Best AI tools for< Investment Analysis >

20 - AI tool Sites

Valuemetrix

Valuemetrix is an AI-enhanced investment analysis platform designed for investors seeking to redefine their investment journey. The platform offers cutting-edge AI technology, institutional-level data, and expert analysis to provide users with well-informed investment decisions. Valuemetrix empowers users to elevate their investment experience through AI-driven insights, real-time market news, stock reports, market analysis, and tailored financial information for over 100,000 international publicly traded companies.

Sagehood

Sagehood is an AI-driven platform that provides real-time market intelligence for investors in the finance sector. By harnessing AI-driven insights, Sagehood helps users stay ahead in the dynamic world of finance by offering intelligent analysis, deep-dive analysis, strategic execution, and intelligent synthesis. The platform aims to optimize investment strategies and enhance decision-making by leveraging AI technology to analyze vast amounts of data and provide actionable insights. With advanced features for informed decision-making and a focus on minimizing bias while maximizing insight, Sagehood offers tailored intelligence to help users make data-driven investment decisions.

Kazuha

Kazuha is an AI-powered platform that provides investment insights extracted from top financial content creators on platforms like podcasts, YouTube, and Twitter. The platform uses advanced AI algorithms to analyze hours of content and generate concise summaries and key takeaways for investors. Users can stay informed about the latest investment opportunities and never miss actionable insights buried in lengthy financial content.

AI CRE Tools

AI CRE Tools is a platform that helps users discover and compare the best AI tools for Commercial Real Estate (CRE). Users can explore a curated directory of AI tools across categories such as Property Search & Acquisition, Property Analysis & Valuation, Development & Construction, Legal, Compliance & Due Diligence, and more. The platform showcases innovative AI features developed by real estate experts to meet diverse business needs in the CRE industry.

Intellectia.AI

Intellectia.AI is a powerful AI platform designed to provide smarter investment insights for investors across stocks, ETFs, and cryptocurrencies. The platform offers advanced technical analysis, tailored stock analysis, and quick insights on market trends. With over 100 supported indicators, Intellectia.AI empowers investors with actionable insights derived from AI-driven analysis. The platform also features a dedicated news section summarizing financial news using AI, ensuring users stay informed about events affecting stock movements. Intellectia.AI aims to democratize financial information intelligence through AI, making it accessible to investors of all levels, from individuals to large institutions.

Hermes by ConsX

Hermes by ConsX is an AI-driven Equity Research Center that empowers users to make informed investment decisions in the stock market. The platform offers AlphaFlex Portfolio for strong returns with reduced risk, and AlphaFlex Equity Research Hub for real-time research on over 6,000 companies. By combining human expertise with AI-driven insights, Hermes by ConsX provides cutting-edge tools for investors to navigate market conditions and build generational wealth.

Multibagg

Multibagg is an AI-powered stock research and analysis platform that empowers investors to navigate the complexities of the stock market confidently. With a modern and intuitive user interface, the platform offers unparalleled insights and in-depth analysis using powerful AI technology. Users can analyze, invest, and enhance their investment strategy with the help of AI tools. Multibagg provides data, information, content, and analytics for over 6000 publicly traded Indian companies, ensuring that users have access to up-to-date market information. The platform prioritizes data security through encryption and cloud storage, guaranteeing the privacy of user data. Enjoy premium features at no cost until Dec 31, 2024, and experience effortless excellence in stock market research and analysis.

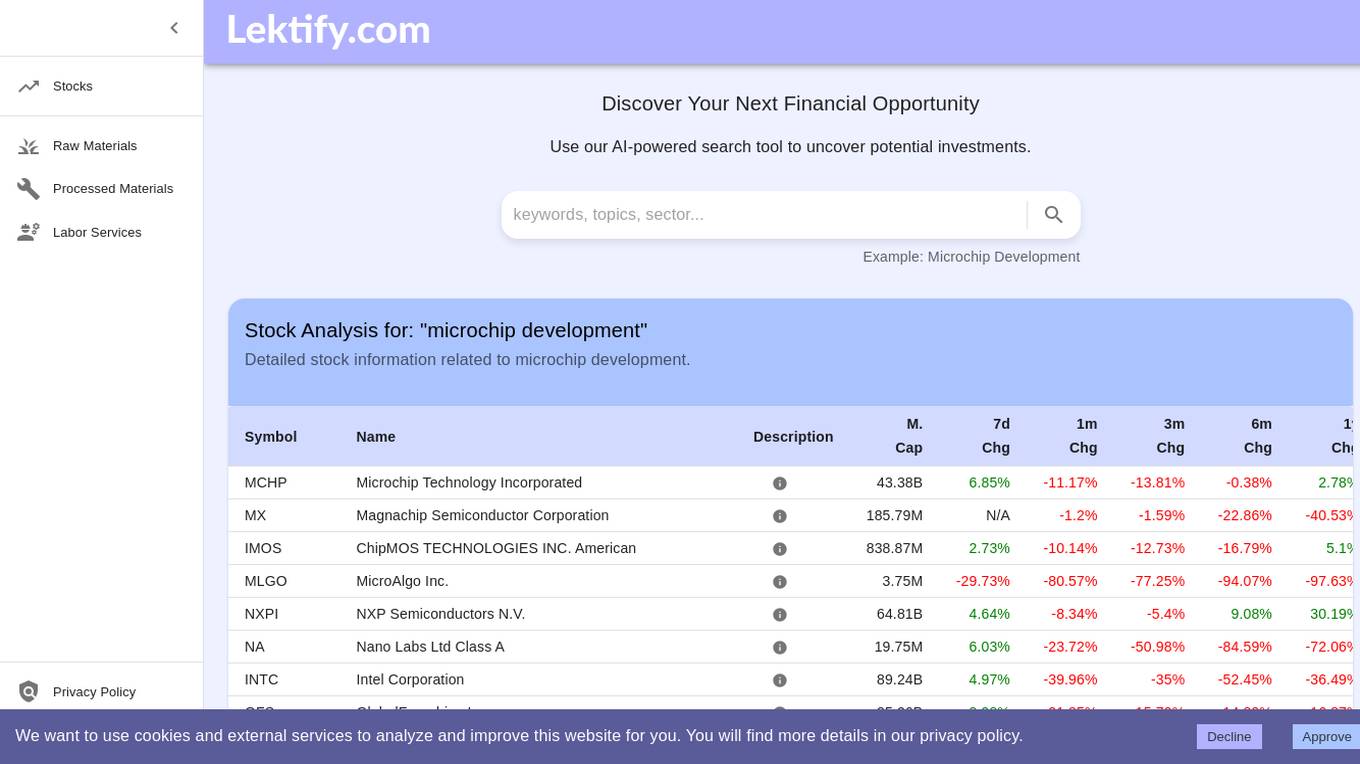

Lektify

Lektify is an AI-powered platform designed to revolutionize the way users manage their investment portfolios. By leveraging advanced artificial intelligence algorithms, Lektify helps users discover top-performing stocks and make informed investment decisions. The platform provides valuable insights and recommendations based on extensive data analysis, enabling users to optimize their investment strategies and maximize returns. With Lektify, users can stay ahead of market trends and enhance their portfolio performance with confidence.

Rafa.ai

Rafa.ai is an AI-powered investing application that offers a comprehensive suite of tools and features to assist users in making informed investment decisions. The platform utilizes AI agents to provide real-time insights, portfolio alerts, risk analysis, and options monitoring. Users can access data-driven trading strategies, perform equity research, and analyze news sentiment. Rafa.ai aims to help users manage their investment risks, discover investment opportunities, and make smarter investment decisions.

AI in Finance Summit

The AI in Finance Summit is a leading conference that brings together experts in artificial intelligence and finance to discuss the latest trends and developments in the field. The summit features a variety of speakers, including researchers, practitioners, and investors, who share their insights on how AI is being used to transform the financial industry. The summit also provides a platform for attendees to network and learn from each other.

Chaplin

Chaplin is a 100% free AI-based technical analysis tool that offers a wide range of features for stock market analysis. It provides tools for live market analysis, stock, forex, and crypto screening, stock and chart analysis, sentiment analysis, trend prediction, price forecasting, and various strategy simulations. Users can access advanced stock analysis tools, stock scanners, time series analysis, and more. Chaplin also includes tools for portfolio optimization, earnings calendar tracking, financial analysis, investment calculation, and data visualization. The platform aims to assist professional traders with AI-driven insights and tools for making informed investment decisions.

AltIndex

AltIndex is an AI-powered investment analysis platform that provides unique AI stock picks, stock alerts, and alternative insights to help users make better investment decisions. The platform goes beyond traditional financial data by integrating various alternative data points such as job postings, website traffic, customer satisfaction, app downloads, and social media trends. AltIndex offers impactful insights and alerts, cutting-edge solutions to stay informed about companies in your portfolio, and advanced algorithms for real-time investment decision-making.

Decode Investing

Decode Investing is an AI-powered platform that helps users automate their stock research process. The platform offers a range of tools such as an AI Chat assistant, Stock Screener, Earnings Calls analysis, SEC Filings analysis, and more. Users can easily find and analyze stocks by simply entering the stock name or ticker. Decode Investing aims to simplify the investment process by providing valuable insights and data to make informed decisions. The platform is designed to cater to both novice and experienced investors, offering a user-friendly interface and comprehensive features.

Morphlin

Morphlin is an AI-powered trading platform that empowers traders with smart tools and insights to make informed decisions. The platform offers a powerful AI MorphlinGPT API Key Pair for smart trading on Binance. Users can access real-time information, investment analysis, and professional research reports from third-party experts. Morphlin integrates data from mainstream markets and exchanges, providing clear information through a dynamic dashboard. The platform's core values include offering a good environment for researchers to share opinions and a referral program that shares 10% of Morphlin fees with community KOLs. With Morphlin, traders can trade wisely and efficiently, backed by AI technology and comprehensive market data.

eSapiens

eSapiens is an AI last-mile delivery platform dedicated to solving real business problems with AI technology. It offers solutions to boost productivity and elevate products by leveraging AI-driven insights and automation. The platform provides features for customer support, sales management, accounting automation, marketing optimization, investment analysis, and product management. eSapiens enables users to streamline operations, make data-driven decisions, and enhance user experience through AI capabilities. With LangChain technology, eSapiens ensures accurate responses and deeper insights. The platform also offers no-code SQL queries for easy data access and automates message management to free up resources and enhance productivity.

Splore

Splore is an AI-powered platform designed for asset managers to streamline fund management processes. It simplifies asset management by consolidating fragmented data, automating data extraction, and enhancing cross-document insights. Splore's AI capabilities help asset managers make faster, informed decisions and boost productivity by automating repetitive tasks. The platform prioritizes data security and compliance, adhering to strict standards like GDPR, SOC 2, and HIPAA.

AI VC

AI VC was a project that is no longer active. It was likely an AI tool or application related to venture capital. The project may have involved using artificial intelligence to analyze investment opportunities, predict market trends, or provide insights for venture capitalists. Unfortunately, the project is no longer operational, but it may have offered valuable resources and information for individuals interested in the intersection of AI and venture capital.

Crunchbase Solutions

Crunchbase Solutions is an AI-powered company intelligence platform that helps users find prospects, investors, conduct market research, enrich databases, and build products. The platform offers products like Crunchbase Pro and Crunchbase Enterprise, providing personalized recommendations, AI-powered insights, and tools for company discovery and research. With a focus on leveraging AI technology, Crunchbase Solutions aims to assist users in making better decisions about investments, pipeline management, fundraising, partnerships, and product development. The platform's data is sourced from various contributors, partners, in-house experts, and AI algorithms, ensuring quality and compliance with SOC 2 Type II standards.

Layron

Layron is an AI-powered platform for deal sourcing in real estate and private markets. It leverages AI technology to streamline the deal-making process, providing users with speed, precision, and intelligence to make quick decisions, conduct due diligence, and manage deals efficiently. Layron offers a seamless interface for investors, brokers, and capital seekers to interact, analyze documents, and make informed investment decisions faster and smarter.

AllMind AI

AllMind AI is an AI-powered financial markets research terminal designed for institutional investors. It offers a petabyte-scale financial data pipeline, enabling users to access investment-grade research, automate workflows, and save significant time in conducting financial research. The platform combines AI-powered research capabilities with unified data access, workflow automation, and enterprise-grade security features to cater to the needs of leading financial institutions. AllMind AI is built by a team of finance executives, quants, PhDs, and AI researchers, ensuring institutional-grade accuracy and efficiency in financial analysis.

0 - Open Source AI Tools

20 - OpenAI Gpts

Crowd Equity Analyst

Analyzes crowdfunding ventures for market potential and business viability, aiding investment decisions. by neuralvault

Warren

The intelligent investor. Analyse stocks using Warren Buffet's favourite investment framework, outlined in Benjamin Graham's famous book. Warren takes no responsibility for investment risk.

DueDiligencePro AI

"DueDiligencePro AI" is engineered to support businesses and investment professionals by conducting thorough due diligence on mergers, acquisitions, investments, and other business ventures.

Corporate Finance Advisor

Guides financial decisions by monitoring and enforcing policies and procedures.

💲 Discounted Cash Flow (DCF) Expert (5.0⭐)

Financial analyst specializing in Discounted Cash Flow (DCF) analysis for investment valuation.

VC Associate

A gpt assistant that helps with analyzing a startup/market. The answers you get back is already structured to give you the core elements you would want to see in an investment memo/ market analysis

策略研报分析 Investment Strategy Research

专注于“投资策略”类型的研报分析总结,提炼对行业配置的核心观点 Focusing on the analysis and summary of research reports on the type of "investment strategy", refining core perspectives on industry allocation