Best AI tools for< Investment Decision >

20 - AI tool Sites

MDOTM Ltd

MDOTM Ltd is a global provider of AI-driven investment solutions for Institutional Investors. Founded in London in 2015, the company offers Portfolio Advisory and Asset Allocation services to various financial institutions. MDOTM's AI platform, Sphere, empowers asset and wealth managers with AI-driven insights, seamless portfolio rebalancing, and automated reports at scale.

AnalyStock.ai

AnalyStock.ai is a financial application leveraging AI to provide users with a next-generation investment toolbox. It helps users better understand businesses, risks, and make informed investment decisions. The platform offers direct access to the stock market, powerful data-driven tools to build top-ranking portfolios, and insights into company valuations and growth prospects. AnalyStock.ai aims to optimize the investment process, offering a reliable strategy with factors like A-Score, factor investing scores for value, growth, quality, volatility, momentum, and yield. Users can discover hidden gems, fine-tune filters, access company scorecards, perform activity analysis, understand industry dynamics, evaluate capital structure, profitability, and peers' valuation. The application also provides adjustable DCF valuation, portfolio management tools, net asset value computation, monthly commentary, and an AI assistant for personalized insights and assistance.

RoboFin

RoboFin is an AI-powered investment analyst that helps you make better investment decisions. It analyzes mountains of data - news, financials, trends - faster than any human could. You get clear, actionable information about each stock you are interested in such as positive things, concerns and a forecast of how the price might move based on the data analysis. Data-driven decisions replace gut feelings.

Sagehood

Sagehood is an AI-driven platform that provides real-time market intelligence for investors in the finance sector. By harnessing AI-driven insights, Sagehood helps users stay ahead in the dynamic world of finance by offering intelligent analysis, deep-dive analysis, strategic execution, and intelligent synthesis. The platform aims to optimize investment strategies and enhance decision-making by leveraging AI technology to analyze vast amounts of data and provide actionable insights. With advanced features for informed decision-making and a focus on minimizing bias while maximizing insight, Sagehood offers tailored intelligence to help users make data-driven investment decisions.

Monexa

Monexa is a professional-grade financial analysis platform that offers institutional-grade market insights, news, and data analysis in one powerful platform. It provides comprehensive market analysis, AI-powered insights, rich data visualizations, research and analysis tools, advanced screener, rich financial history, automated SWOT analysis, comprehensive reports, interactive performance analytics, institutional investment tracking, company intelligence, dividend analysis, earnings call analysis, portfolio analytics, strategy explorer, real-time market intelligence, and more. Monexa is designed to help users make data-driven investment decisions with a comprehensive suite of analytical capabilities.

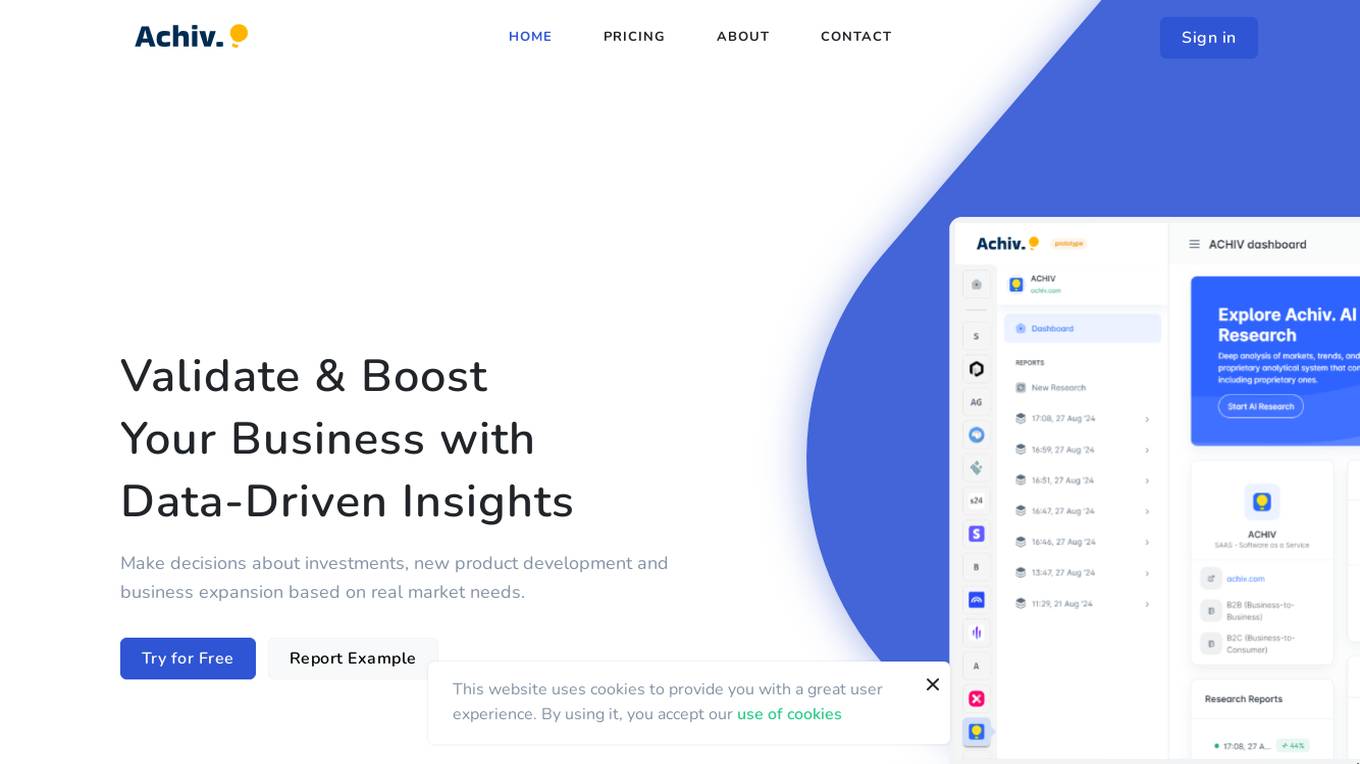

ACHIV

ACHIV is an AI tool for ideas validation and market research. It helps businesses make informed decisions based on real market needs by providing data-driven insights. The tool streamlines the market validation process, allowing quick adaptation and refinement of product development strategies. ACHIV offers a revolutionary approach to data collection and preprocessing, along with proprietary AI models for smart analysis and predictive forecasting. It is designed to assist entrepreneurs in understanding market gaps, exploring competitors, and enhancing investment decisions with real-time data.

PropHunt.ai

PropHunt.ai is an AI-powered platform designed for real estate professionals and property investors. It utilizes advanced machine learning algorithms to analyze property data and provide valuable insights for property hunting and investment decisions. The platform offers features such as property price prediction, neighborhood analysis, investment risk assessment, property comparison, and market trend forecasting. With PropHunt.ai, users can make informed decisions, optimize their property investments, and stay ahead in the competitive real estate market.

Chicago Bull AI Wallstreet Chatbot

Chicago Bull AI Wallstreet Chatbot is an AI application designed to provide users with real-time information and insights on the stock market. Users can interact with the chatbot to ask questions related to equities, crypto, or bond markets. The chatbot is not affiliated with the Chicago Bulls organization or the National Basketball Association. It aims to assist users in making informed investment decisions by providing market updates and analysis.

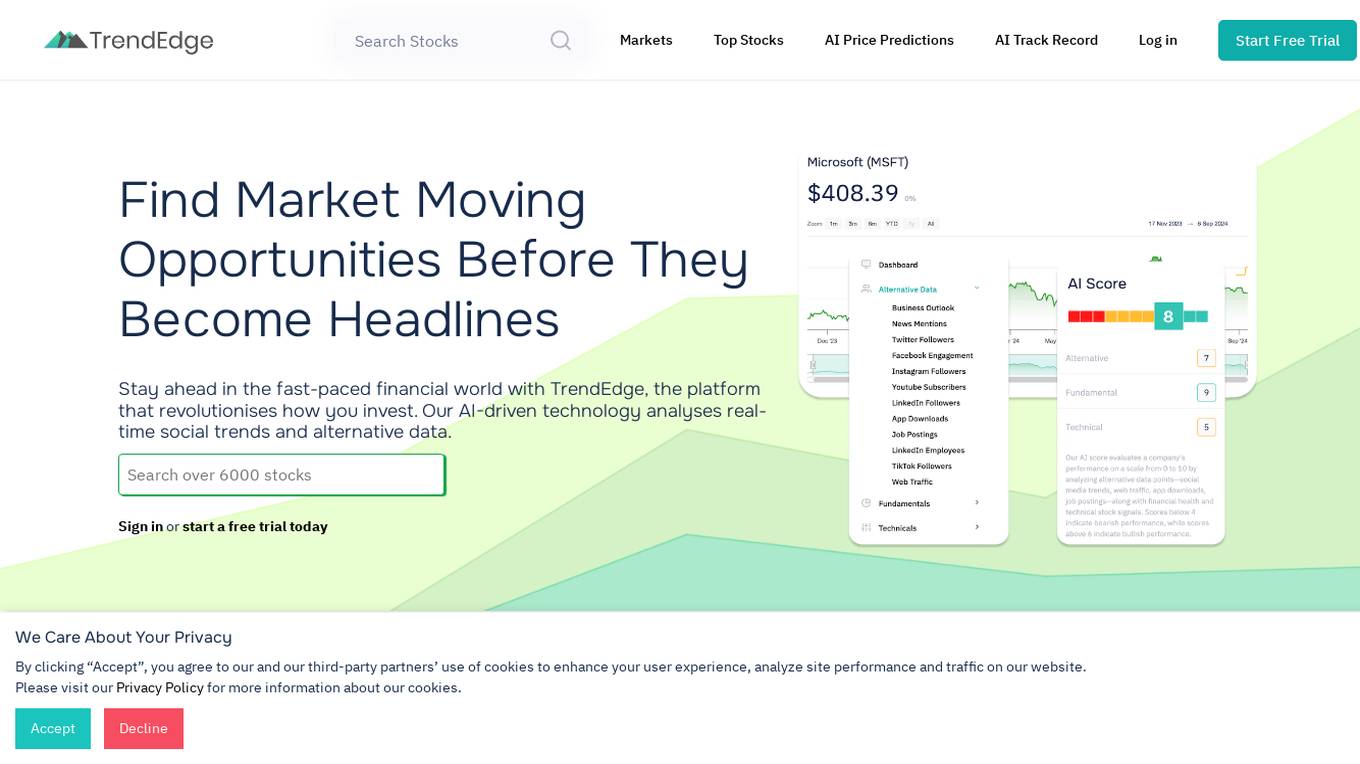

TrendEdge

TrendEdge is an AI-driven platform that revolutionizes investment strategies by providing comprehensive insights through the analysis of real-time social trends and alternative data sources. It offers exclusive data access, AI-powered stock signals, and personalized recommendations to help users make informed and confident investment decisions. The platform integrates diverse data sources, including social media sentiment, technical indicators, and fundamental analysis, to provide a nuanced market view and uncover hidden trends.

Intellectia.AI

Intellectia.AI is a powerful AI platform designed to provide smarter investment insights for investors across stocks, ETFs, and cryptocurrencies. The platform offers advanced technical analysis, tailored stock analysis, and quick insights on market trends. With over 100 supported indicators, Intellectia.AI empowers investors with actionable insights derived from AI-driven analysis. The platform also features a dedicated news section summarizing financial news using AI, ensuring users stay informed about events affecting stock movements. Intellectia.AI aims to democratize financial information intelligence through AI, making it accessible to investors of all levels, from individuals to large institutions.

Kavout

Kavout is an AI-powered financial research assistant that provides investors with data-driven insights and cutting-edge technology to help them make informed investment decisions. The platform offers a range of features, including natural language search, stock screening, portfolio analysis, and personalized recommendations. Kavout's AI algorithms adapt to each user's unique investment style, providing tailored insights and guidance.

Valuemetrix

Valuemetrix is an AI-enhanced investment analysis platform designed for investors seeking to redefine their investment journey. The platform offers cutting-edge AI technology, institutional-level data, and expert analysis to provide users with well-informed investment decisions. Valuemetrix empowers users to elevate their investment experience through AI-driven insights, real-time market news, stock reports, market analysis, and tailored financial information for over 100,000 international publicly traded companies.

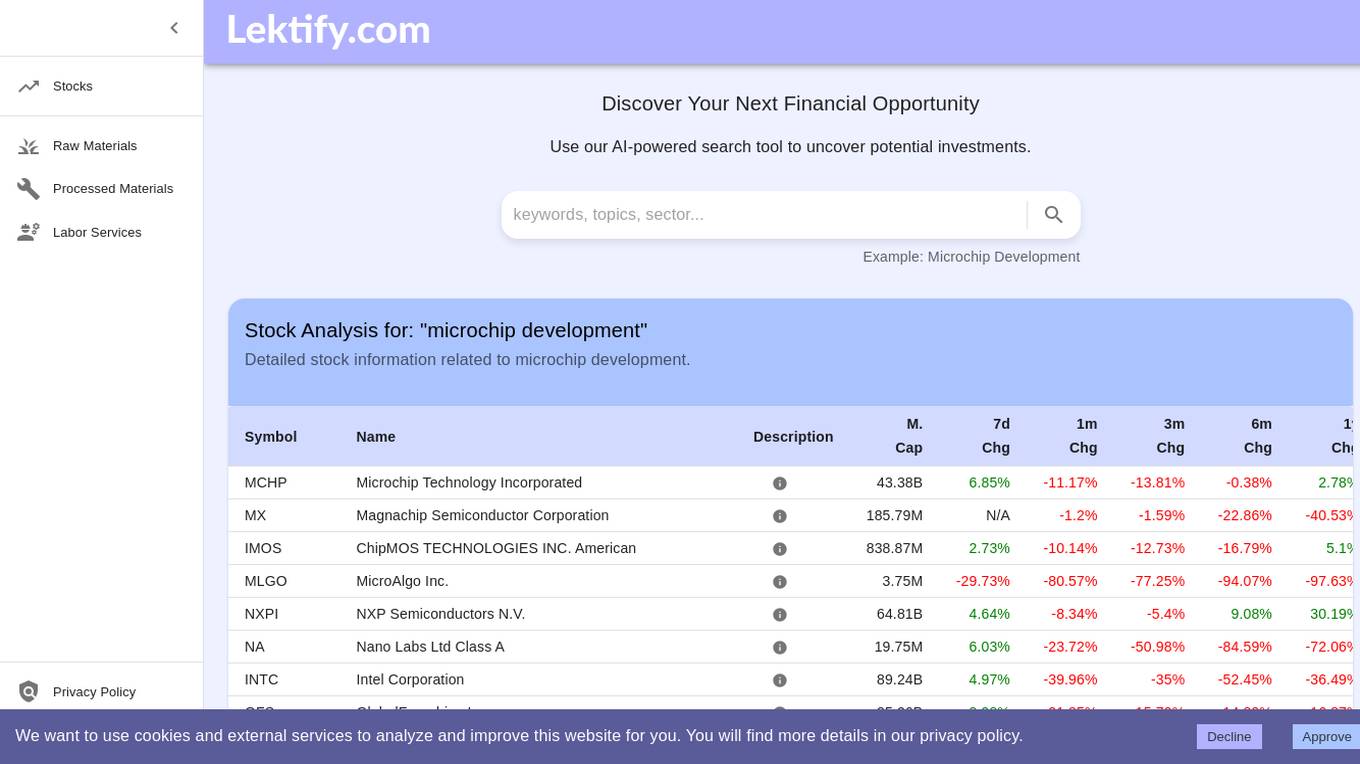

Lektify

Lektify is an AI-powered platform designed to revolutionize the way users manage their investment portfolios. By leveraging advanced artificial intelligence algorithms, Lektify helps users discover top-performing stocks and make informed investment decisions. The platform provides valuable insights and recommendations based on extensive data analysis, enabling users to optimize their investment strategies and maximize returns. With Lektify, users can stay ahead of market trends and enhance their portfolio performance with confidence.

Borea AI

Borea AI is an AI application that provides stock price predictions and stock ratings based on past market behavior and historical stock performance. It empowers users to unlock intelligent financial mastery by offering insights on popular stocks, market leaders, index ETFs, top movers, most tweeted stocks, and best-performing predictions. Borea AI serves as a personal financial assistant, but it is important to note that past performance is not an indicator of future results, and professional investment advice should not be substituted.

Stockaivisor

Stockaivisor is an AI-driven platform that offers comprehensive stock analysis, financial statement analysis, risk assessment, and predictive analytics for investors. With over 20,000 stocks and portfolios, the platform provides advanced insights through generative AI technology, predictive correlation models, and automated portfolio management. Stockaivisor empowers users to make informed decisions, anticipate market shifts, and optimize their investment strategies with data-driven trading signals. The platform also features dedicated customer support and tools for stock and portfolio screening, making it a valuable resource for both novice and experienced investors.

MacroMicro

MacroMicro is an AI analytics platform that combines technology and research expertise to empower users with valuable insights into global market trends. With over 0k registered users and 0M+ monthly website traffic, MacroMicro offers real-time charts, cycle analysis, and data-driven insights to optimize investment strategies. The platform compiles the MM Global Recession Probability, utilizes OpenAI's Embedding technology, and provides exclusive reports and analysis on key market events. Users can access dynamic and automatically-updated charts, a powerful toolbox for analysis, and engage with a vibrant community of macroeconomic professionals.

Roic AI

Roic AI is an AI tool designed to provide users with essential financial data for analyzing companies. It offers comprehensive company summaries, 30+ years of financial statements, and earnings call transcripts in a single location. Users can access crucial information about popular companies like Apple Inc. and Microsoft Corporation through this platform.

Vercel Security Checkpoint

Vercel Security Checkpoint is a web application that provides a security verification process for users accessing the Vercel platform. It ensures the safety and integrity of the platform by verifying the user's browser and enabling JavaScript before proceeding. The checkpoint serves as a protective measure to prevent unauthorized access and potential security threats.

CityFALCON

CityFALCON is a financial and business due diligence platform that provides a range of solutions for the needs of a wide audience, including retail investors, retail traders, daily business news readers, brokers, students, professors, academia, wealth managers, financial advisors, P2P crowdfunding, VC, PE, institutional investors, treasury, consultancy, legal, accounting, central banks, and regulatory agencies. The platform offers a variety of features and content, including a CityFALCON Score, watchlists, similar stories, grouping news on charts, key headlines, sentiment content translation, content news premium publications, insider transactions, official company filings, investor relations, ESG content, and languages.

InciteAI

InciteAI is a real-time intelligence platform for stocks and crypto, offering powerful AI stock and crypto analysis. The platform provides investors with accurate insights, analysis, and predictions needed to make informed investment decisions. It leverages cutting-edge AI technology to analyze extensive datasets, historical trends, and real-time market conditions, empowering users to navigate the stock market with confidence and stay ahead of market shifts. InciteAI aims to simplify and enhance the investment journey for both financial professionals and novice investors, offering AI-driven tools for stock prediction, trading, and analysis.

0 - Open Source AI Tools

20 - OpenAI Gpts

Crowd Equity Analyst

Analyzes crowdfunding ventures for market potential and business viability, aiding investment decisions. by neuralvault

Bitcoin Price Wizard

I am packed with every Bitcoin price from 2014-2023. I quickly analyze Bitcoin data to help you make smart investment decisions, plot trends, and find interesting correlations! *Warning: This is not financial advice.

策略研报分析 Investment Strategy Research

专注于“投资策略”类型的研报分析总结,提炼对行业配置的核心观点 Focusing on the analysis and summary of research reports on the type of "investment strategy", refining core perspectives on industry allocation

Quotient

Investment Co-Pilot: Portfolio backtesting and access to in-depth financial data and historical closing prices of US-listed companies. (Pulse formerly)

Market Maven

An analyst versed in investment strategies and philosophies of financial icons.

Bitcoin GPT

Offers Bitcoin investment strategy insights based on recent or your own chart data.

💲 Discounted Cash Flow (DCF) Expert (5.0⭐)

Financial analyst specializing in Discounted Cash Flow (DCF) analysis for investment valuation.

Energy and Natural Resources Insighter

Discover the pulse of energy investment: first the latest news, then deeper insights.

Politician Trade Tracker

AI assistant for analyzing Congress members' trades for investment insights.

💹 EcoInvest Navigator

Your go-to AI for green finance! It offers tailored investment tips, market analyses, and sustainability insights to navigate eco-friendly portfolios. 🌱💰

VC Associate

A gpt assistant that helps with analyzing a startup/market. The answers you get back is already structured to give you the core elements you would want to see in an investment memo/ market analysis