Best AI tools for< Optimize Investment Choices >

20 - AI tool Sites

Susterra

Susterra is an advanced analytics platform for Public Finance stakeholders, aiming to catalyze urban development by providing powerful insights. The platform integrates leading practices from academia, utilizes public data for creating relevant insights, and leverages technology innovations like ML and AI. Susterra offers solutions such as TerraScore, TerraVision, TerraView, and Impact IQ, enabling evaluation of public benefit programs in various sectors. The platform also provides data visualization tools and is powered by Google Cloud, offering state-of-the-art analytics for smart decision-making in the Municipal Bond Market and Smart Cities development.

Mool Capital

Mool Capital is an AI-powered platform that offers elevated investing and high fidelity research capabilities. The platform provides revolutionary AI tools for analyzing vast datasets in seconds, trustworthy analysis for informed investing, and performant portfolios curated for optimal performance. Users can access the latest market analysis, investment ideas, and premium articles to enhance their investment decisions. Mool Capital aims to empower investors with AI superpowers to make better investment choices and navigate the complex world of finance with confidence.

Exabeam

Exabeam is a cybersecurity and compliance platform that offers Security Information and Event Management (SIEM) solutions. The platform provides flexible choices for threat detection, investigation, and response, whether through cloud-based AI-driven solutions or on-premises SIEM deployments. Exabeam's AI-driven Security Operations Platform combines advanced threat detection capabilities with automation to deliver faster and more accurate TDIR. With features like UEBA, SOAR, and insider threat detection, Exabeam helps organizations improve security posture and optimize investments. The platform supports various industries and use cases, offering pre-built content, behavioral analytics, and context enrichment for enhanced threat coverage and compliance.

AI Signals

AI Signals is an AI trading application that provides cutting-edge AI trading tools and signals for a diverse range of crypto pairs. The platform offers advanced AI algorithms that ensure precise and timely signals for trading, enhancing trading performance and delivering consistent long-term success. With a focus on accuracy, reliability, and user satisfaction, AI Signals stands out as the ultimate choice for traders seeking to maximize gains and minimize risks in the cryptocurrency market.

Sagehood

Sagehood is an AI-driven platform that provides real-time market intelligence for investors in the finance sector. By harnessing AI-driven insights, Sagehood helps users stay ahead in the dynamic world of finance by offering intelligent analysis, deep-dive analysis, strategic execution, and intelligent synthesis. The platform aims to optimize investment strategies and enhance decision-making by leveraging AI technology to analyze vast amounts of data and provide actionable insights. With advanced features for informed decision-making and a focus on minimizing bias while maximizing insight, Sagehood offers tailored intelligence to help users make data-driven investment decisions.

MacroMicro

MacroMicro is an AI analytics platform that combines technology and research expertise to empower users with valuable insights into global market trends. With over 0k registered users and 0M+ monthly website traffic, MacroMicro offers real-time charts, cycle analysis, and data-driven insights to optimize investment strategies. The platform compiles the MM Global Recession Probability, utilizes OpenAI's Embedding technology, and provides exclusive reports and analysis on key market events. Users can access dynamic and automatically-updated charts, a powerful toolbox for analysis, and engage with a vibrant community of macroeconomic professionals.

EquBot

EquBot is an AI tool designed for investment and wealth management. It offers non-advisory institutional solutions powered by IBM Watson. The tool can be accessed at www.QuantumStreetAI.com. EquBot is based in San Francisco, California, and provides advanced AI-driven services to optimize investment decisions and wealth management strategies.

EarningsCall.ai

EarningsCall.ai is an AI-powered tool that provides stock earnings call summaries and insights, saving users hours of reading transcripts. It allows users to compare competitors, analyze trends, and generate their own insights. The tool is designed for business leaders, financial professionals, consultants, and advisors to track competitor earnings, assess market trends, and optimize investment strategies.

AnalyStock.ai

AnalyStock.ai is a financial application leveraging AI to provide users with a next-generation investment toolbox. It helps users better understand businesses, risks, and make informed investment decisions. The platform offers direct access to the stock market, powerful data-driven tools to build top-ranking portfolios, and insights into company valuations and growth prospects. AnalyStock.ai aims to optimize the investment process, offering a reliable strategy with factors like A-Score, factor investing scores for value, growth, quality, volatility, momentum, and yield. Users can discover hidden gems, fine-tune filters, access company scorecards, perform activity analysis, understand industry dynamics, evaluate capital structure, profitability, and peers' valuation. The application also provides adjustable DCF valuation, portfolio management tools, net asset value computation, monthly commentary, and an AI assistant for personalized insights and assistance.

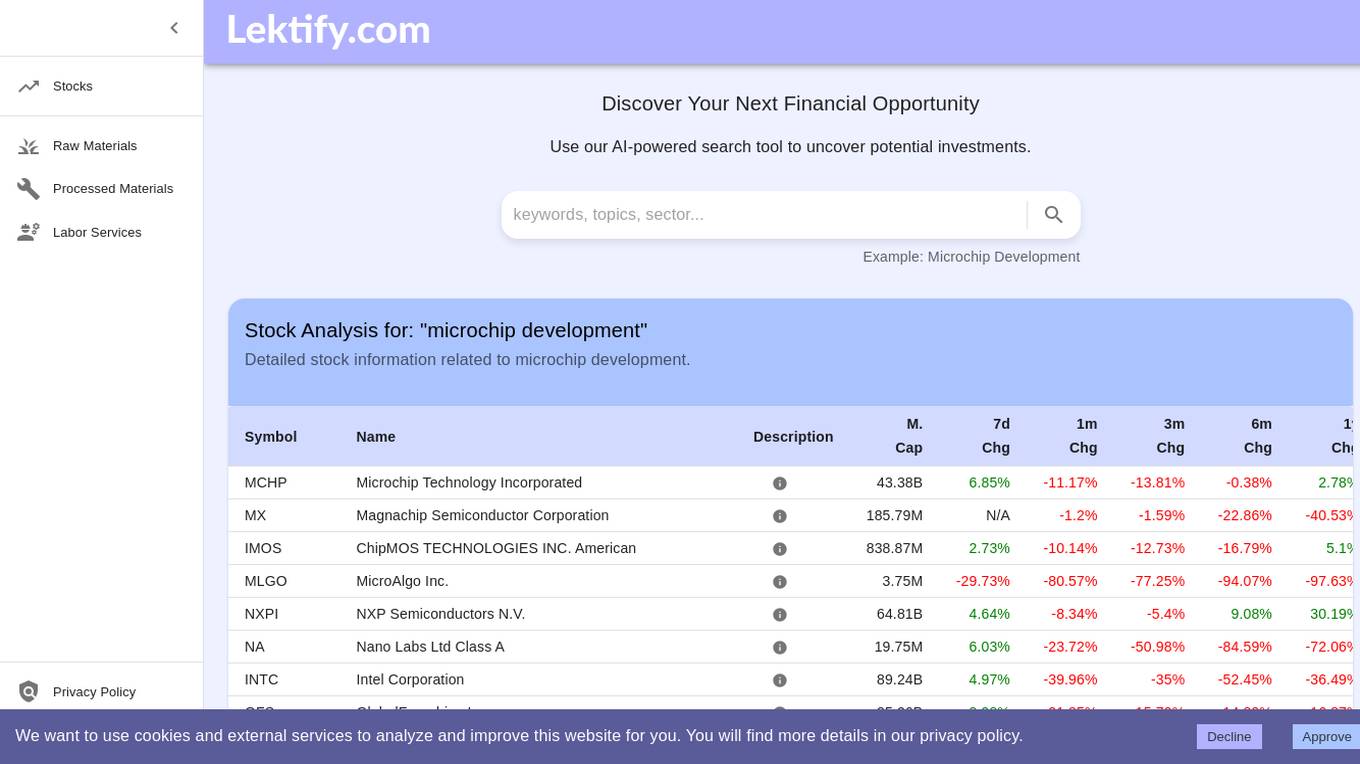

Lektify

Lektify is an AI-powered platform designed to revolutionize the way users manage their investment portfolios. By leveraging advanced artificial intelligence algorithms, Lektify helps users discover top-performing stocks and make informed investment decisions. The platform provides valuable insights and recommendations based on extensive data analysis, enabling users to optimize their investment strategies and maximize returns. With Lektify, users can stay ahead of market trends and enhance their portfolio performance with confidence.

Stockaivisor

Stockaivisor is an AI-driven platform that offers comprehensive stock analysis, financial statement analysis, risk assessment, and predictive analytics for investors. With over 20,000 stocks and portfolios, the platform provides advanced insights through generative AI technology, predictive correlation models, and automated portfolio management. Stockaivisor empowers users to make informed decisions, anticipate market shifts, and optimize their investment strategies with data-driven trading signals. The platform also features dedicated customer support and tools for stock and portfolio screening, making it a valuable resource for both novice and experienced investors.

Deferred.com

Deferred.com is a free AI tool designed to assist users with 1031 exchanges, a tax-deferral strategy in real estate investment. The platform offers a range of resources, including an exchange calculator, expert answers, and matching with 1031 professionals. Users can optimize tax savings, find the right intermediary, and access essential reading materials on tax deferral and exchange rules. With a focus on simplifying the complex process of 1031 exchanges, Deferred.com aims to empower real estate investors to make informed decisions and maximize their financial benefits.

Three Sigma

Three Sigma is a quantitative hedge fund that uses advanced artificial intelligence and machine learning techniques to identify and exploit trading opportunities in global financial markets.

Vercel Security Checkpoint

Vercel Security Checkpoint is a web application that provides a security verification process for users accessing the Vercel platform. It ensures the safety and integrity of the platform by verifying the user's browser and enabling JavaScript before proceeding. The checkpoint serves as a protective measure to prevent unauthorized access and potential security threats.

RockFlow

RockFlow is an AI-powered fintech platform that simplifies investing by offering AI-first trading experiences. The platform, powered by Bobby AI, allows users to build AI portfolios, execute trades, manage portfolios, and receive real-time trading opportunities. With features like Copy Trading, simplified options trading, and access to a wide range of investment products, RockFlow aims to empower users to make informed investment decisions effortlessly. The platform also prioritizes customer service and security, ensuring a safe and reliable trading environment for users.

Macroaxis

Macroaxis is a wealth optimization platform that leverages artificial intelligence to help users make informed investment decisions. It offers a range of features to generate optimal portfolios, provide investment insights, and rebalance portfolios efficiently. The platform caters to self-directed investors, finance academia, fintech professionals, and individuals looking to invest with AI-driven strategies. Macroaxis aims to empower users with adaptive investment solutions and resilient portfolio management capabilities.

Nest AI

Nest AI is an autonomous DeFAI agent that utilizes artificial intelligence to provide advanced financial services. The platform offers automated investment strategies, portfolio management, and personalized financial advice to help users optimize their financial decisions. With cutting-edge AI algorithms, Nest AI aims to revolutionize the way individuals manage their finances by offering intelligent and data-driven solutions.

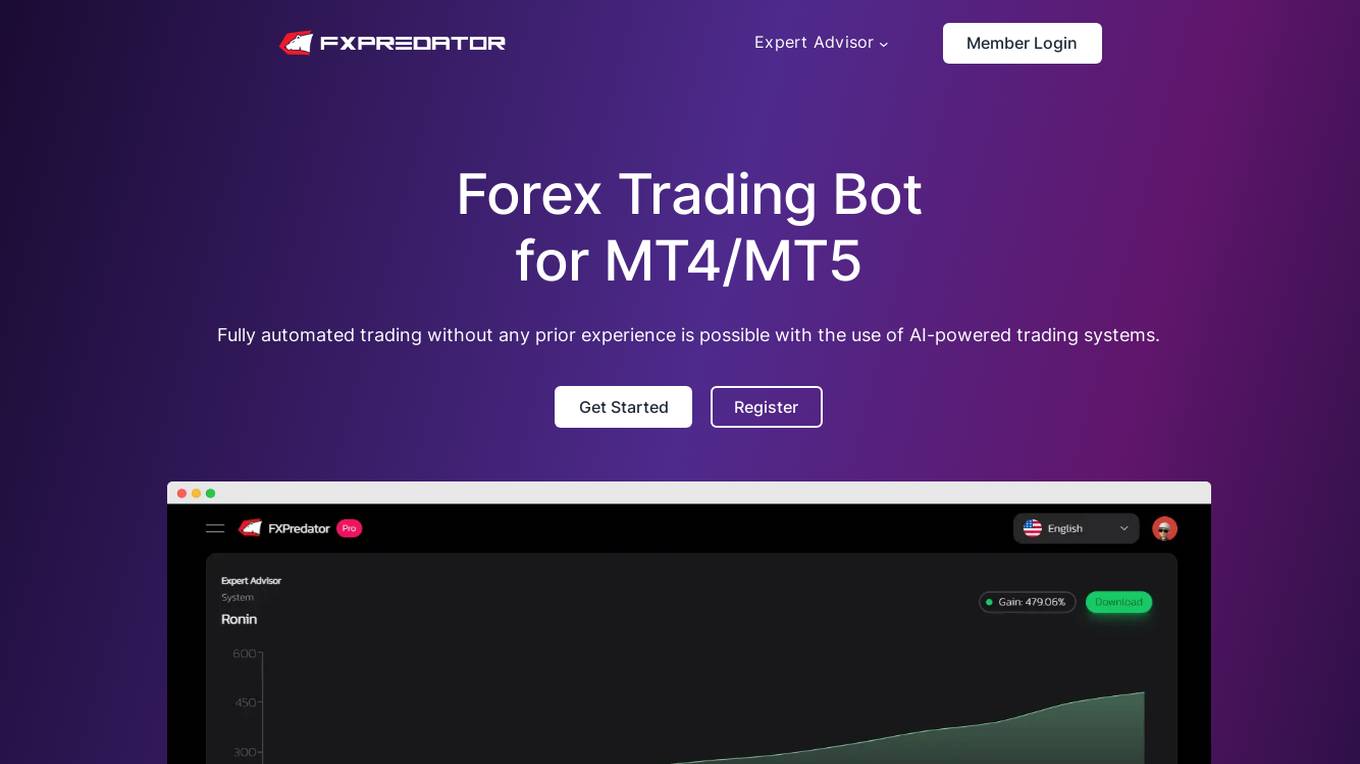

FXPredator

FXPredator is the #1 Forex Trading Bot for MT4/MT5 Expert Advisor that offers fully automated trading powered by AI technology. Users can track real-time and historical performance, enjoy fast delivery of the Expert Advisor, and receive top-notch customer support. FXPredator provides multiple advantages such as automated trading based on numerical data, generating passive income, proven performance monitoring, and peace of mind in managing trades. With a focus on transparency, customization, and outstanding customer support, FXPredator is the ultimate solution for automated trading.

Ontra

Ontra is an AI-powered platform that offers contract automation, fundraising insights, and entity management solutions for private markets. With a focus on streamlining workflows and unlocking valuable insights, Ontra serves over 800 global investment firms. The platform leverages cutting-edge AI technology, including the Synapse AI engine powered by OpenAI's GPT-4, to automate routine legal workflows and improve efficiency in contract negotiation, compliance, and entity management.

Tickeron

Tickeron is an AI trading platform that offers a variety of tools and features to enhance trading in the stock market. It provides AI predictions for stocks, ETFs, forex, and other assets, empowering users with accurate stock predictions and trend insights. The platform includes AI robots for virtual accounts, trend predictions, pattern search engines, and real-time patterns. Additionally, Tickeron offers tools for traders and investors, such as stock portfolio wizards, active portfolios, model portfolios, and 401(k) portfolios. Users can also explore the marketplace for trading and investing tools, join trader and investor clubs, and access educational resources to improve their trading skills.

0 - Open Source AI Tools

20 - OpenAI Gpts

Investment Management Advisor

Provides strategic financial guidance for investment behavior to optimize organization's wealth.

Nimbus

Expert in CFA, quant, software engineering, data science, and economics for investment strategies.

FinWiz

FinWiz-GPT is designed for finance professionals. It assists in market analysis, financial modeling, and understanding complex financial instruments. It's a great tool for financial analysts, investment bankers, and accountants.

Portfolio Management GPT

Assists in portfolio management, offering optimization strategies and market insights.

AI Trading Ace

Expert in AI trading strategies, guiding users to leverage market opportunities.

Family Asset Management

Guides asset allocation in family segments, focusing on investments.

Finance Generalist

Provides financial advice to steer organizational growth and sustainability.

MarketMaster AI.

Dynamic financial expert with a multifaceted approach to market analysis.