Best AI tools for< Investment Banking Analyst >

Infographic

20 - AI tool Sites

Comparables.ai

Comparables.ai is an AI-powered company and market intelligence platform designed for M&A professionals. It offers comprehensive data insights, valuation multiples, and market analysis to help users make informed decisions in investment banking, private equity, and corporate finance. The platform leverages AI technology to provide relevant company information, financial data, and M&A transaction history, enabling users to identify new investment targets, benchmark companies, and conduct market analysis efficiently.

Sensei AI

Sensei AI is a real-time interview copilot application designed to provide assistance during live interviews. It offers instant answers to questions, personalized responses, and aims to help users land their dream job. The application uses advanced AI insights to understand the true intent behind interview questions, tailoring responses based on tone, word choices, keywords, timing, formality level, and context. Sensei AI also offers a hands-free experience, robust privacy features, and a personalized interview experience by tailoring answers to the user's job role, resume, and personal stories.

Shortcut

Shortcut is an AI-powered Excel tool that revolutionizes spreadsheet work. It is designed to enhance accuracy, auditability, Excel parity, and speed in handling complex tasks. Shortcut ensures professional formatting, never overwrites existing data, and provides instant auditability with enterprise-grade security. With seamless file compatibility, 95% feature parity on the web, and lightning-fast performance, Shortcut is the go-to solution for professionals seeking efficiency and precision in Excel tasks.

Inven

Inven is an AI-powered company data platform that helps professionals in private equity, investment banking, business brokerage, consulting, and corporate development find companies faster and more efficiently. With Inven, users can access a database of over 23 million companies and 430 million contacts in over 160 countries. Inven's AI algorithms and NLP solutions analyze millions of data points from a wide range of sources to give users actionable insights on any niche.

Revi

Revi is an AI-enabled deal origination platform designed for Private Equity (PE), Investment Banking (IB), corporate development, and consultants. It offers a sophisticated solution that leverages artificial intelligence to streamline market mapping efforts, track data from over 1,000 sources in real-time, and reduce manual research tasks by 85%. The platform allows users to create complex search queries in natural language, enabling precise identification of M&A targets with unparalleled accuracy.

Onnix AI

Onnix AI is a personalized AI co-pilot designed specifically for bankers, aiming to save teams time by providing accurate answers and deliverables quickly. It brings AI and powerful data science tools to the banking sector, offering features such as creating personalized slide decks, conducting Excel analysis, and querying data sources. Onnix AI caters to both senior and junior teams, enabling them to generate deeper insights and streamline their workflow efficiently.

Monarch Money

Monarch Money is an all-in-one money management platform that helps you track your finances, collaborate with your partner or financial advisor, and achieve your financial goals. It offers a variety of features, including budgeting, investment tracking, transaction categorization, and financial planning. Monarch Money is available on the web, iOS, and Android.

Responsive.ai

Responsive.ai is a foundational software designed for financial advice, aimed at maximizing advisor productivity through workflow automation, client engagement tools, and AI-powered insights. The platform offers solutions like Prioritize for enhancing relationships and revenue growth, Enable for managing documents and integrations, and Dash for creating seamless digital experiences. Responsive empowers advisors with an API-first ecosystem to deliver advice-led financial services and elevate enterprise value.

Global Fintech Series

Global Fintech Series is a comprehensive platform that covers top finance technology news, editorial insights, and digital marketing trends from around the world. It provides relevant updates on modern Fintech adoption through Fintech interviews, tech articles, and events.

KGiSL

KGiSL is a BFSI-centric multiproduct enterprise software company focused on insurance, capital markets, and wealth management segments, delivering AI and ML-driven products for a transformative edge. The company offers a wide range of solutions for various industries, including digital transformation, automation, analytics, and IT infrastructure management. KGiSL aims to empower its clients through innovative technologies such as Machine Learning, Artificial Intelligence, Analytics, and Cloud services to enhance productivity and deliver exceptional customer experiences.

Dantia

Dantia is an AI-powered investment platform that focuses on helping founders build climate ventures by providing them with the necessary capital and resources. The platform connects founders with climate-conscious advisors, early adopters, and corporations to accelerate the launch of sustainable solutions. Dantia also caters to investors looking to support climate startups globally and consumers interested in backing climate-positive companies. By leveraging AI technology, Dantia offers personalized opportunities based on user preferences, making decision-making easier and more efficient.

MDOTM Ltd

MDOTM Ltd is a global provider of AI-driven investment solutions for Institutional Investors. Founded in London in 2015, the company offers Portfolio Advisory and Asset Allocation services to various financial institutions. MDOTM's AI platform, Sphere, empowers asset and wealth managers with AI-driven insights, seamless portfolio rebalancing, and automated reports at scale.

Valuemetrix

Valuemetrix is an AI-enhanced investment analysis platform designed for investors seeking to redefine their investment journey. The platform offers cutting-edge AI technology, institutional-level data, and expert analysis to provide users with well-informed investment decisions. Valuemetrix empowers users to elevate their investment experience through AI-driven insights, real-time market news, stock reports, market analysis, and tailored financial information for over 100,000 international publicly traded companies.

Rize Capital

Rize Capital is an AI-powered investment chatbot designed to provide fast, accurate answers to complex financial and investment questions. It offers real-time data on stocks, cryptocurrencies, ETFs, and more, leveraging institutional investment data and large language models. The chatbot aims to simplify the journey through financial markets by providing personalized insights, portfolio analysis, and alternative data access.

AnalyStock.ai

AnalyStock.ai is a financial application leveraging AI to provide users with a next-generation investment toolbox. It helps users better understand businesses, risks, and make informed investment decisions. The platform offers direct access to the stock market, powerful data-driven tools to build top-ranking portfolios, and insights into company valuations and growth prospects. AnalyStock.ai aims to optimize the investment process, offering a reliable strategy with factors like A-Score, factor investing scores for value, growth, quality, volatility, momentum, and yield. Users can discover hidden gems, fine-tune filters, access company scorecards, perform activity analysis, understand industry dynamics, evaluate capital structure, profitability, and peers' valuation. The application also provides adjustable DCF valuation, portfolio management tools, net asset value computation, monthly commentary, and an AI assistant for personalized insights and assistance.

RoboFin

RoboFin is an AI-powered investment analyst that helps you make better investment decisions. It analyzes mountains of data - news, financials, trends - faster than any human could. You get clear, actionable information about each stock you are interested in such as positive things, concerns and a forecast of how the price might move based on the data analysis. Data-driven decisions replace gut feelings.

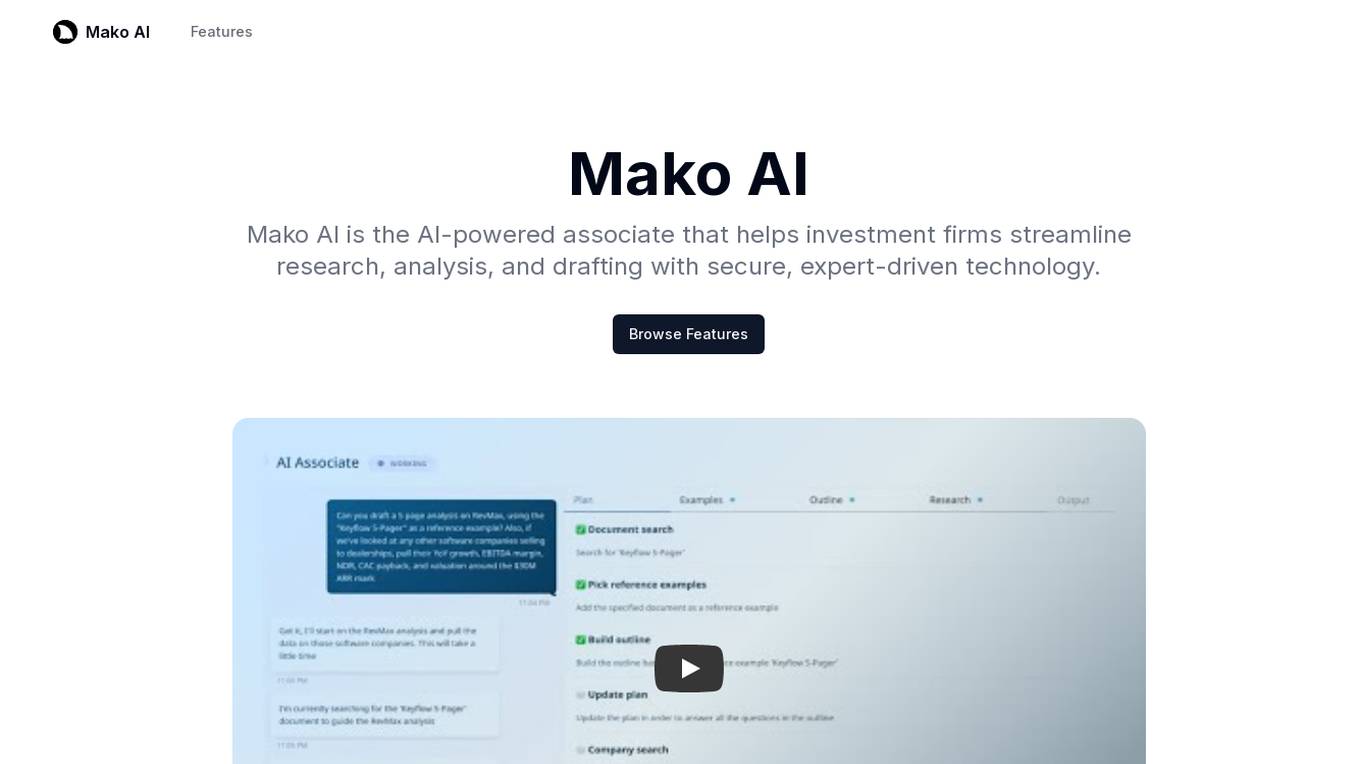

Mako AI

Mako AI is an AI-powered associate designed to revolutionize the workflows of investment firms by streamlining research, analysis, and drafting processes. It offers essential tools to simplify data access, safeguard information, and provide actionable insights. With features like enterprise search, chat capabilities, and a knowledge base, Mako AI centralizes institutional knowledge and ensures data security with SOC 2 Type II certification. The application is easy to implement, prioritizes security, and enhances collaboration within firms.

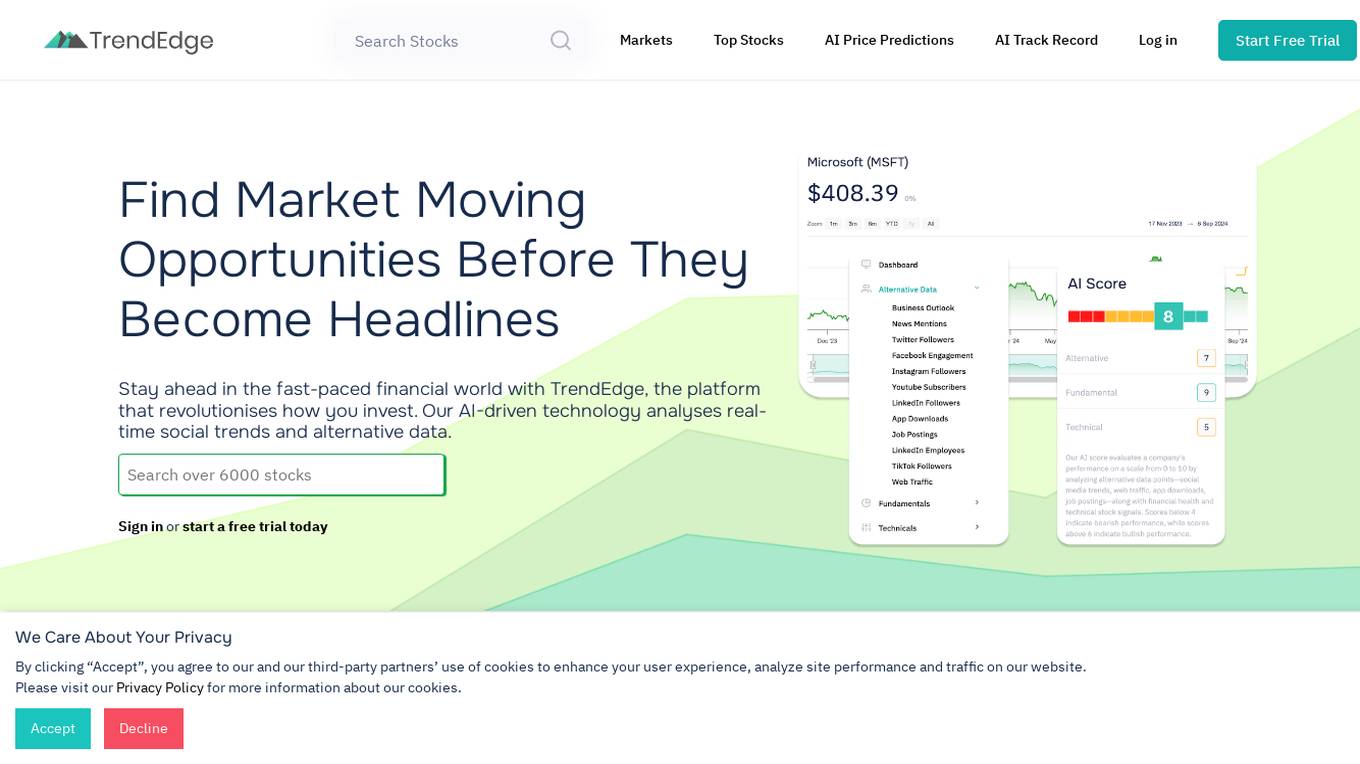

TrendEdge

TrendEdge is an AI-driven platform that revolutionizes investment strategies by providing comprehensive insights through the analysis of real-time social trends and alternative data sources. It offers exclusive data access, AI-powered stock signals, and personalized recommendations to help users make informed and confident investment decisions. The platform integrates diverse data sources, including social media sentiment, technical indicators, and fundamental analysis, to provide a nuanced market view and uncover hidden trends.

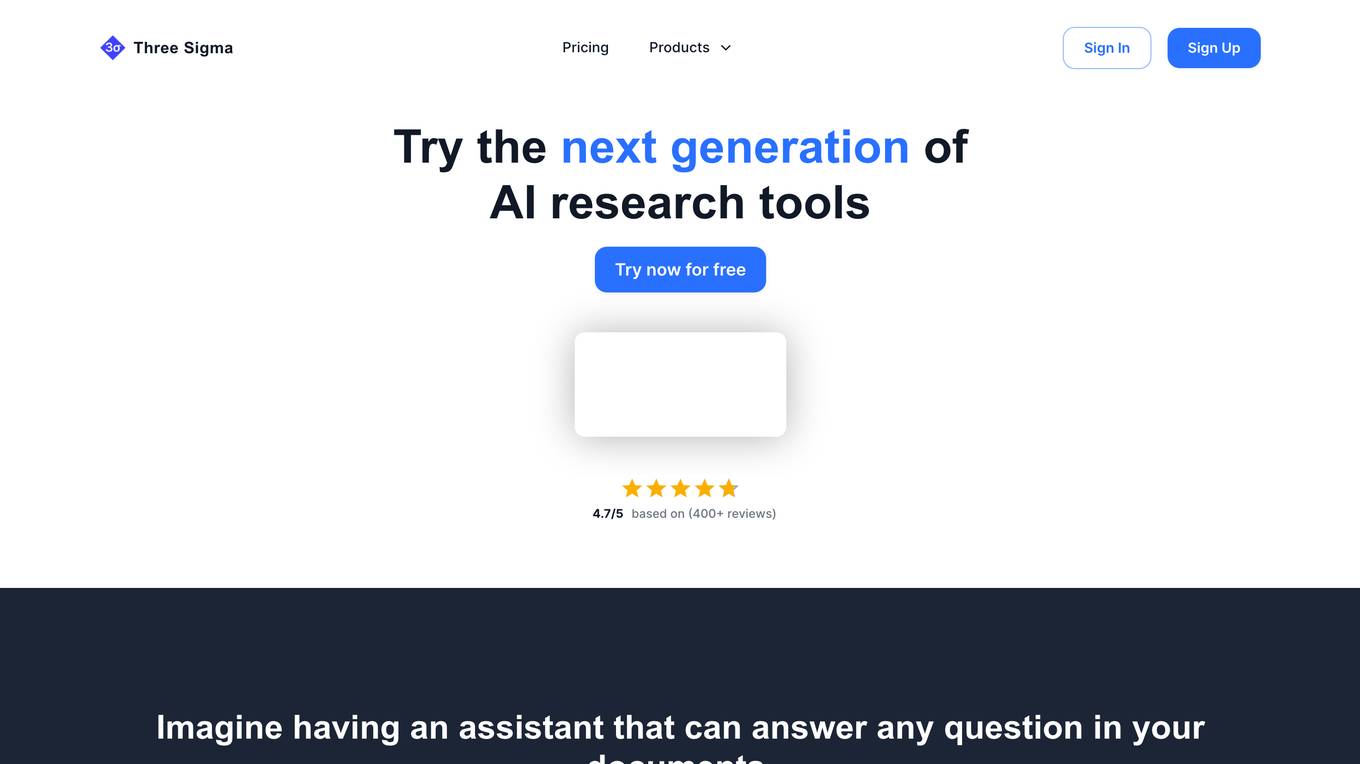

Three Sigma

Three Sigma is a quantitative hedge fund that uses advanced artificial intelligence and machine learning techniques to identify and exploit trading opportunities in global financial markets.

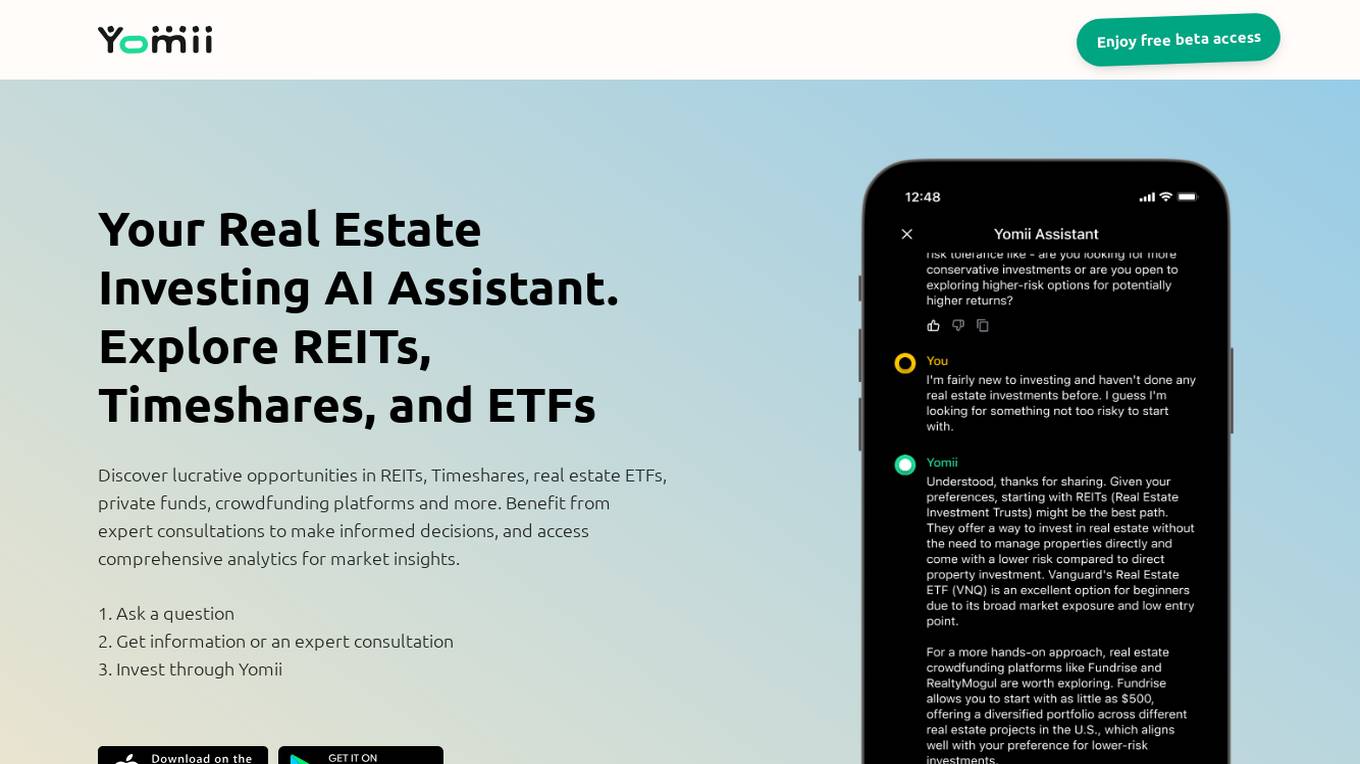

Yomii

Yomii is a Real Estate Investing AI Assistant that offers free beta access to explore REITs, Timeshares, ETFs, and more. It provides expert consultations, comprehensive analytics, personalized investment matching, access to experts, powerful analytics, effortless sharing, properties worldwide, and connections to private investor communities. Users can ask questions, get information, invest through the platform, and access PDF reports. Yomii simplifies the investment journey with AI-driven tools for investors of all levels, making real estate investing accessible and profitable.

0 - Open Source Tools

20 - OpenAI Gpts

Private Equity Interview Mentor

Ace PE interviews with a bot trained on 1,000+ real interviews.

Investment Banking Tech Prep with Recalc Academy

Coach for investment banking technical interviews

Consulting & Investment Banking Interview Prep GPT

Run mock interviews, review content and get tips to ace strategy consulting and investment banking interviews

IB Interview Guide

Master the Investment Banking Interview Arena: Chatbot Solutions to Ace Any Banking Question

Finance Coach Interview

Prepares students for competitive finance fields like Investment Banking and PE.

Mergers & Acquisitions Advisor

Facilitates successful corporate mergers and acquisitions to drive growth.

Investment Management Advisor

Provides strategic financial guidance for investment behavior to optimize organization's wealth.

策略研报分析 Investment Strategy Research

专注于“投资策略”类型的研报分析总结,提炼对行业配置的核心观点 Focusing on the analysis and summary of research reports on the type of "investment strategy", refining core perspectives on industry allocation

Best Gold Investment Companies Tool

This FREE tool can help you choose the best gold investment companies to work with.