt Expert Québec

Expert in Quebec income tax returns, providing precise, professional advice. (2022 documents will update when 2023 documents are available)

GST Calculator

A GST rate calculator for goods and services, using provided documents for accuracy.

Norsk Skatterådgiver

Erfaren norsk skatterådgiver klar for å hjelpe med din selvangivelse!

Svenska Skatteassistenten

Skattexpert som hjälper till med deklarationen och skattefrågor i Sverige.

Guida Fiscale Professionisti e Imprese in Italia

Questo ChatBot è allenato sulle istruzioni e interpelli pubblicati dall'Agenzia dell'Entrate per rispondere alle domande di professionisti e imprese (by Luigi Severini - https://www.linkedin.com/in/luigiseverini/)

TaxGPT

Tax advice specialist offering guidance on tax-related queries. [FOR ENTERTAINMENT PURPOSES ONLY. NOT ACTUAL TAX ADVICE.]

SmartSkatt - Skatteeksperten for Norske AS

Din guide i skattespørsmål for aksjeselskap og holdingselskap.

USA Taxation Law Master

Expert in answering Taxation Law queries for small businesses in the USA

International Tax Advisor

Advises on international tax matters to optimize company's global tax position.

Tax Policy and Legislation Advisor

Informs tax strategies by analyzing and interpreting tax laws.

Danske Skatteregler

En assistent, der giver vejledende og opdaterede oplysninger om danske skatteregler. Det anbefales at spørge om kilden til svarene eller dobbelttjekke svarene på Skats egen hjemmeside.

Ayuda SAT México

Asistente experto para despejar dudas del SAT con respuestas rápidas y en lenguaje sencillo. ¡Pregunta y simplifica tus trámites tributarios!

TaxoGPT

Asesor de impuestos y finanzas empresariales, con enfoque en leyes fiscales de Guatemala

Your Business Taxes: Guide

insightful articles and guides on business tax strategies at AfterTaxCash. Discover expert advice and tips to optimize tax efficiency, reduce liabilities, and maximize after-tax profits for your business. Stay informed to make informed financial decisions.

Legal Tax Minimizer

Interactive questionnaire-based guide for assessing tax residency, liability, and legal minimization strategies.

Accounting News Tutor

Learn about accounting and related fields with today's top business & finance news.

lohnsteuerprüfung

Professional Austrian Payroll Tax Expert, ensuring clarity and precision in information.

Tax Optimization Techniques for Investors

💼📉 Maximize your investments with AI-driven tax optimization! 💡 Learn strategies to reduce taxes 📊 and boost after-tax returns 💰. Get tailored advice 📘 for smart investing 📈. Not a financial advisor. 🚀💡

Fiscal Solutions Turkey

Comprehensive knowledge base on fiscalization in Turkey, brought to you by Fiscal Solutions (www.fiscal-solutions.com)

Tax Assistant Pro

A tax expert GPT that creates forms, calculates taxes, and knows all state laws.