Best AI tools for< Research Investment Options >

20 - AI tool Sites

Insider Monkey

Insider Monkey is an AI-powered platform that provides data and insights on insider trading, hedge funds, investment newsletters, and stock market analysis. The platform offers a wide range of features such as stock screening, tracking insider purchases and sales, browsing companies, accessing the latest 13D & 13G filings, and analyzing hedge funds. Insider Monkey also provides market predictions, options trading information, and educational resources on stock and hedge fund analysis. Users can benefit from premium newsletters, investment research, and ad-free browsing to make informed investment decisions.

Rafa.ai

Rafa.ai is an AI-powered investing application that offers a comprehensive suite of tools and features to assist users in making informed investment decisions. The platform utilizes AI agents to provide real-time insights, portfolio alerts, risk analysis, and options monitoring. Users can access data-driven trading strategies, perform equity research, and analyze news sentiment. Rafa.ai aims to help users manage their investment risks, discover investment opportunities, and make smarter investment decisions.

Mool Capital

Mool Capital is an AI-powered platform that offers elevated investing and high fidelity research capabilities. The platform provides revolutionary AI tools for analyzing vast datasets in seconds, trustworthy analysis for informed investing, and performant portfolios curated for optimal performance. Users can access the latest market analysis, investment ideas, and premium articles to enhance their investment decisions. Mool Capital aims to empower investors with AI superpowers to make better investment choices and navigate the complex world of finance with confidence.

FinChat.io

FinChat.io is a comprehensive AI-powered stock research platform that provides institutional-quality data and insights to investors. With FinChat.io, you can access accurate financial data on over 100,000 global public companies, as well as company revenue and profit segments, KPIs, analyst estimates, price targets, and ratings. FinChat.io also utilizes cutting-edge AI to build summaries, models, and visualizations, making it easy to understand complex financial data. Additionally, FinChat.io offers a customizable terminal, allowing you to track what matters most to you and auto-save your research. With FinChat.io, you can work faster than ever and make better investment decisions.

Reportify

Reportify is an AI platform for investment research that provides detailed analysis and insights on various companies, filings, transcripts, reports, and news. Users can explore financial data, performance metrics, and market trends to make informed investment decisions. The platform offers a comprehensive view of the investment landscape, including company histories, financial reports, and industry analysis.

Rize Capital

Rize Capital is an AI-powered investment chatbot designed to provide fast, accurate answers to complex financial and investment questions. It offers real-time data on stocks, cryptocurrencies, ETFs, and more, leveraging institutional investment data and large language models. The chatbot aims to simplify the journey through financial markets by providing personalized insights, portfolio analysis, and alternative data access.

Kazuha

Kazuha is an AI-powered platform that provides investment insights extracted from top financial content creators on platforms like podcasts, YouTube, and Twitter. The platform uses advanced AI algorithms to analyze hours of content and generate concise summaries and key takeaways for investors. Users can stay informed about the latest investment opportunities and never miss actionable insights buried in lengthy financial content.

Intellectia.AI

Intellectia.AI is a powerful AI platform designed to provide smarter investment insights for investors across stocks, ETFs, and cryptocurrencies. The platform offers advanced technical analysis, tailored stock analysis, and quick insights on market trends. With over 100 supported indicators, Intellectia.AI empowers investors with actionable insights derived from AI-driven analysis. The platform also features a dedicated news section summarizing financial news using AI, ensuring users stay informed about events affecting stock movements. Intellectia.AI aims to democratize financial information intelligence through AI, making it accessible to investors of all levels, from individuals to large institutions.

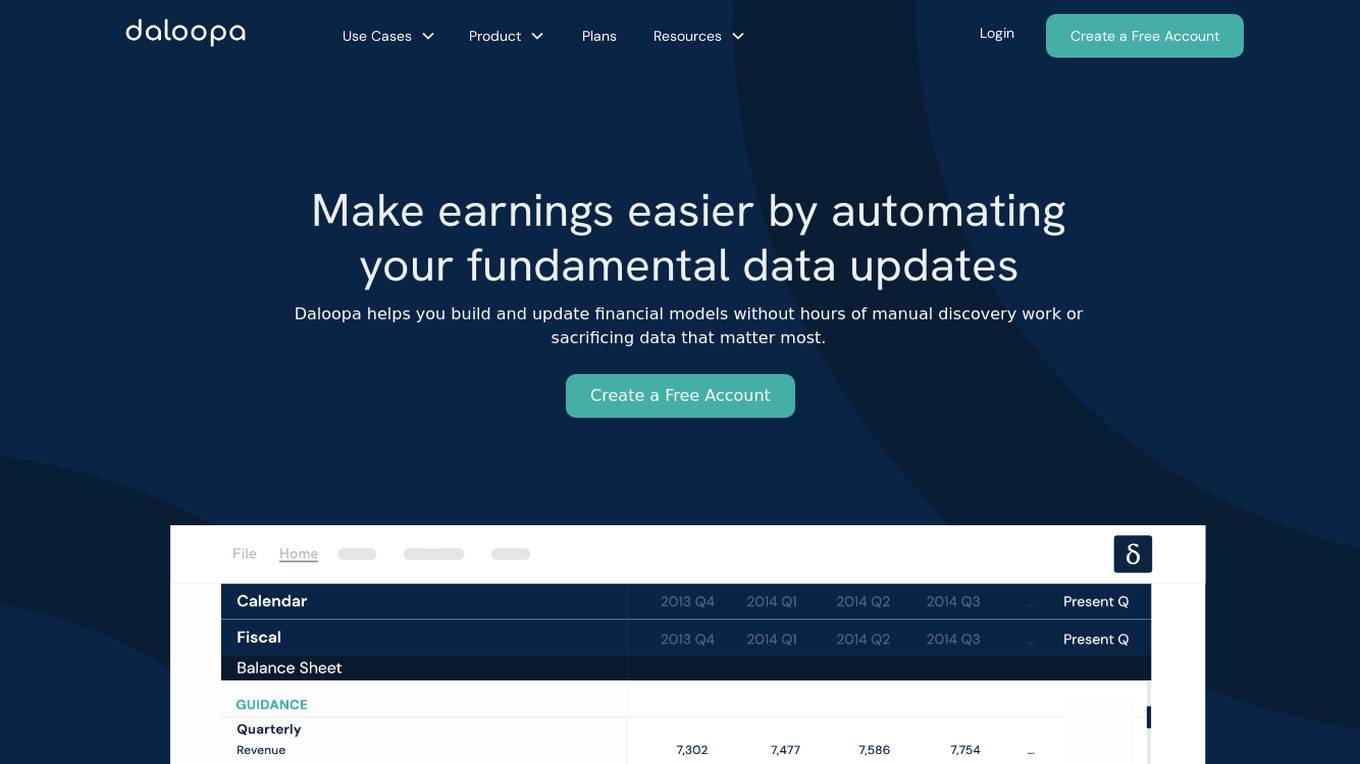

Daloopa

Daloopa is an AI financial modeling tool designed to automate fundamental data updates for financial analysts working in Excel. It helps analysts build and update financial models efficiently by eliminating manual work and providing accurate, auditable data points sourced from thousands of companies. Daloopa leverages AI technology to deliver complete and comprehensive data sets faster than humanly possible, enabling analysts to focus on analysis, insight generation, and idea development to drive better investment decisions.

Stock Market GPT

Stock Market GPT is an AI-powered investment research tool that provides investors with in-depth analysis and insights into global equities. It uses advanced AI models, including GPT-4, to help investors make better investment decisions. The tool offers a range of features, including stock comparison, live data, and growth-focused pricing.

LunarCrush

LunarCrush is a social media analytics and investment research platform that helps investors make better decisions. It tracks social media activity across multiple platforms to identify trends and sentiment around cryptocurrencies and other digital assets. LunarCrush also provides a variety of research tools, including charting, technical analysis, and news feeds.

MLQ.ai

MLQ.ai is an AI application designed for investors to simplify their workflow and enhance their investment research process. The platform offers a suite of AI tools and agents to analyze stocks, stay updated with the market trends, and automate investment research. Users can access AI-powered equity research tools, crypto news and research tools, and track recently-funded AI startups. MLQ.ai provides simple and flexible pricing plans suitable for both businesses and individuals, aiming to help users make informed investment decisions with the power of AI.

Realiste

Realiste is an AI-powered real estate investment platform that provides users with data-driven insights to help them make informed investment decisions. It offers access to a wide range of properties and markets worldwide. Realiste specifically focuses on market research, analytics, and real estate price forecasts based on data gathered by the AI algorithm. The platform uses advanced AI algorithms to process vast amounts of real estate data, combining machine learning, data analytics, and market research to generate investment insights and recommendations. Realiste aims to revolutionize how individuals perceive and engage with the real estate sector by providing accurate forecasts and objective decisions.

AnalyStock.ai

AnalyStock.ai is a financial application leveraging AI to provide users with a next-generation investment toolbox. It helps users better understand businesses, risks, and make informed investment decisions. The platform offers direct access to the stock market, powerful data-driven tools to build top-ranking portfolios, and insights into company valuations and growth prospects. AnalyStock.ai aims to optimize the investment process, offering a reliable strategy with factors like A-Score, factor investing scores for value, growth, quality, volatility, momentum, and yield. Users can discover hidden gems, fine-tune filters, access company scorecards, perform activity analysis, understand industry dynamics, evaluate capital structure, profitability, and peers' valuation. The application also provides adjustable DCF valuation, portfolio management tools, net asset value computation, monthly commentary, and an AI assistant for personalized insights and assistance.

Kavout

Kavout is an AI-powered financial research assistant that provides investors with data-driven insights and cutting-edge technology to help them make informed investment decisions. The platform offers a range of features, including natural language search, stock screening, portfolio analysis, and personalized recommendations. Kavout's AI algorithms adapt to each user's unique investment style, providing tailored insights and guidance.

Mako AI

Mako AI is an AI-powered associate designed to revolutionize the workflows of investment firms by streamlining research, analysis, and drafting processes. It offers essential tools to simplify data access, safeguard information, and provide actionable insights. With features like enterprise search, chat capabilities, and a knowledge base, Mako AI centralizes institutional knowledge and ensures data security with SOC 2 Type II certification. The application is easy to implement, prioritizes security, and enhances collaboration within firms.

Stockpulse

Stockpulse is an AI-powered platform that analyzes financial news and communities using Artificial Intelligence. It provides decision support for operations by collecting, filtering, and converting unstructured data into processable information. With extensive coverage of financial media sources globally, Stockpulse offers unique historical data, sentiment analysis, and AI-driven insights for various sectors in the financial markets.

ACHIV

ACHIV is an AI tool for ideas validation and market research. It helps businesses make informed decisions based on real market needs by providing data-driven insights. The tool streamlines the market validation process, allowing quick adaptation and refinement of product development strategies. ACHIV offers a revolutionary approach to data collection and preprocessing, along with proprietary AI models for smart analysis and predictive forecasting. It is designed to assist entrepreneurs in understanding market gaps, exploring competitors, and enhancing investment decisions with real-time data.

BERA.ai

BERA.ai is an advanced brand management tracking software that offers solutions for brand positioning, tracking, competitive intelligence, and conversion funnel analysis. It connects brand strategy to business outcomes, enabling users to measure, predict, and optimize the financial impact of their brand. With AI-powered insights, census-matched data, and predictive analytics, BERA.ai helps users make smarter decisions, prioritize high-value audiences, and drive measurable growth. The platform integrates brand data into the marketing ecosystem, providing intelligence to outmaneuver competitors and maximize ROI.

Finlo

Finlo is an AI-powered financial research assistant that provides comprehensive market insights, financial data, and analysis tools for investors. It simplifies complex financial information into understandable insights, offering real-time monitoring, trend analysis, comparative insights, and personalized recommendations to help users make informed investment decisions. With knowledge of earnings releases, financial reports, and fundamental information for S&P 500 and Nasdaq companies, Finlo aims to enhance decision-making and confidence in navigating the stock market.

0 - Open Source AI Tools

20 - OpenAI Gpts

SEI NETWORK SEINERGY by SEINDICATE

Provides up to date SEI Network Info, including market data

CryptoGPT

Unearth hidden crypto gems with AI-driven analysis of low-cap coins poised for growth. Smart, insightful, your go-to for bullish potential

Parsers VC - Weekly Venture Report

A detailed report on funding rounds over the past week with information about startups and investors. The most interesting news from the Venture market.

Stock Market Analyst

I read and analyze annual reports of companies. Just upload the annual report PDF and start asking me questions!

GICS Classifier

GICS is a classification standard developed by MSCI and S&P Dow Jones Indices. This GPT is not a MSCI and S&P product. Official website : https://www.msci.com/our-solutions/indexes/gics

Tech Stock Analyst

Analyzes tech stocks with in-depth, qualitative and quantitative analysis

策略研报分析 Investment Strategy Research

专注于“投资策略”类型的研报分析总结,提炼对行业配置的核心观点 Focusing on the analysis and summary of research reports on the type of "investment strategy", refining core perspectives on industry allocation

13F Research Assistant

Expert in 13F filings analysis backed by specific APIs and 13F Database