Best AI tools for< Optimize Portfolio Allocation >

20 - AI tool Sites

AnalyStock.ai

AnalyStock.ai is a financial application leveraging AI to provide users with a next-generation investment toolbox. It helps users better understand businesses, risks, and make informed investment decisions. The platform offers direct access to the stock market, powerful data-driven tools to build top-ranking portfolios, and insights into company valuations and growth prospects. AnalyStock.ai aims to optimize the investment process, offering a reliable strategy with factors like A-Score, factor investing scores for value, growth, quality, volatility, momentum, and yield. Users can discover hidden gems, fine-tune filters, access company scorecards, perform activity analysis, understand industry dynamics, evaluate capital structure, profitability, and peers' valuation. The application also provides adjustable DCF valuation, portfolio management tools, net asset value computation, monthly commentary, and an AI assistant for personalized insights and assistance.

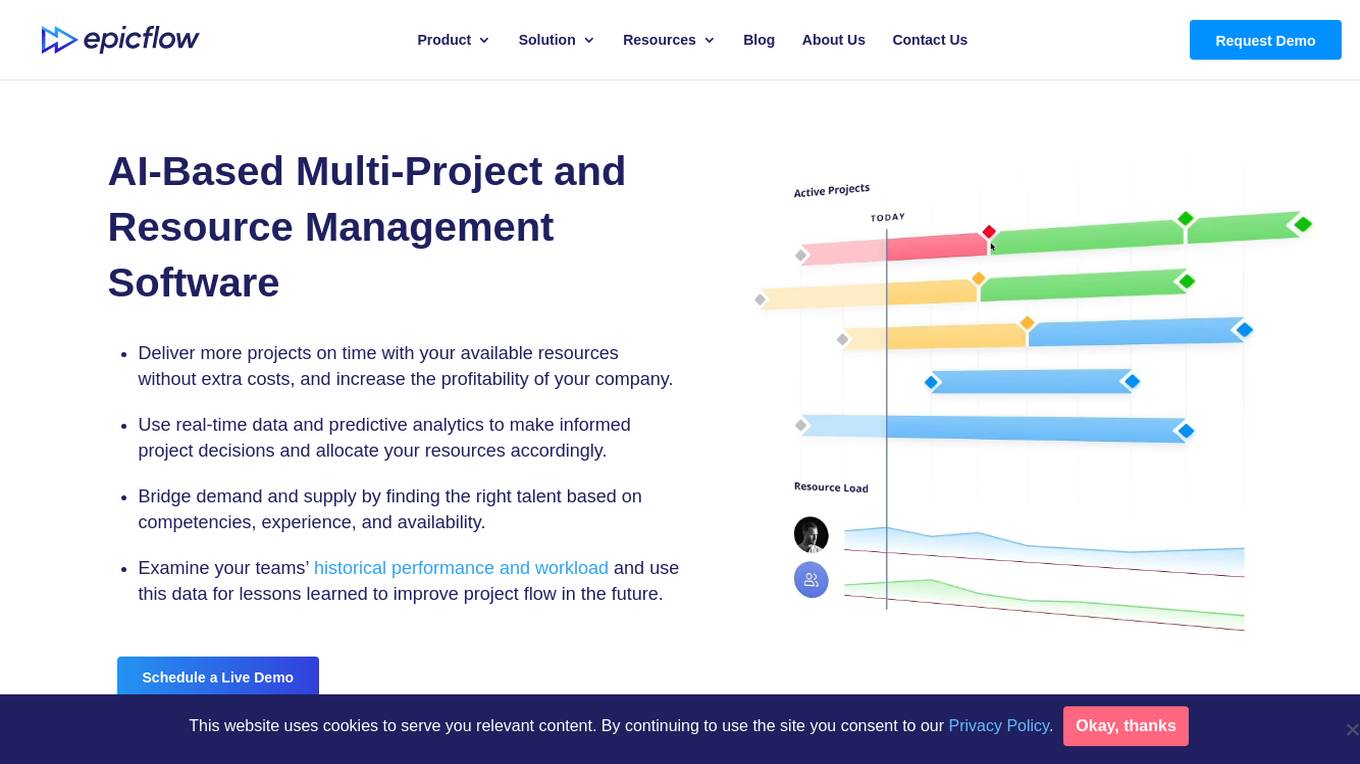

Epicflow

Epicflow is an AI-based multi-project and resource management software designed to help organizations deliver more projects on time with available resources, increase profitability, and make informed project decisions using real-time data and predictive analytics. The software bridges demand and supply by matching talent based on competencies, experience, and availability. It offers features like AI assistant, What-If Analysis, Future Load Graph, Historical Load Graph, Task List, and Competence Management Pipeline. Epicflow is trusted by leading companies in various industries for high performance and flawless project delivery.

ficc.ai

ficc.ai is an AI application that revolutionizes municipal bond pricing by providing real-time, accurate AI technology for informed decisions, portfolio optimization, and compliance. The platform offers a user-friendly web app, direct API access, and integration with existing software or vendors. ficc.ai uses cutting-edge AI models developed in-house by market experts and scientists to deliver highly accurate bond prices based on trade size, ensuring valuable output for trading decisions, investment allocations, and compliance oversight.

Pantarai

Pantarai is an AI-powered adaptive investment platform that offers an intelligent system to interpret financial markets in real time. The platform's proprietary AI expert system, Cartesio, manages daily ETP allocation supervised by real humans. Pantarai's adaptive investment strategy adjusts to shifting market conditions, aiming to deliver consistent returns with smoother volatility across a wide range of market outcomes. The platform invests in stock, bond, commodity, and cash proxy indices via low-cost ETFs, with a focus on multi-asset investing, systematic and AI-powered processes, tactical asset rotation, and resilience in market outcomes.

TeamifAI

TeamifAI is an AI-powered resource management tool that helps users manage professional profiles, create and organize project portfolios, generate optimized project teams using AI, forecast resources, and oversee all aspects of project management in one central location. With features like rich profile creation, project CV management, and AI-powered team generation, TeamifAI streamlines resource management and enhances teamwork efficiency.

Pluto.fi

Pluto.fi is an AI investing application that provides users with research, insights, and trading capabilities in one platform. It offers personalized AI assistance for making informed investment decisions, analyzing real-time market data, and optimizing investment portfolios. With access to over 40 data sources, Pluto ensures users stay informed and empowered to make prompt decisions. The application is trusted by individuals taking control of their finances and offers features like scheduled prompts, portfolio optimization, attachments & charts, and syncing of financial accounts.

AI Investing Tools

AI Investing Tools is a curated directory of AI tools designed to help users automate their investing process. The platform offers a handpicked collection of AI investing tools that assist in making more money, developing trading strategies, automating investing, rebalancing portfolios, and analyzing markets. It aims to leverage AI technology to enhance trading efficiency, optimize portfolios, and eliminate emotional biases in investment decisions.

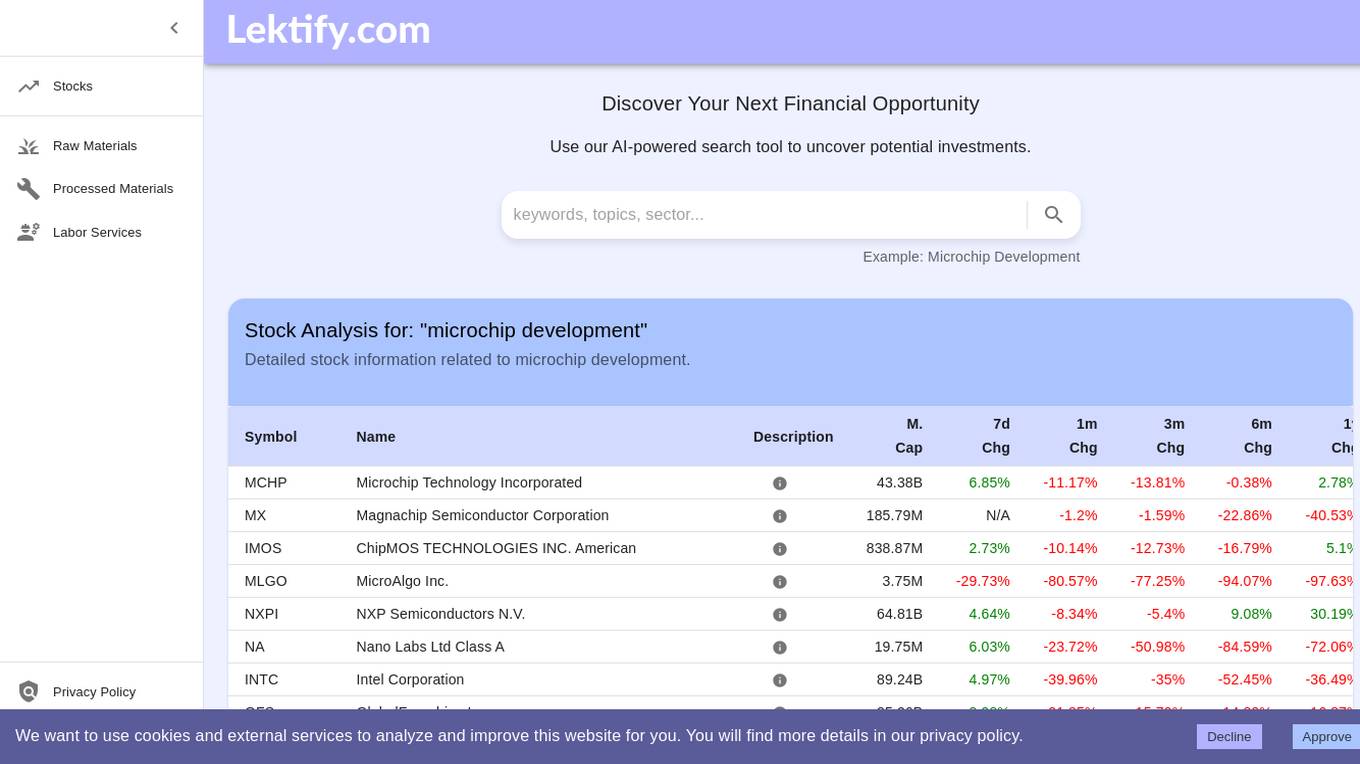

Lektify

Lektify is an AI-powered platform designed to revolutionize the way users manage their investment portfolios. By leveraging advanced artificial intelligence algorithms, Lektify helps users discover top-performing stocks and make informed investment decisions. The platform provides valuable insights and recommendations based on extensive data analysis, enabling users to optimize their investment strategies and maximize returns. With Lektify, users can stay ahead of market trends and enhance their portfolio performance with confidence.

Mool Capital

Mool Capital is an AI-powered platform that offers elevated investing and high fidelity research capabilities. The platform provides revolutionary AI tools for analyzing vast datasets in seconds, trustworthy analysis for informed investing, and performant portfolios curated for optimal performance. Users can access the latest market analysis, investment ideas, and premium articles to enhance their investment decisions. Mool Capital aims to empower investors with AI superpowers to make better investment choices and navigate the complex world of finance with confidence.

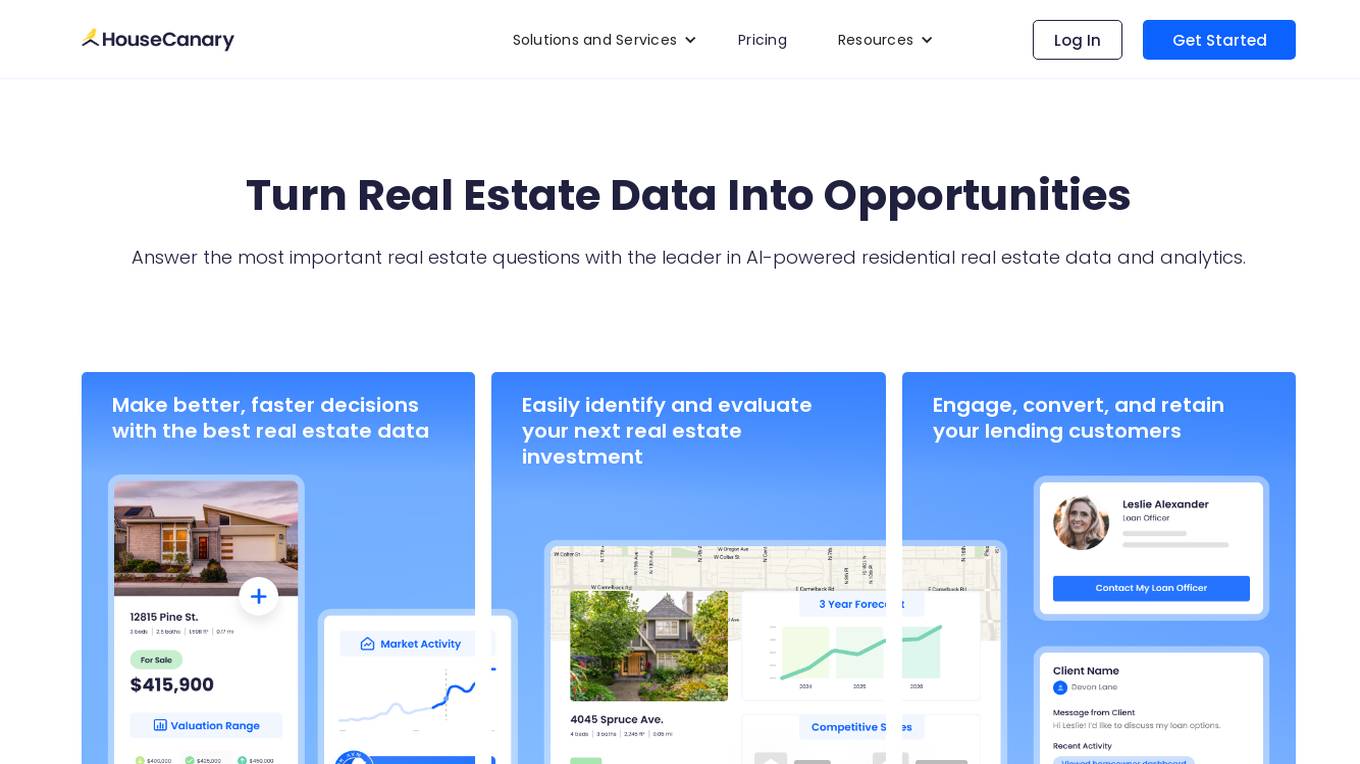

HouseCanary

HouseCanary is a leading AI-powered data and analytics platform for residential real estate. With a full suite of industry-leading products and tools, HouseCanary provides real estate investors, mortgage lenders, investment banks, whole loan buyers, and prop techs with the most comprehensive and accurate residential real estate data and analytics in the industry. HouseCanary's AI algorithms analyze a vast array of real estate data to generate meaningful insights to help teams be more efficient, ultimately saving time and money.

Quanty

Quanty is an AI-driven financial knowledge graph application that provides market insights on crypto and stocks news through advanced algorithms and knowledge graphs. It offers a GraphQL API for deep market understanding, smart data classification, current market insights, entity and relationship extraction, and dynamic GraphQL access. Users can access a wide range of financial news, insights, and analytics seamlessly through Quanty's robust GraphQL API.

Vercel Security Checkpoint

Vercel Security Checkpoint is a web application that provides a security verification process for users accessing the Vercel platform. It ensures the safety and integrity of the platform by verifying the user's browser and enabling JavaScript before proceeding. The checkpoint serves as a protective measure to prevent unauthorized access and potential security threats.

Bhavv

Bhavv is India's first and most powerful AI platform for Nifty and Bank Nifty Options buying. The platform offers automated trade management, personalized risk management, integrated stop loss, and a user-friendly interface. Bhavv's AI algorithms continuously analyze market data to create and manage a diversified trading portfolio tailored to individual goals and risk tolerance. The platform aims to revolutionize trading by simplifying the process and making it more accessible and enjoyable for traders.

Patsnap

Patsnap is an AI-powered innovation intelligence platform that provides data, analytics, and expertise for innovative companies. It revolutionizes how IP and R&D teams collaborate by helping them analyze the competitive landscape, reduce risks, and accelerate the entire innovation lifecycle. Patsnap offers a connected product suite trusted by over 12,000 innovators worldwide, saving valuable time and resources. The platform enables users to ideate, validate, review, submit, and monitor innovations with advanced AI tools and collaboration features.

WHATALOCATION

WHATALOCATION is an AI-driven retail consumer and location intelligence platform that accelerates location and retail intelligence for retailers, franchises, and real estate companies. Through the lens of emerging technology and AI, the platform helps businesses pick the right locations and boost same store sales by providing data and AI-driven insights across Europe. WHATALOCATION shapes the future of retail and location intelligence by collapsing the distance between brick-and-mortar retail and e-commerce.

Answer.AI

Answer.AI is an AI tool developed by Benjamin Clavié, focusing on NLP&IR with a special interest in developing smaller models to power LLM-based applications. The tool includes models like answerai-colbert-small-v1 and JaColBERTv2.5🇯🇵, offering efficient pooling tricks and optimizing retrieval training for lower-resource languages. Benjamin Clavié shares insights and thoughts on ML/NLP/IR ecosystem through blog posts on the website.

Macroaxis

Macroaxis is a wealth optimization platform that leverages artificial intelligence to help users make informed investment decisions. It offers a range of features to generate optimal portfolios, provide investment insights, and rebalance portfolios efficiently. The platform caters to self-directed investors, finance academia, fintech professionals, and individuals looking to invest with AI-driven strategies. Macroaxis aims to empower users with adaptive investment solutions and resilient portfolio management capabilities.

DRYiCE

DRYiCE is an AI foundation for the digital enterprise, offering a range of AI ops products and solutions to transform and simplify IT and business operations by leveraging AI and Cloud technologies. With a diverse portfolio including DRYiCE iAutomate, DRYiCE AEX, DRYiCE MyCloud, DRYiCE MyXalytics, and more, DRYiCE aims to enhance service orchestration, observability, and business flow management across various industries such as energy, healthcare, financial services, and manufacturing. The platform boasts over 12 years of experience in AI-led R&D, serving 283 customers globally and holding 30 patents.

Tickeron

Tickeron is an AI trading platform that offers a variety of tools and features to enhance trading in the stock market. It provides AI predictions for stocks, ETFs, forex, and other assets, empowering users with accurate stock predictions and trend insights. The platform includes AI robots for virtual accounts, trend predictions, pattern search engines, and real-time patterns. Additionally, Tickeron offers tools for traders and investors, such as stock portfolio wizards, active portfolios, model portfolios, and 401(k) portfolios. Users can also explore the marketplace for trading and investing tools, join trader and investor clubs, and access educational resources to improve their trading skills.

Vindey

Vindey is an industry-leading AI-powered CRM platform designed for property management and sales solutions. It offers real-time smart suggestions, automation features, and intelligent sales automation to transform customer experiences. Vindey handles the entire sales pipeline, from lead qualification to deal closing, while providing personalized interactions and seamless lead management. The platform also offers AI-powered payment insights, workflow automation, and tailored solutions for various industries, such as sales, healthcare, real estate, education, and manufacturing.

0 - Open Source AI Tools

20 - OpenAI Gpts

Family Asset Management

Guides asset allocation in family segments, focusing on investments.

Portfolio Management GPT

Assists in portfolio management, offering optimization strategies and market insights.

Investment Management Advisor

Provides strategic financial guidance for investment behavior to optimize organization's wealth.

Liquidity Management Advisor

Optimizes financial liquidity, mitigates operational risk, and enhances financial performance.

AI Trading Ace

Expert in AI trading strategies, guiding users to leverage market opportunities.

VaultCraft Trainer

VaultCraft trains users to create automated yield strategies using the VaultCraft VCI & SDK

MarketMaster AI.

Dynamic financial expert with a multifaceted approach to market analysis.

Anything Finance Guru Advance

Advanced financial advisor for business and personal finance, with a focus on New Zealand.

Stock Photo .CSV Scribe

Upload your image, and our scribe instantly provides optimised keywords, titles, and categories in a CSV for Adobe Stock, Shutterstock and iStock. Simplify your workflow and elevate your portfolio effortlessly!

Ai Trading Indicator Creator

Specializing in AI-driven trading indicators, offering innovative, data-driven solutions for traders and investors seeking enhanced market analysis and decision-making tools.