Best AI tools for< Manage Risk Portfolios >

20 - AI tool Sites

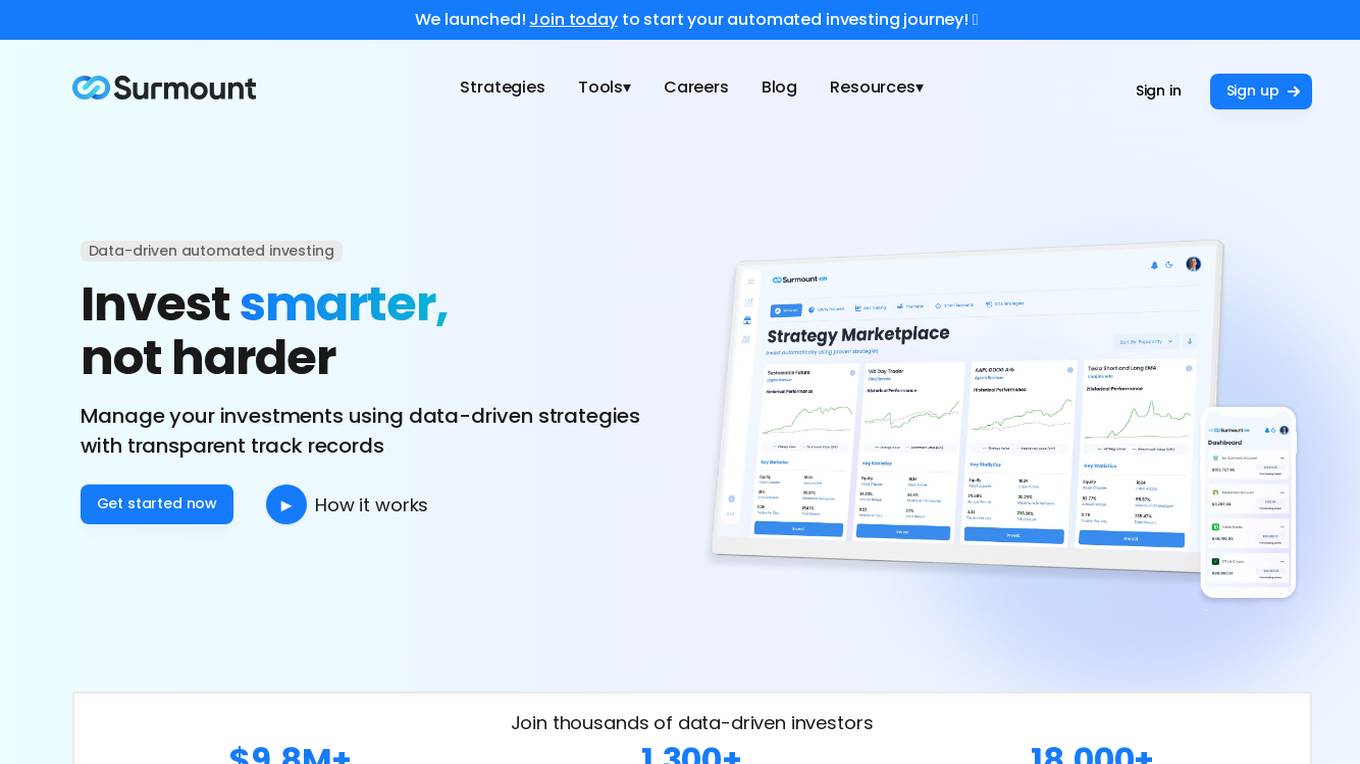

Surmount AI

Surmount AI is an automated investing platform designed to make investing accessible to everyone. It utilizes advanced algorithms to provide users with personalized investment strategies based on their financial goals and risk tolerance. With Surmount AI, users can easily create and manage their investment portfolios, track performance, and receive real-time insights to make informed decisions. The platform aims to democratize investing by removing barriers to entry and empowering individuals to grow their wealth through intelligent automation.

Nest AI

Nest AI is an autonomous DeFAI agent that utilizes artificial intelligence to provide advanced financial services. The platform offers automated investment strategies, portfolio management, and personalized financial advice to help users optimize their financial decisions. With cutting-edge AI algorithms, Nest AI aims to revolutionize the way individuals manage their finances by offering intelligent and data-driven solutions.

RockFlow

RockFlow is an AI-powered fintech platform that simplifies investing by offering AI-first trading experiences. The platform, powered by Bobby AI, allows users to build AI portfolios, execute trades, manage portfolios, and receive real-time trading opportunities. With features like Copy Trading, simplified options trading, and access to a wide range of investment products, RockFlow aims to empower users to make informed investment decisions effortlessly. The platform also prioritizes customer service and security, ensuring a safe and reliable trading environment for users.

Ultralgo

Ultralgo is an AI-powered trading platform that provides users with a variety of tools and features to help them make more informed and profitable trades. The platform offers a range of features, including AI-powered market analysis, automated trading, and portfolio management. Ultralgo is designed to be easy to use, even for beginners, and it offers a variety of resources to help users learn how to trade. The platform is also highly customizable, so users can tailor it to their own individual needs.

Pantarai

Pantarai is an AI-powered adaptive investment platform that offers an intelligent system to interpret financial markets in real time. The platform's proprietary AI expert system, Cartesio, manages daily ETP allocation supervised by real humans. Pantarai's adaptive investment strategy adjusts to shifting market conditions, aiming to deliver consistent returns with smoother volatility across a wide range of market outcomes. The platform invests in stock, bond, commodity, and cash proxy indices via low-cost ETFs, with a focus on multi-asset investing, systematic and AI-powered processes, tactical asset rotation, and resilience in market outcomes.

Three Sigma

Three Sigma is a quantitative hedge fund that uses advanced artificial intelligence and machine learning techniques to identify and exploit trading opportunities in global financial markets.

Stockaivisor

Stockaivisor is an AI-driven platform that offers comprehensive stock analysis, financial statement analysis, risk assessment, and predictive analytics for investors. With over 20,000 stocks and portfolios, the platform provides advanced insights through generative AI technology, predictive correlation models, and automated portfolio management. Stockaivisor empowers users to make informed decisions, anticipate market shifts, and optimize their investment strategies with data-driven trading signals. The platform also features dedicated customer support and tools for stock and portfolio screening, making it a valuable resource for both novice and experienced investors.

PortfolioGPT

PortfolioGPT is an AI-powered platform that enables users to generate smart investment portfolios in seconds. It leverages OpenAI's advanced algorithms to automatically create personalized portfolios based on user input, including risk tolerance, investment amount, and financial goals. With features like personalized risk profiling, instant portfolio suggestions, and simple user input, PortfolioGPT aims to simplify the investment process for both novice and experienced investors. The platform offers subscription plans for users to access unlimited queries per day and receive tailored investment recommendations.

STRATxAI

STRATxAI is an AI-powered quantitative investment platform that offers custom AI model portfolios tailored to clients' investment philosophy, risk tolerance, and objectives. The platform harnesses machine learning to deliver data-driven insights for security analysis, portfolio construction, and management. Powered by the proprietary investment engine Alana, STRATxAI processes over 8 billion financial data points daily to uncover hidden alpha beyond traditional methods. Clients benefit from smarter decision-making, better risk-adjusted returns, optimized portfolio management, and savings on resources. The platform is designed to enhance investment decisions for forward-thinking investors by leveraging AI technology.

Capital Companion

Capital Companion is an AI-powered trading and investing platform designed to provide users with a competitive edge in the markets. The platform offers a range of features including 24/7 AI assistant support, intelligent trading recommendations, risk analysis tools, real-time stock analytics, market sentiment analysis, and pattern recognition for technical analysis. By leveraging artificial intelligence, Capital Companion aims to help traders make well-informed decisions and protect their investments in a dynamic market environment.

TradeBX

TradeBX is an AI-powered trading platform that provides advanced AI algorithms, an inbuilt training course, and a user-friendly interface. Its AI algorithms analyze vast amounts of data in real-time to identify profitable opportunities and execute trades with precision. The platform also offers a training course to help users leverage the bot's advanced features and strategies. With 24/7 trading and a user-friendly interface, TradeBX empowers traders of all levels to achieve their financial goals.

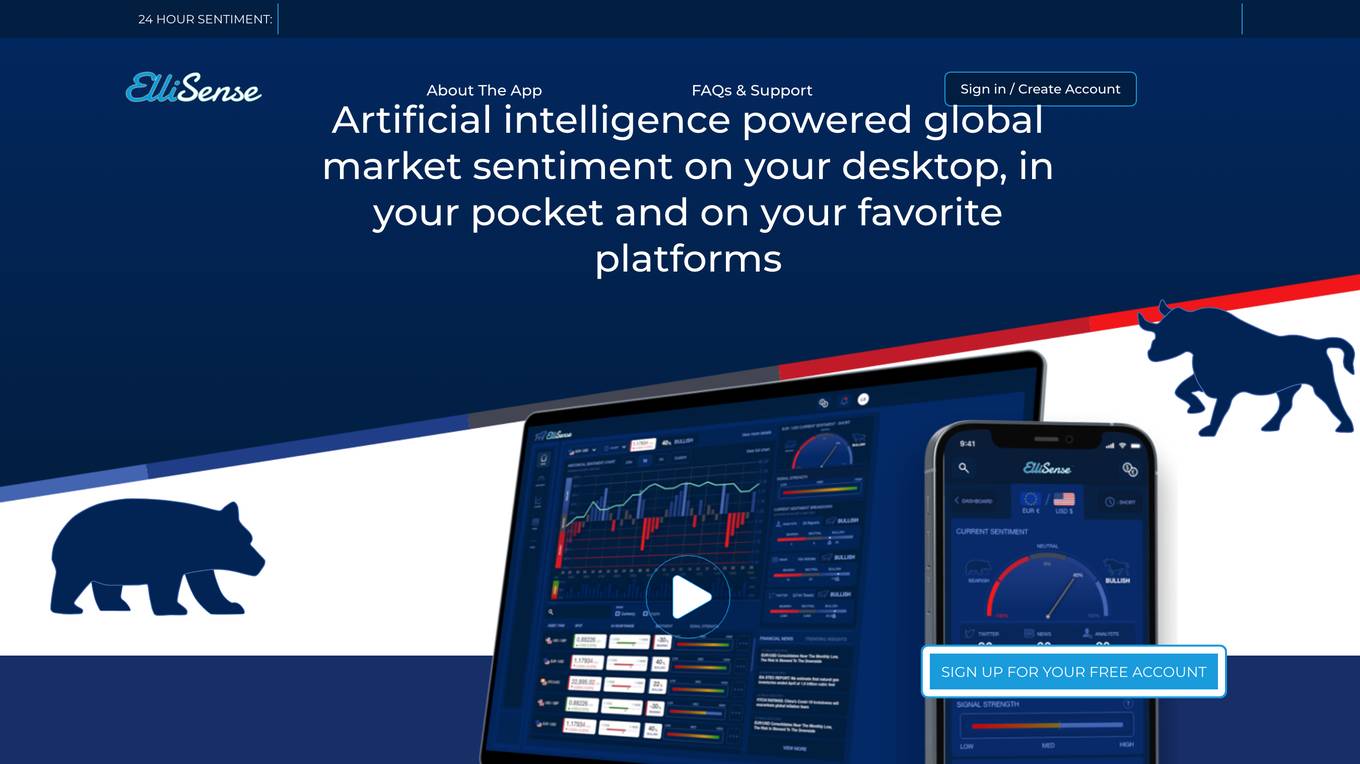

ElliSense

ElliSense is an AI-powered global market sentiment analysis tool that provides real-time insights into the sentiment of various financial assets, including stocks, cryptocurrencies, and forex currencies. It analyzes thousands of data points per second from various sources, including social media, news outlets, and industry analysts, to provide accurate and up-to-date market sentiment. The tool is designed to help traders and investors make informed decisions by providing clear and easy-to-understand market insights.

Dark Pools

Dark Pools is a leading provider of AI-powered solutions for the financial industry. Our mission is to empower our clients with the tools and insights they need to make better decisions, improve their performance, and stay ahead of the competition. We offer a range of products and services that leverage AI to automate tasks, optimize workflows, and generate actionable insights. Our solutions are used by a wide range of financial institutions, including hedge funds, asset managers, and banks.

FINQ

FINQ is an AI-driven platform designed to help users build dynamic investment portfolios, follow model portfolios, and optimize investments effortlessly. The platform offers AI-based stocks portfolios with three distinct strategies to outperform the S&P. FINQ assesses financial product risk daily using a data-driven approach and provides users with 100% objectivity by eliminating biases. The AI engine monitors the market 24/7, ensuring users are aware of investment opportunities and offers risk-guided investing to match products with comfort levels.

DeFi Lens

DeFi Lens is an advanced market insights platform that leverages Generative AI to provide users with valuable information and analysis in the decentralized finance space. By utilizing cutting-edge AI technology, DeFi Lens offers users a unique perspective on market trends, investment opportunities, and risk assessment in the rapidly evolving DeFi landscape. The platform is designed to empower users with actionable insights and data-driven decision-making tools, enabling them to stay ahead in the competitive DeFi market.

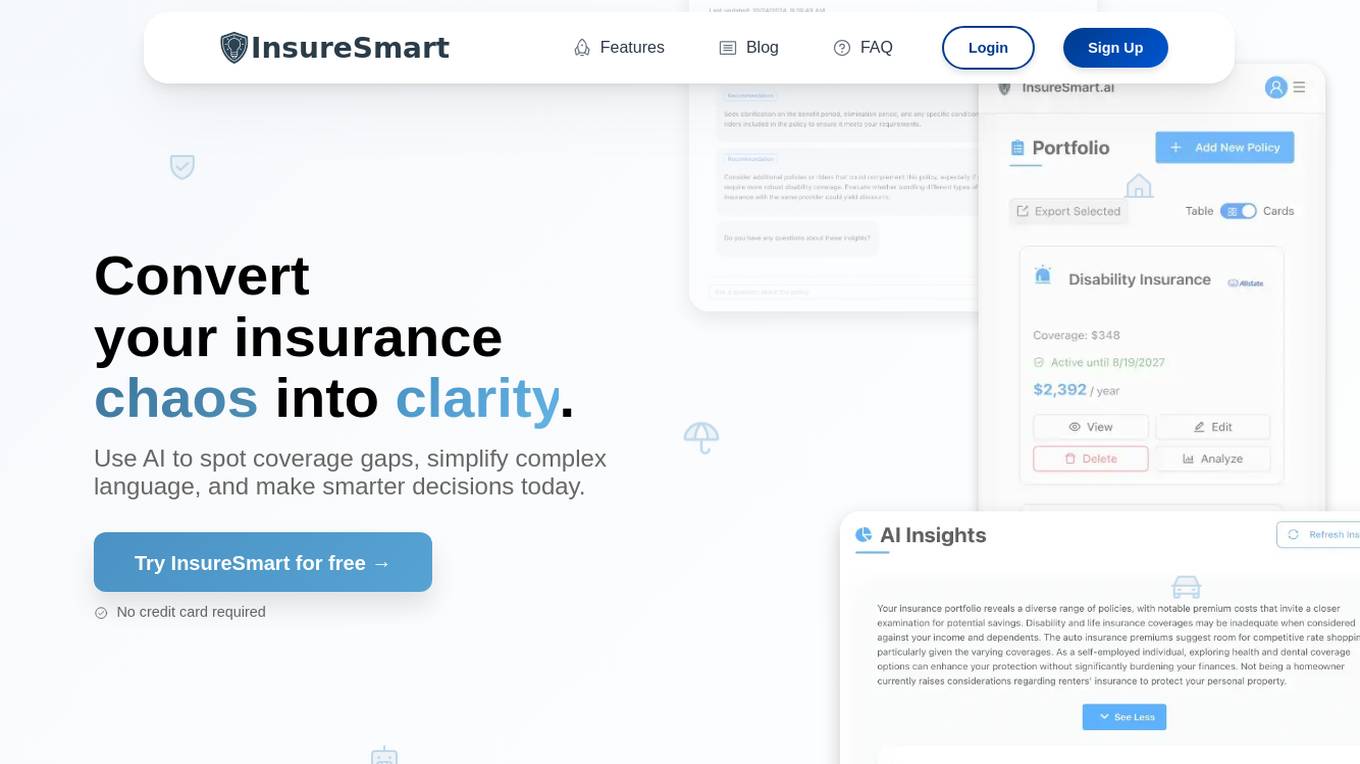

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

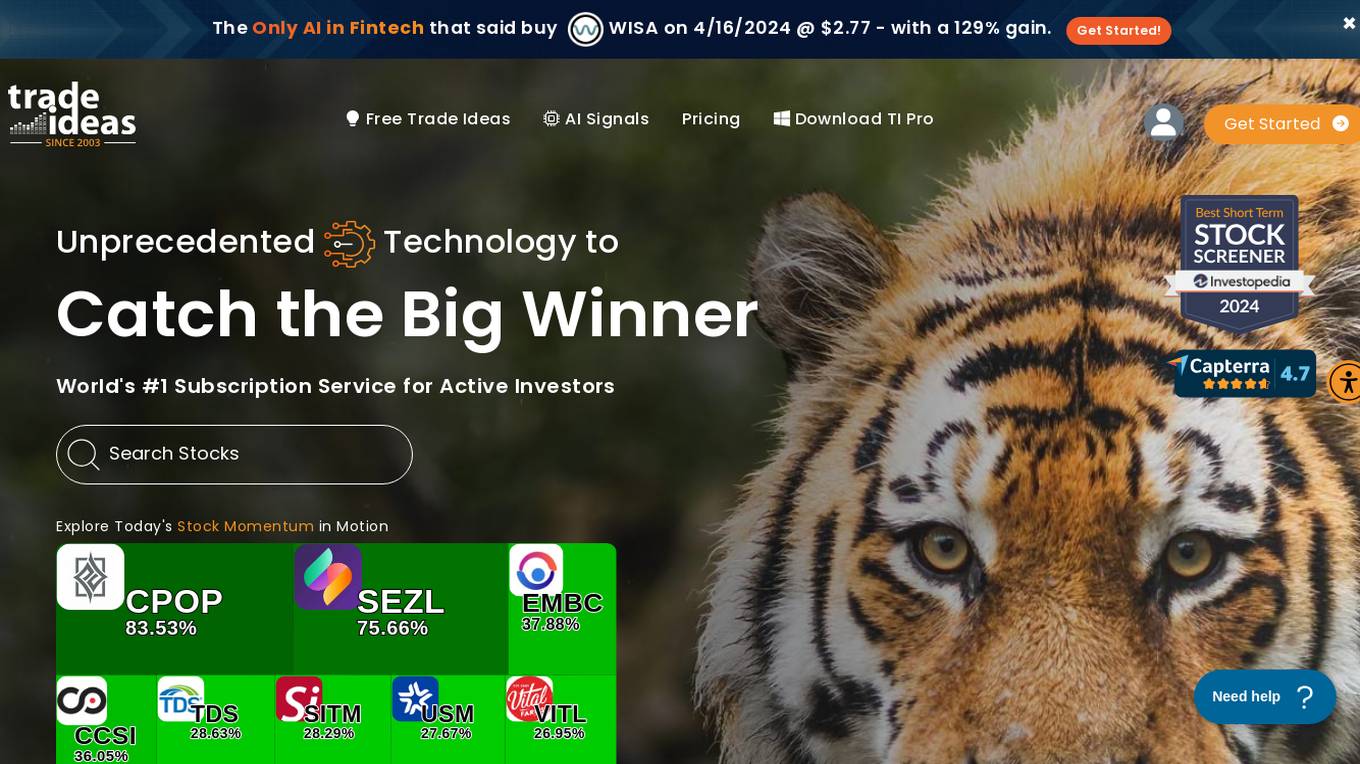

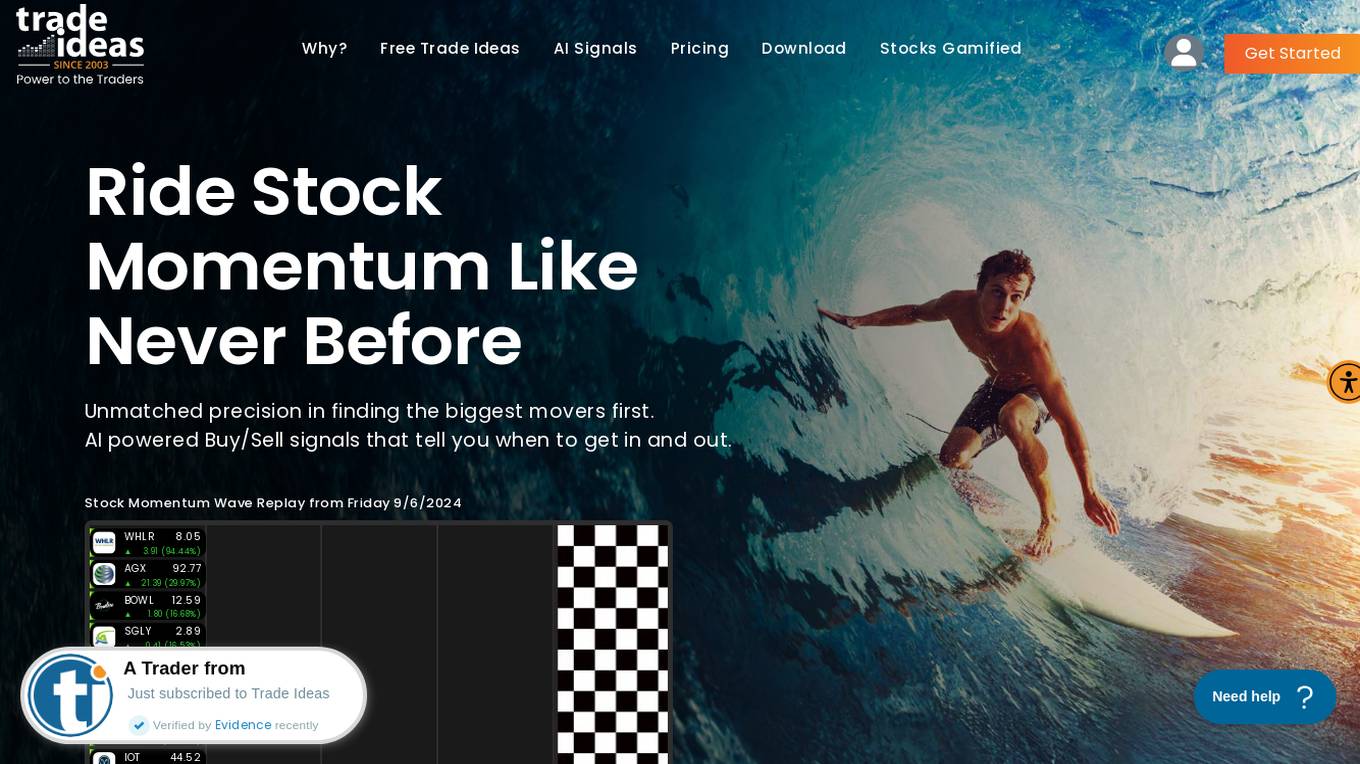

Trade Ideas

Trade Ideas is an AI-driven stock scanning and charting platform designed to meet the needs of active traders. It provides powerful tools such as real-time market scanning, AI-driven trade signals, customizable alerts, advanced charting capabilities, and time-saving data visualization. Trade Ideas offers users the confidence to make smarter trading decisions and the freedom to conquer markets anytime, anywhere. The platform also includes features like a trading simulator for practicing new strategies, Picture in Picture charts for visualizing multiple timeframes, and integration with leading brokers and trading platforms.

Trade Ideas

Trade Ideas is an AI-driven stock scanning and charting platform that provides unmatched precision in finding the biggest movers first. It offers AI-powered Buy/Sell signals, real-time market scanning, customizable alerts, advanced charting capabilities, and time-saving data visualization. Users can access the platform on any device, empowering them to make smarter trading decisions and stay ahead of the game. Trade Ideas also features a live trading room with expert market commentary and a simulator for practicing new trading strategies under actual market conditions. The platform is trusted by leading brokers and trading platforms, offering users a competitive edge in the market.

Rafa.ai

Rafa.ai is an AI-powered investing application that offers a comprehensive suite of tools and features to assist users in making informed investment decisions. The platform utilizes AI agents to provide real-time insights, portfolio alerts, risk analysis, and options monitoring. Users can access data-driven trading strategies, perform equity research, and analyze news sentiment. Rafa.ai aims to help users manage their investment risks, discover investment opportunities, and make smarter investment decisions.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

0 - Open Source AI Tools

20 - OpenAI Gpts

Instructors in Global Economics and Finance

Multilingual support in Global Economics & Finance studies.

Digital Assets @ FS

Consultant on digital assets in financial services, using a pricing study for insights.

Trading Assistant

Assists with daily trading activities, focusing on market trends and data analysis.

Trader GPT - Real Time - Market Technical Analysis

Technical analyst backed with 1W-1D-4H refreshed financial market data. For more timeframes and granularity please check our website.

VaultCraft Trainer

VaultCraft trains users to create automated yield strategies using the VaultCraft VCI & SDK