Best AI tools for< Risk Adjustment Specialist >

Infographic

20 - AI tool Sites

Apixio

Apixio is a healthcare AI company that provides solutions for health plans, providers, and ACOs. Their AI-powered platform helps organizations improve administrative, clinical, and financial outcomes. Apixio's solutions include risk adjustment, payment integrity, health data management, and AI-as-a-service.

ZeOmega

ZeOmega is an AI-powered healthcare solutions platform that offers population health analytics, care management, benefits administration, and operational efficiency. It provides a comprehensive set of practical, AI-powered solutions for various healthcare stakeholders, including health plans, health systems, Medicare, Medicaid, and ACOs. ZeOmega's platform integrates data to create a single source of truth, drives intelligent automation, and optimizes quality of care through AI-powered insights and automated workflows. The platform is designed to streamline operations, improve efficiency, and enhance the overall quality of healthcare services.

Navina AI

Navina AI is a clinician-first AI platform designed to streamline patient care by providing key insights and actionable recommendations to healthcare providers, ACOs, MSOs, and health plans. The platform leverages proprietary AI technology to improve clinical decision-making, reduce administrative burden, and enhance quality management and risk adjustment processes. Navina AI offers efficient chart review, accurate risk adjustment, streamlined quality management, robust analytics, and a user-friendly interface that integrates seamlessly into the clinical workflow.

Dataminr

Dataminr is a leading provider of real-time event and risk detection. Its AI platform processes billions of public data units daily to deliver real-time alerts on high-impact events and emerging risks. Dataminr's products are used by businesses, public sector organizations, and newsrooms to plan for and respond to crises, manage risks, and stay informed about the latest events.

Unit21

Unit21 is a customizable no-code platform designed for risk and compliance operations. It empowers organizations to combat financial crime by providing end-to-end lifecycle risk analysis, fraud prevention, case management, and real-time monitoring solutions. The platform offers features such as AI Copilot for alert prioritization, Ask Your Data for data analysis, Watchlist & Sanctions for ongoing screening, and more. Unit21 focuses on fraud prevention and AML compliance, simplifying operations and accelerating investigations to respond to financial threats effectively and efficiently.

FOCAL

FOCAL is an AI-driven platform designed for AML compliance and anti-fraud purposes. It offers solutions for verification, customer due diligence, fraud prevention, and financial insights. The platform leverages AI technology to streamline onboarding processes, enhance trust through advanced customer screening, and detect and prevent fraud using advanced AI algorithms. FOCAL is tailored to meet industry-specific needs, provides seamless integration with existing systems, and offers localized expertise with global standards for regulatory compliance.

BCT Digital

BCT Digital is an AI-powered risk management suite provider that offers a range of products to help enterprises optimize their core Governance, Risk, and Compliance (GRC) processes. The rt360 suite leverages next-generation technologies, sophisticated AI/ML models, data-driven algorithms, and predictive analytics to assist organizations in managing various risks effectively. BCT Digital's solutions cater to the financial sector, providing tools for credit risk monitoring, early warning systems, model risk management, environmental, social, and governance (ESG) risk assessment, and more.

datasurfr

datasurfr is an AI-driven risk monitoring and analysis platform augmented by human intelligence. It provides operational risk data and intelligence that is curated, customized, and comprehensive. The platform offers tailored alerts detected by AI, curated by surfers, and analyzed by subject matter experts for global security teams. datasurfr also offers predictive risk analytics, proactive alert risk assessment, resilience strategy, data-driven decision-making, supply chain resilience, dynamic incident response, regulatory compliance, and future-proofing strategies. The platform's algorithm works on AI detection and structuring, while human-based smart curation eliminates irrelevant data. Subject matter experts provide event summaries with insights and recommendations. datasurfr offers multi-modal communication through intuitive dashboards, mobile apps, emails, WhatsApp, and seamless APIs for versatile consumption.

Censinet

Censinet is a purpose-built AI-powered solution designed to reduce risk in the healthcare industry. It offers a comprehensive platform to address various risk factors, including third-party vendors, patient data, medical devices, and supply chain cybersecurity. The flagship offering, Censinet RiskOps, facilitates secure data sharing and collaboration among healthcare delivery organizations and vendors. With deep expertise in healthcare and cybersecurity, Censinet aims to transform cybersecurity and risk management in the healthcare sector.

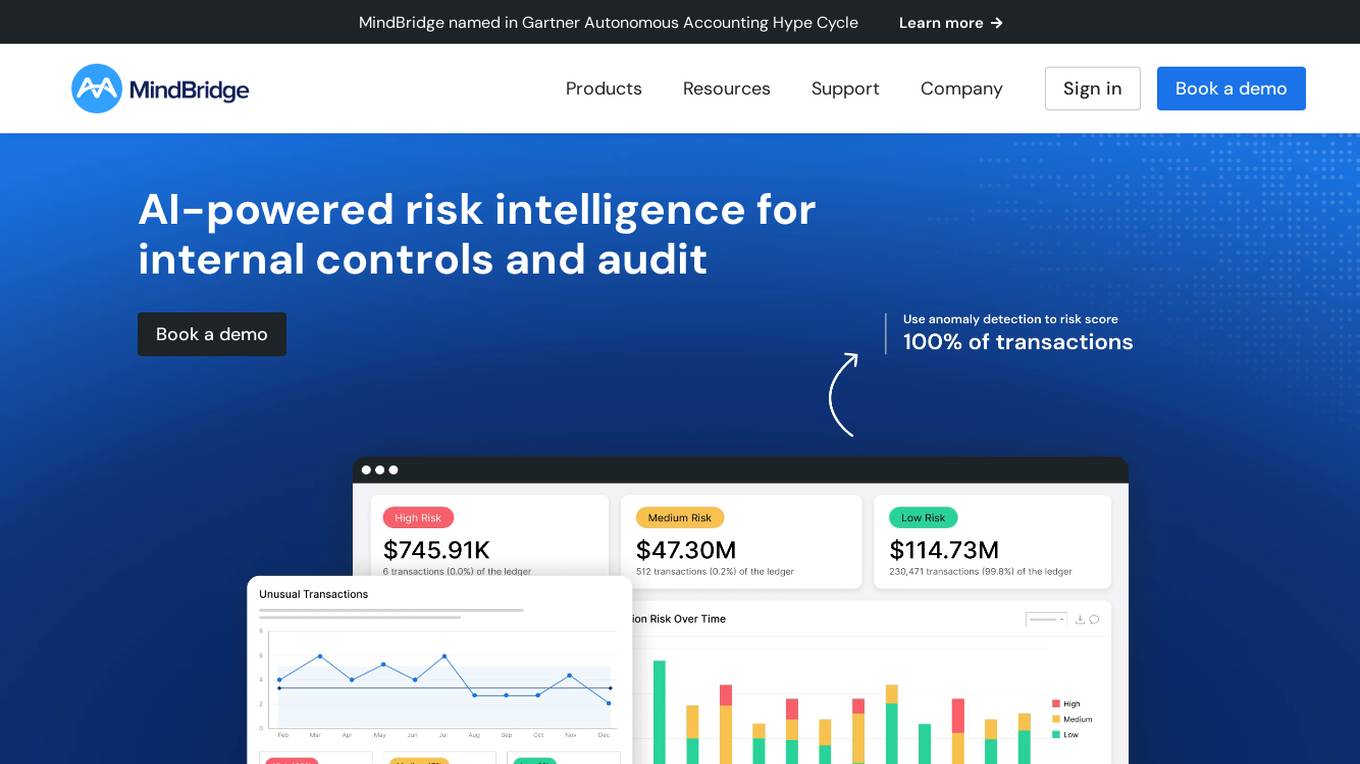

MindBridge

MindBridge is a global leader in financial risk discovery and anomaly detection. The MindBridge AI Platform drives insights and assesses risks across critical business operations. It offers various products like General Ledger Analysis, Company Card Risk Analytics, Payroll Risk Analytics, Revenue Risk Analytics, and Vendor Invoice Risk Analytics. With over 250 unique machine learning control points, statistical methods, and traditional rules, MindBridge is deployed to over 27,000 accounting, finance, and audit professionals globally.

SafeWaters.ai

SafeWaters.ai is an AI-powered application that provides shark risk forecasts for beaches globally. The app utilizes predictive AI technology trained on 200+ years of shark attack and marine weather data to deliver accurate 7-day forecasts. Users can search for any beach in the world, save favorites, and receive current and future risk assessments. Additionally, SafeWaters.ai offers features like Shark Spotting Drones Live Feed, Chatbot assistance, and Shark Tracking & Pattern Predictions based on tagged shark data.

Intelligencia AI

Intelligencia AI is a leading provider of AI-powered solutions for the pharmaceutical industry. Our suite of solutions helps de-risk and enhance clinical development and decision-making. We use a combination of data, AI, and machine learning to provide insights into the probability of success for drugs across multiple therapeutic areas. Our solutions are used by many of the top global pharmaceutical companies to improve their R&D productivity and make more informed decisions.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

DryRun Security

DryRun Security is an AI-driven application security tool that provides Contextual Security Analysis to detect and prevent logic flaws, authorization gaps, IDOR, and other code risks. It offers features like code insights, natural language code policies, and customizable notifications and reporting. The tool benefits CISOs, security leaders, and developers by enhancing code security, streamlining compliance, increasing developer engagement, and providing real-time feedback. DryRun Security supports various languages and frameworks and integrates with GitHub and Slack for seamless collaboration.

KnowBe4

KnowBe4 is a human risk management platform that offers security awareness training, cloud email security, phishing protection, real-time coaching, compliance training, and AI defense agents. The platform integrates AI to help organizations drive awareness, change user behavior, and reduce human risk. KnowBe4 is trusted by 70,000 organizations worldwide and is known for its comprehensive security products and customer-centric approach.

Growlonix

Growlonix is a cutting-edge crypto trading and investment platform designed to optimize and automate your trading experience. From innovative trading bots to dynamic signal automation and automated AI Bots, we cover it all. Our trading bots use advanced algorithms to maximize profits, minimize losses, and bring efficiency to your trading activities. We employ top-notch security measures to ensure that your funds remain secure while utilizing our bots. Whether you're stepping into the world of crypto or have years of trading expertise, Growlonix caters to every stage of your trading evolution.

Quantifind

Quantifind is an AI-powered financial crimes automation platform that specializes in Anti-Money Laundering (AML) and Know Your Customer (KYC) solutions. It offers end-to-end automation impact, best-in-class accuracy, and powerful APIs and applications for risk screening, investigations, and compliance in the financial services and public sector industries. Quantifind's Graphyte platform leverages AI and external data to streamline AML-KYC processes, providing comprehensive data coverage, dynamic risk typologies, and seamless integrations with case management systems.

nSure.ai

nSure.ai is a cutting-edge AI tool that specializes in payment fraud prevention solutions for industries such as Crypto, Gaming, Prepaid & Gift Cards. The platform offers a range of features including high transaction approval rates, chargeback guarantee, real-time decisioning, and innovative fraud prevention protocols like SoftApproval®, StingBack®, and DynamicKYC®. nSure.ai is backed by leading insurers and provides dedicated API and SDK for seamless integration. The tool aims to deliver guaranteed net incremental profit to clients while taking 100% liability for fraud-related chargebacks.

Constella Intelligence

Constella Intelligence is a world-class identity protection and identity risk intelligence platform powered by AI and the world's largest breach data lake. It offers solutions for API integrations, identity theft monitoring, threat intelligence, identity fraud detection, digital risk protection services, executive and brand protection, OSINT cybercrime investigations, and threat monitoring and alerting. Constella provides precise and timely alerts, in-depth real-time identity data signals, and enhanced situational awareness to help organizations combat cyber threats effectively.

WTRI

WTRI is an AI application that offers FutureView™, a suite of tools designed to help individuals and businesses rehearse their future scenarios in a virtual environment. By leveraging cognitive agility assessment, event generation, modeling, and virtual world platforms, WTRI aims to assist users in making agile decisions and adapting to rapidly changing business environments. With a focus on risk management and outcome optimization, WTRI provides a unique approach to strategic planning and preparedness.

0 - Open Source Tools

20 - OpenAI Gpts

Fluffy Risk Analyst

A cute sheep expert in risk analysis, providing downloadable checklists.

Diabetes Risk Evaluator

A professional, medical-focused tool for diabetes risk assessment.

Project Risk Assessment Advisor

Assesses project risks to mitigate potential organizational impacts.

Crisis & Risk Communication AI Assistant

Guide your Crisis Communication activity with tips from world-leading crisis professionals, Dr. Vincent Covello and Dr. Timothy Coombs.

Credit & Collections Advisor

Manages credit risk and implements effective collection strategies.

Hazard Analyst

Generates risk maps, emergency response plans and safety protocols for disaster management professionals.

Compliance Officer

Oversees company compliance, managing risk and audits, with a focus on staying current with regulations and software.

Nabard

This GPT, fueled by NABARD's insights, transforms rural lending in India with custom models, better risk assessments, policy guidance, rural-specific financial products, and financial literacy support, aiming to enhance accessibility and growth in rural economies.

Brand Safety Audit

Get a detailed risk analysis for public relations, marketing, and internal communications, identifying challenges and negative impacts to refine your messaging strategy.