Best AI tools for< Quantitative Trader >

Infographic

20 - AI tool Sites

NITG Inc

NITG Inc is the world's leading AI quantitative trading platform that combines innovative technologies such as AI, blockchain, and big data analysis to provide intelligent quantitative services. The platform offers efficient and secure trading solutions, automated intelligent trading system, excellent customer support, professional guidance, and top technical team to ensure a stable and reliable trading environment. NITG's AI quantitative trading strategies enable emotion-free decision-making, efficient execution, enhanced risk control capabilities, and adaptability to different market environments. The platform is committed to safeguarding users' funds and data through high-security measures and transparent trading practices.

Composer

Composer is an AI-powered trading platform that allows users to build trading algorithms with AI, backtest them, and execute trades all in one place. The platform does not require coding skills and offers pre-built strategies for users to invest in. Composer also provides automation features for trading strategy execution, portfolio management, and community sharing. With Composer, users can create, customize, and test trading strategies with the help of AI technology.

Token Metrics

Token Metrics is an AI-powered crypto trading and research platform that provides users with real-time market trends, live trade alerts, and AI grades to help make informed investment decisions. With features like AI ratings, personalized research, and trading signals, Token Metrics aims to empower users to navigate the cryptocurrency markets effectively. Trusted by over 70,000 crypto investors, Token Metrics offers a comprehensive suite of tools and resources to enhance crypto investment strategies.

Capital Companion

Capital Companion is an AI-powered trading and investing platform designed to provide users with a competitive edge in the markets. The platform offers a range of features including 24/7 AI assistant support, intelligent trading recommendations, risk analysis tools, real-time stock analytics, market sentiment analysis, and pattern recognition for technical analysis. By leveraging artificial intelligence, Capital Companion aims to help traders make well-informed decisions and protect their investments in a dynamic market environment.

TradeOS AI

TradeOS AI is an advanced AI tool designed to provide professional insights for traders and investors. The platform utilizes cutting-edge artificial intelligence algorithms to analyze market trends, predict price movements, and offer personalized trading recommendations. With TradeOS AI, users can access real-time data, historical analysis, and market sentiment indicators to make informed decisions and optimize their trading strategies. Whether you are a novice trader or an experienced investor, TradeOS AI empowers you with the tools and knowledge needed to succeed in the financial markets.

Tradytics

Tradytics is an AI-powered platform that simplifies complex trading data, making it accessible and actionable for every trader. With expertise in AI, Tradytics mines data that only Wall Street professionals have access to, providing a one-stop shop for all traders. The platform combines news for every stock, summarizes them with AI, and offers high-quality data worth millions to retail traders. Tradytics is available on all platforms, including Web, iOS, and Android, with lightweight mobile apps. The platform also offers Discord integration through bots for data access within Discord servers.

Fintwit

Fintwit is an AI-powered stock market analysis tool that provides users with stock market quotes, free screener, AI top picks, AI stock analysis, market news, and trading signals. The platform leverages artificial intelligence to offer valuable insights and recommendations to investors and traders. With Fintwit, users can access real-time data, make informed investment decisions, and stay updated on the latest market trends.

TradeUI

TradeUI is a comprehensive trading platform that provides advanced tools and resources for stock and options traders. It offers a range of features powered by artificial intelligence (AI), including AI sentiment analysis, option flow analysis, and AI pattern recognition. These tools help traders make informed decisions and identify potential trading opportunities. TradeUI also provides educational videos, a vibrant community, and a unified ecosystem for traders to connect and share knowledge.

Bobby™

Bobby™ is a cutting-edge AI platform designed for traders to track market manipulation and enhance trading strategies. It allows users to input trading rules in plain English and converts them into automated strategies without the need for coding. The platform offers features such as AI-powered analysis, pattern recognition, social sentiment tracking, and automated trading strategies, making it a valuable tool for traders looking to optimize their trading performance.

IntelligentCross

Imperative Execution is the parent company of IntelligentCross, a platform that uses artificial intelligence (AI) to optimize trading performance in the US equities market. The platform's matching logic enhances market efficiency by optimizing price discovery and minimizing market impact. IntelligentCross is built with high-performance, massively parallel transaction processing that fully utilizes modern multi-core servers.

Ailtra AI Crypto Bot

Ailtra's AI Crypto Bot is a revolutionary trading tool that leverages artificial intelligence to maximize profits and minimize losses in the cryptocurrency market. With its advanced algorithms, smart fund management, and risk-free trading experience, Ailtra empowers traders of all levels to achieve consistent profitability. The AI Crypto Bot's 13 levels of holding capacity and intelligent trading strategies ensure that your investments are in capable hands, guiding you through the complexities of the crypto market.

Archaide TradeLab

Archaide TradeLab is an AI-powered platform designed for algorithmic trading, enabling users to easily automate their trading strategies using simple English prompts. The platform allows users to quickly and reliably launch custom trading bots without the need for coding, streamlining deployment and providing data-driven insights for smarter trading decisions. With a focus on security and privacy, Archaide TradeLab ensures that users have complete control over their data and strategies, offering a secure environment for algorithmic trading.

Web3 Summary

Web3 Summary is an AI-powered platform that simplifies on-chain research across multiple chains and protocols, helping users find trading alpha in the DeFi and NFT space. It offers a range of products including a trading terminal, wallet study tool, Discord bot, mobile app, and Chrome extension. The platform aims to streamline the process of understanding complex crypto projects and tokenomics using AI and ChatGPT technology.

AskJimmy

AskJimmy is a platform for AI agents focused on finance and trading. It offers exposure to a diverse range of strategies managed by top-notch AI Agents. The platform allows users to compose autonomous agents and trading strategies with extreme customization. It aims to create a decentralized multi-strategy collaborative hedge-fund powered by AI agents. AskJimmy is designed to aggregate non-correlated autonomous agent strategies into a diversified subnet, shaping the future of multi-strategies decentralized hedge-fund.

BIASafe

BIASafe is an AI-driven platform that revolutionizes institutional portfolio management by leveraging artificial intelligence to drive unbiased, efficient, and scalable investment decisions. The platform offers a comprehensive suite of tools, including Soteria AI for data analytics, research and development capabilities, and portfolio management solutions. BIASafe empowers users with AI-powered intelligence for data-driven decision-making, predictive analytics, and uncovering hidden opportunities across portfolio strategies. The platform features a no-code R&D ecosystem for rapid design and strategy deployment, along with fully automated portfolio operations. With a focus on bias-free decisions and accelerated innovation, BIASafe sets a new standard in institutional-grade investment tools.

AI Signals

AI Signals is an AI trading application that provides cutting-edge AI trading tools and signals for a diverse range of crypto pairs. The platform offers advanced AI algorithms that ensure precise and timely signals for trading, enhancing trading performance and delivering consistent long-term success. With a focus on accuracy, reliability, and user satisfaction, AI Signals stands out as the ultimate choice for traders seeking to maximize gains and minimize risks in the cryptocurrency market.

Quantum AI

Quantum AI is an advanced AI-powered trading platform that revolutionizes the trading experience by empowering users to make intelligent and strategic decisions. The platform offers a user-friendly interface, automated trading system, expert-designed strategies, risk-free demo mode, and top-level security. With round-the-clock expert assistance, exceptional satisfaction levels, and multilingual support, Quantum AI ensures a seamless trading experience for users worldwide.

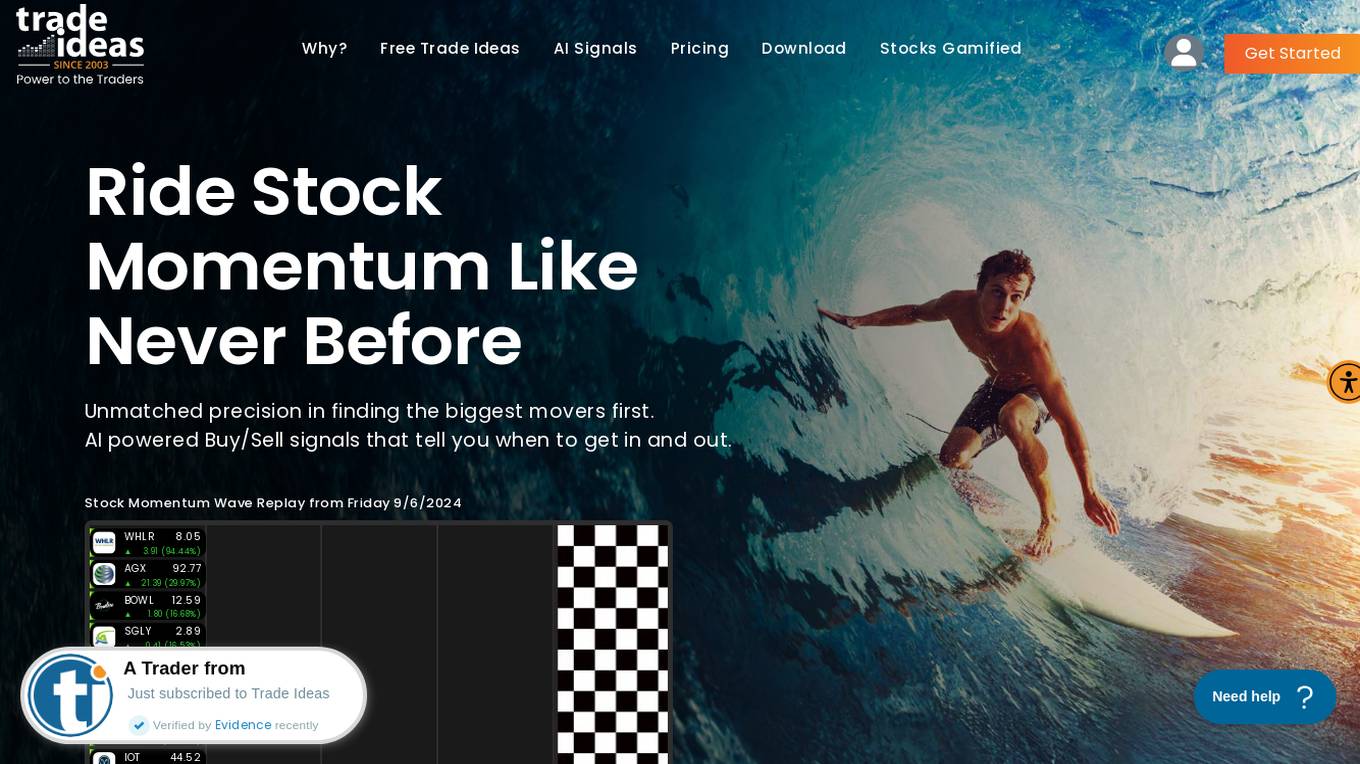

Trade Ideas

Trade Ideas is an AI-driven stock scanning and charting platform that provides unmatched precision in finding the biggest movers first. It offers AI-powered Buy/Sell signals, real-time market scanning, customizable alerts, advanced charting capabilities, and time-saving data visualization. Users can access the platform on any device, empowering them to make smarter trading decisions and stay ahead of the game. Trade Ideas also features a live trading room with expert market commentary and a simulator for practicing new trading strategies under actual market conditions. The platform is trusted by leading brokers and trading platforms, offering users a competitive edge in the market.

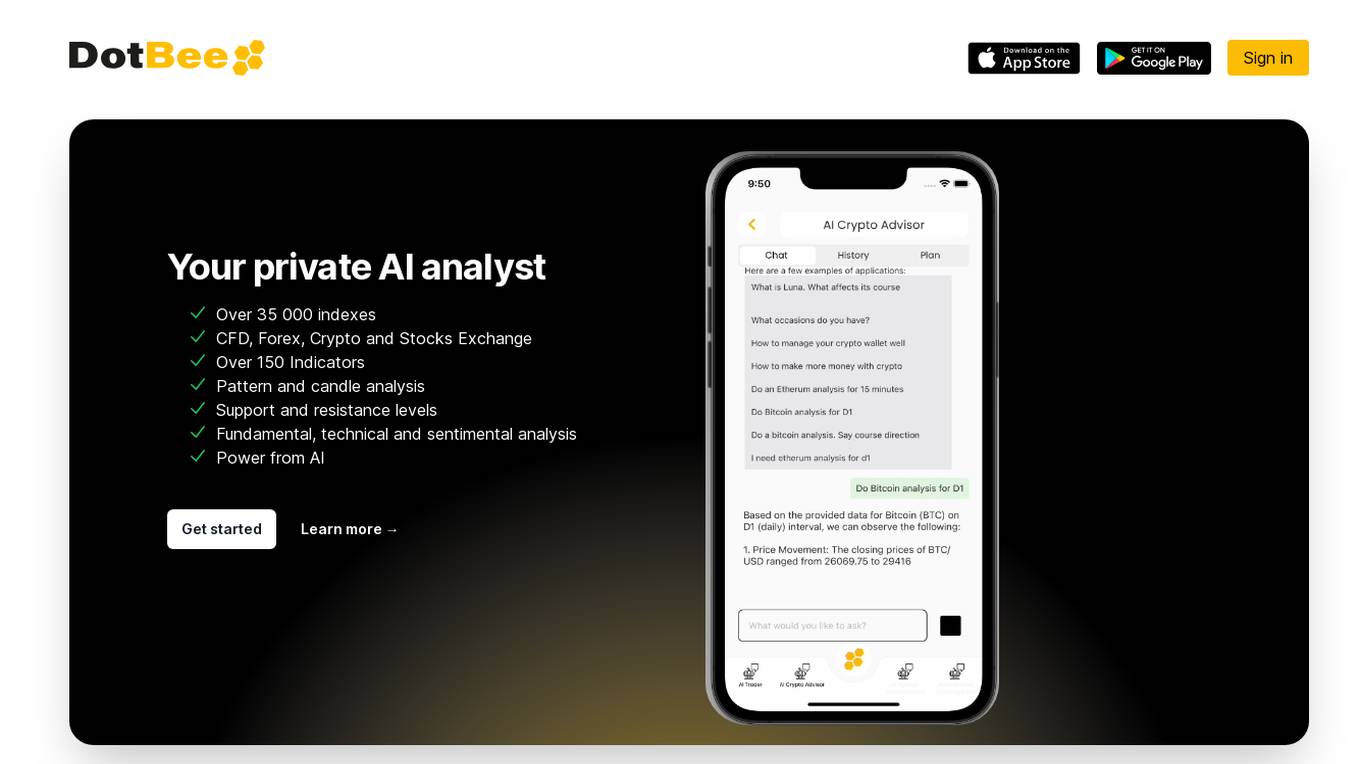

Dotbee.ai

Dotbee.ai is a private AI analyst tool designed for traders in the financial markets, offering analysis on CFD, Forex, Crypto, and Stocks Exchange. The tool provides over 35,000 indexes, 150 indicators, pattern and candle analysis, support and resistance levels, as well as fundamental, technical, and sentimental analysis. Powered by AI, Dotbee.ai delivers real-time insights to help users make informed decisions in the dynamic and complex markets.

MetaMevs

MetaMevs is an advanced AI-powered trading solution designed to maximize profits in the fast-paced world of decentralized finance (DeFi). The platform offers cutting-edge technology and customizable solutions to help traders stay ahead of the curve and capitalize on market opportunities. With features like Sandwich Mevbot, HFT Futures and Spot Bot, FlashLoan Arbitrage Bot, and MetaMev Sniper, MetaMevs provides unmatched performance, security, and reliability for users to optimize their trading strategies.

1 - Open Source Tools

tradecat

TradeCat is a comprehensive data analysis and trading platform designed for cryptocurrency, stock, and macroeconomic data. It offers a wide range of features including multi-market data collection, technical indicator modules, AI analysis, signal detection engine, Telegram bot integration, and more. The platform utilizes technologies like Python, TimescaleDB, TA-Lib, Pandas, NumPy, and various APIs to provide users with valuable insights and tools for trading decisions. With a modular architecture and detailed documentation, TradeCat aims to empower users in making informed trading decisions across different markets.

20 - OpenAI Gpts

Tech Stock Analyst

Analyzes tech stocks with in-depth, qualitative and quantitative analysis

MilaexGPT

Mila-ex: Your solution to seamless data and price retrieval across cryptocurrency exchanges, through our unified and simple RESTful API.

MQL5 Coder

Developer with the latest MQL5 documentation. Assists in making Expert Advisors for trading, Debugging, etc.

AI Trading Ace

Expert in AI trading strategies, guiding users to leverage market opportunities.

Quant Jiang

"My quantitative, my math specialist. Look at him, you notice anything different about him? Look at his face."

How to Measure Anything

对各种量化问题进行拆解和粗略的估算。注意这种估算主要是靠推测,而不是靠准确的数据,因此仅供参考。理想情况下,估算结果和真实值差距可能在1个数量级以内。即使数值不准确,也希望拆解思路对你有所启发。

VaultCraft Trainer

VaultCraft trains users to create automated yield strategies using the VaultCraft VCI & SDK

Nimbus

Expert in CFA, quant, software engineering, data science, and economics for investment strategies.