Best AI tools for< Quantitative Trading Strategist >

Infographic

20 - AI tool Sites

IntelligentCross

Imperative Execution is the parent company of IntelligentCross, a platform that uses artificial intelligence (AI) to optimize trading performance in the US equities market. The platform's matching logic enhances market efficiency by optimizing price discovery and minimizing market impact. IntelligentCross is built with high-performance, massively parallel transaction processing that fully utilizes modern multi-core servers.

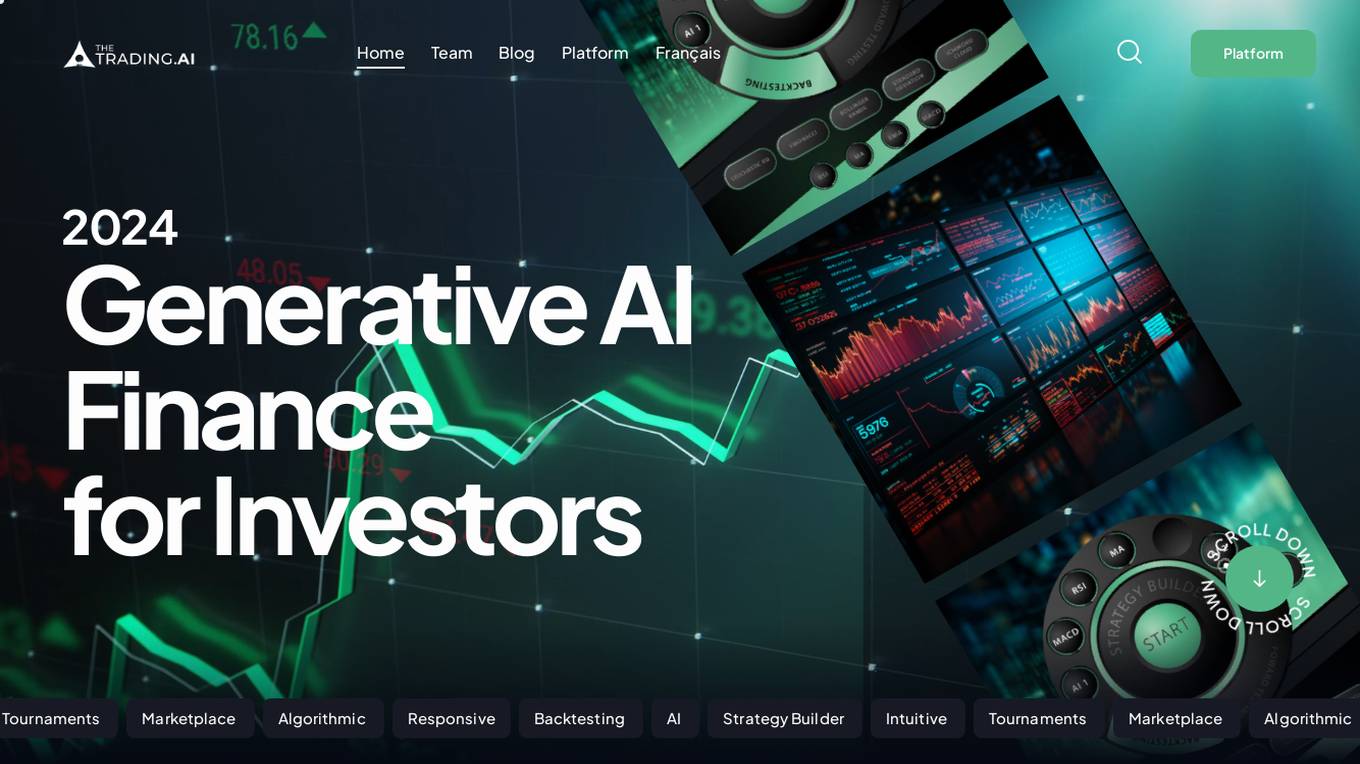

The Trading AI

The Trading AI is a generative AI financial platform that revolutionizes investment decisions. It offers an all-in-one solution for portfolio management, AI-assisted strategies, backtesting, and algorithmic trading. The platform features an intuitive user-friendly interface, lightning-fast backtesting, advanced live dashboard, and a strategy builder requiring no programming skills. Users can join the VIP Club for exclusive advantages, participate in tournaments, and monetize their strategies in the marketplace. The platform leverages AI to provide data-backed intelligence for optimized trading decisions.

b-cube.ai

b-cube.ai is a regulated quantamental trading platform that utilizes AI, quantitative models, and fundamentals to generate superior returns for institutional clients. The platform follows a Quantamental strategy, combining AI-generated signals with human verification to trade confidently and maximize profits. It offers two main funds, the AI Alpha Strategy Fund and the B3X Market Neutral Fund, each targeting different market opportunities. Additionally, b-cube.ai has its native token, BCUBE, which is used for value accrual and deflationary pressure through trading profits. The platform aims to provide consistent success over its 7-year track record.

Quadrature

Quadrature is an AI-powered automated trading business founded by programmers in 2010. The company utilizes sophisticated data and powerful technology to trade securities globally based on predictions made by statistical models. Their long-term vision is to trade all liquid electronically tradeable asset classes across all horizons to generate consistent, significant returns on their proprietary capital. Quadrature Climate Foundation (QCF) was established in 2019 as an independent foundation dedicated to addressing climate change through science-led philanthropy and high-impact solutions.

Archaide TradeLab

Archaide TradeLab is an AI-powered platform designed for algorithmic trading, enabling users to easily automate their trading strategies using simple English prompts. The platform allows users to quickly and reliably launch custom trading bots without the need for coding, streamlining deployment and providing data-driven insights for smarter trading decisions. With a focus on security and privacy, Archaide TradeLab ensures that users have complete control over their data and strategies, offering a secure environment for algorithmic trading.

NITG Inc

NITG Inc is the world's leading AI quantitative trading platform that combines innovative technologies such as AI, blockchain, and big data analysis to provide intelligent quantitative services. The platform offers efficient and secure trading solutions, automated intelligent trading system, excellent customer support, professional guidance, and top technical team to ensure a stable and reliable trading environment. NITG's AI quantitative trading strategies enable emotion-free decision-making, efficient execution, enhanced risk control capabilities, and adaptability to different market environments. The platform is committed to safeguarding users' funds and data through high-security measures and transparent trading practices.

Bobby™

Bobby™ is a cutting-edge AI platform designed for traders to track market manipulation and enhance trading strategies. It allows users to input trading rules in plain English and converts them into automated strategies without the need for coding. The platform offers features such as AI-powered analysis, pattern recognition, social sentiment tracking, and automated trading strategies, making it a valuable tool for traders looking to optimize their trading performance.

Capital Companion

Capital Companion is an AI-powered trading and investing platform designed to provide users with a competitive edge in the markets. The platform offers a range of features including 24/7 AI assistant support, intelligent trading recommendations, risk analysis tools, real-time stock analytics, market sentiment analysis, and pattern recognition for technical analysis. By leveraging artificial intelligence, Capital Companion aims to help traders make well-informed decisions and protect their investments in a dynamic market environment.

Tradytics

Tradytics is an AI-powered platform that simplifies complex trading data, making it accessible and actionable for every trader. With expertise in AI, Tradytics mines data that only Wall Street professionals have access to, providing a one-stop shop for all traders. The platform combines news for every stock, summarizes them with AI, and offers high-quality data worth millions to retail traders. Tradytics is available on all platforms, including Web, iOS, and Android, with lightweight mobile apps. The platform also offers Discord integration through bots for data access within Discord servers.

Stockpulse

Stockpulse is an AI-powered platform that analyzes financial news and communities using Artificial Intelligence. It provides decision support for operations by collecting, filtering, and converting unstructured data into processable information. With extensive coverage of financial media sources globally, Stockpulse offers unique historical data, sentiment analysis, and AI-driven insights for various sectors in the financial markets.

AskJimmy

AskJimmy is a platform for AI agents focused on finance and trading. It offers exposure to a diverse range of strategies managed by top-notch AI Agents. The platform allows users to compose autonomous agents and trading strategies with extreme customization. It aims to create a decentralized multi-strategy collaborative hedge-fund powered by AI agents. AskJimmy is designed to aggregate non-correlated autonomous agent strategies into a diversified subnet, shaping the future of multi-strategies decentralized hedge-fund.

Composer

Composer is an AI-powered trading platform that allows users to build trading algorithms with AI, backtest them, and execute trades all in one place. The platform does not require coding skills and offers pre-built strategies for users to invest in. Composer also provides automation features for trading strategy execution, portfolio management, and community sharing. With Composer, users can create, customize, and test trading strategies with the help of AI technology.

Quantum AI

Quantum AI is an advanced AI-powered trading platform that revolutionizes the trading experience by empowering users to make intelligent and strategic decisions. The platform offers a user-friendly interface, automated trading system, expert-designed strategies, risk-free demo mode, and top-level security. With round-the-clock expert assistance, exceptional satisfaction levels, and multilingual support, Quantum AI ensures a seamless trading experience for users worldwide.

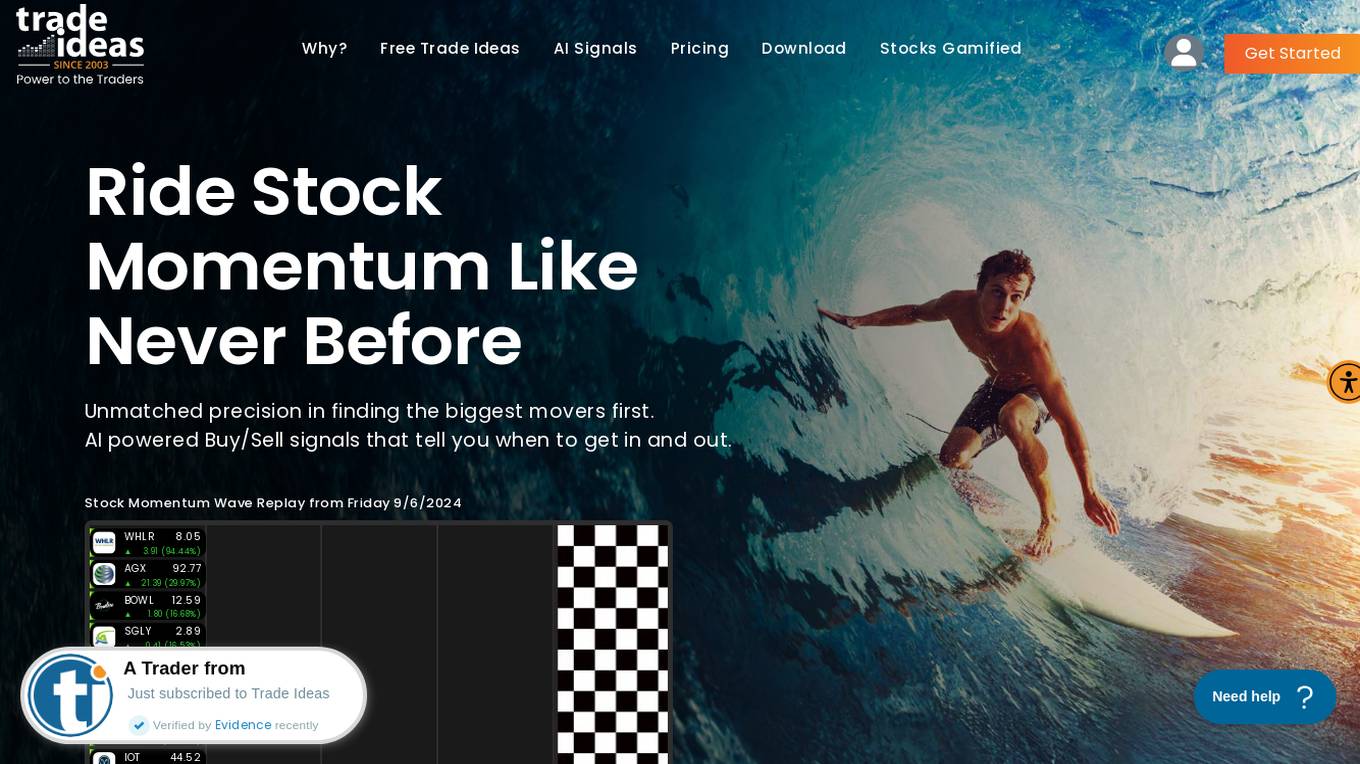

Trade Ideas

Trade Ideas is an AI-driven stock scanning and charting platform that provides unmatched precision in finding the biggest movers first. It offers AI-powered Buy/Sell signals, real-time market scanning, customizable alerts, advanced charting capabilities, and time-saving data visualization. Users can access the platform on any device, empowering them to make smarter trading decisions and stay ahead of the game. Trade Ideas also features a live trading room with expert market commentary and a simulator for practicing new trading strategies under actual market conditions. The platform is trusted by leading brokers and trading platforms, offering users a competitive edge in the market.

MetaMevs

MetaMevs is an advanced AI-powered trading solution designed to maximize profits in the fast-paced world of decentralized finance (DeFi). The platform offers cutting-edge technology and customizable solutions to help traders stay ahead of the curve and capitalize on market opportunities. With features like Sandwich Mevbot, HFT Futures and Spot Bot, FlashLoan Arbitrage Bot, and MetaMev Sniper, MetaMevs provides unmatched performance, security, and reliability for users to optimize their trading strategies.

Dark Pools

Dark Pools is a leading provider of AI-powered solutions for the financial industry. Our mission is to empower our clients with the tools and insights they need to make better decisions, improve their performance, and stay ahead of the competition. We offer a range of products and services that leverage AI to automate tasks, optimize workflows, and generate actionable insights. Our solutions are used by a wide range of financial institutions, including hedge funds, asset managers, and banks.

Finance Wizard

Finance Wizard is an AI-powered financial analytics tool that provides users with advanced stock predictions and market insights. By leveraging cutting-edge AI technology, Finance Wizard automates data analysis, allowing investors to focus on strategic decision-making rather than spending hours on market research. The tool is designed to empower users with accurate predictions and real-time insights to optimize trading strategies and enhance market understanding.

TradeOS AI

TradeOS AI is an advanced AI tool designed to provide professional insights for traders and investors. The platform utilizes cutting-edge artificial intelligence algorithms to analyze market trends, predict price movements, and offer personalized trading recommendations. With TradeOS AI, users can access real-time data, historical analysis, and market sentiment indicators to make informed decisions and optimize their trading strategies. Whether you are a novice trader or an experienced investor, TradeOS AI empowers you with the tools and knowledge needed to succeed in the financial markets.

Ailtra AI Crypto Bot

Ailtra's AI Crypto Bot is a revolutionary trading tool that leverages artificial intelligence to maximize profits and minimize losses in the cryptocurrency market. With its advanced algorithms, smart fund management, and risk-free trading experience, Ailtra empowers traders of all levels to achieve consistent profitability. The AI Crypto Bot's 13 levels of holding capacity and intelligent trading strategies ensure that your investments are in capable hands, guiding you through the complexities of the crypto market.

TradeUI

TradeUI is a comprehensive trading platform that provides advanced tools and resources for stock and options traders. It offers a range of features powered by artificial intelligence (AI), including AI sentiment analysis, option flow analysis, and AI pattern recognition. These tools help traders make informed decisions and identify potential trading opportunities. TradeUI also provides educational videos, a vibrant community, and a unified ecosystem for traders to connect and share knowledge.

0 - Open Source Tools

20 - OpenAI Gpts

AI Trading Ace

Expert in AI trading strategies, guiding users to leverage market opportunities.

MilaexGPT

Mila-ex: Your solution to seamless data and price retrieval across cryptocurrency exchanges, through our unified and simple RESTful API.

MQL5 Coder

Developer with the latest MQL5 documentation. Assists in making Expert Advisors for trading, Debugging, etc.

Quant Jiang

"My quantitative, my math specialist. Look at him, you notice anything different about him? Look at his face."

Tech Stock Analyst

Analyzes tech stocks with in-depth, qualitative and quantitative analysis

How to Measure Anything

对各种量化问题进行拆解和粗略的估算。注意这种估算主要是靠推测,而不是靠准确的数据,因此仅供参考。理想情况下,估算结果和真实值差距可能在1个数量级以内。即使数值不准确,也希望拆解思路对你有所启发。

VaultCraft Trainer

VaultCraft trains users to create automated yield strategies using the VaultCraft VCI & SDK

Nimbus

Expert in CFA, quant, software engineering, data science, and economics for investment strategies.