Best AI tools for< Improve Financial Management >

20 - AI tool Sites

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

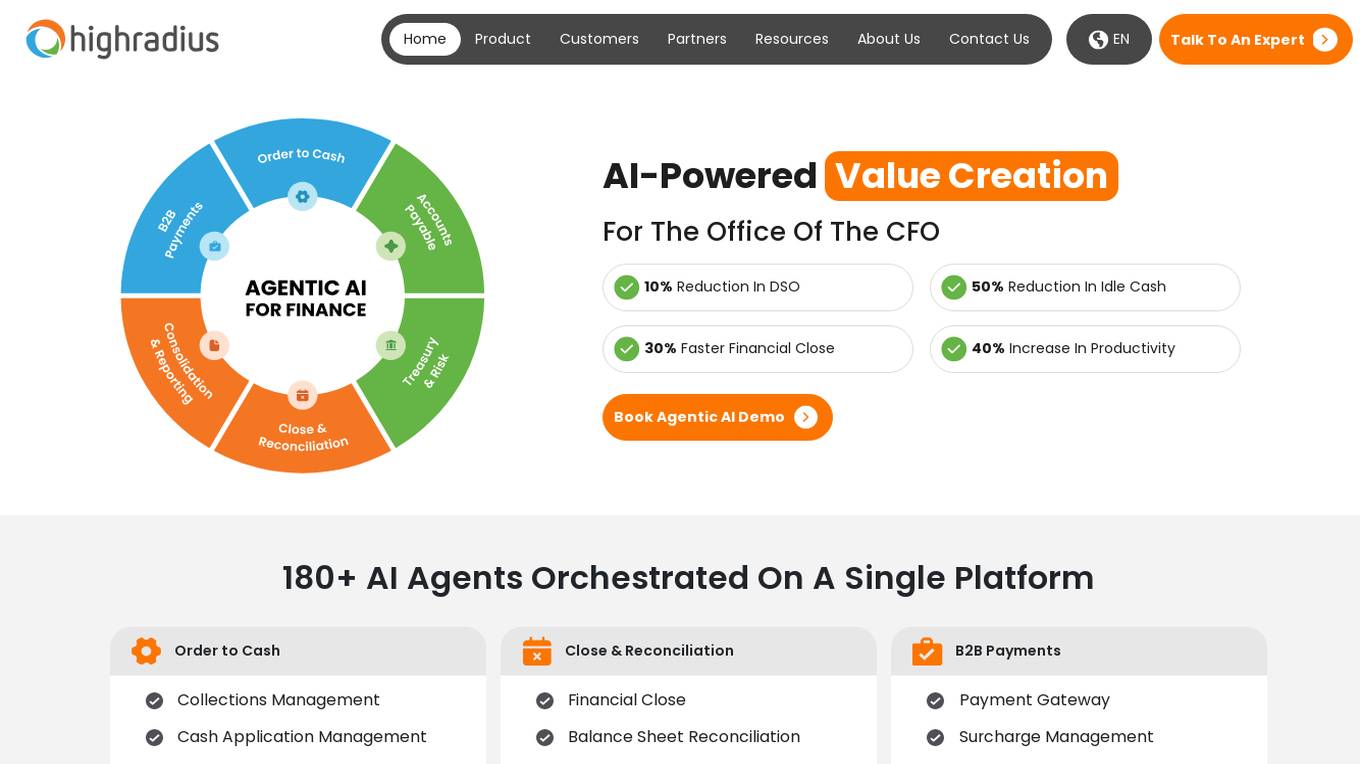

HighRadius

HighRadius is an AI-powered platform that offers Autonomous Finance solutions for Order to Cash (O2C), Treasury, and Record-to-Report (R2R) processes. It provides a single platform for various financial functions such as Accounts Payable, B2B Payments, Cash Management, and Financial Reporting. HighRadius leverages Generative AI and a No-Code AI Platform to automate data analysis and streamline financial operations for the Office of the CFO. The platform aims to enhance productivity, reduce manual work, and improve financial decision-making through advanced AI capabilities.

Serina Invoice Automation Software

Serina is an AI-powered Invoice Automation Software designed to streamline the invoice processing workflow for accounts payable teams. By leveraging advanced technologies such as machine learning and artificial intelligence, Serina automates data capture, validation, and workflow management, saving time and reducing errors in the invoicing process. The software offers features such as data entry automation, payment processing integration, invoice generation and management, machine learning-driven enhancements, workflow automation, reporting and analytics. Serina is suitable for small businesses, scaling organizations, and large enterprises looking to improve efficiency and accuracy in their financial processes.

LivePlan

LivePlan is a business plan software that offers performance tracking and financial forecasting tools to help small businesses plan, launch, and grow successfully. It provides a user-friendly interface with AI-powered features, such as the LivePlan Assistant, to guide users through creating comprehensive business plans and financial reports. LivePlan also offers interactive demos, integrations with accounting software like QuickBooks and Xero, and a range of solutions tailored for different business stages and needs. With over 1 million users, LivePlan has helped entrepreneurs and business owners achieve their goals by providing tools and resources to streamline the planning process and improve decision-making.

Supervity

Supervity is an AI application that empowers businesses to scale operations, optimize efficiency, and achieve transformative growth with intelligent automation. It offers a range of AI agents for various industries and functions, such as finance, HR, IT, customer service, and more. Supervity's AI agents help streamline processes, automate tasks, and enhance decision-making across different business sectors.

Thoughtful

Thoughtful is an AI-powered revenue cycle automation platform that offers efficiency reports, eligibility verification, patient intake automation, claims processing, and more. It deploys AI across healthcare organizations to maximize profitability, reduce errors, and enhance operational excellence. Thoughtful's AI agents work tirelessly, 10x more efficiently than humans, and never get tired. The platform helps providers improve revenue cycle management, financial health, HR processes, and healthcare IT operations through seamless integration, reduced overhead, and significant performance improvements. Thoughtful offers a white-glove service, custom-built platform, seamless integration with all healthcare applications, and performance-based contracting with refund and value guarantees.

Jinna.ai

Jinna.ai is an AI assistant designed to help solopreneurs with tedious administrative tasks, financial management, and day-to-day operations. By leveraging AI technology, Jinna.ai aims to streamline processes and improve efficiency for small business owners. The platform offers AI-powered invoicing solutions to facilitate faster payment processing and enhance overall productivity. With a focus on assisting solopreneurs, Jinna.ai provides a comprehensive suite of tools to simplify business operations and reduce manual workload.

Forescribe AI

Forescribe AI is a spend management platform that uses artificial intelligence (AI) to help businesses streamline their spending and fuel growth. The platform provides real-time visibility into spending, automates invoice processing, and identifies opportunities for cost savings. Forescribe AI is designed to help businesses of all sizes improve their financial performance.

SnaptoBook

SanptoBook is a personal accounting software designed to help individuals manage their finances efficiently. It offers features such as invoice and receipt management, reimbursement facilitation, tax filing assistance, bill splitting, and project tracking. The application aims to simplify financial tasks and improve overall financial organization for users. With AI-powered efficiency, SnaptoBook provides state-of-the-art receipt recognition technology and secure cloud storage for all receipts.

Paymefy

Paymefy is an AI-powered tool designed to optimize debt management and financial improvement for businesses. It offers a centralized platform for managing payment experiences, integrating with existing systems, and automating repetitive manual processes. Paymefy utilizes advanced artificial intelligence to provide personalized payment experiences, increase payment rates, and streamline debt collection processes. The tool aims to reduce days sales outstanding (DSO), improve cash flow, and enhance customer satisfaction through clear communication and flexible payment options.

SymphonyAI NetReveal Financial Services

SymphonyAI NetReveal Financial Services is an AI-powered platform that offers solutions for financial crime prevention in various industries such as banking, insurance, financial markets, and private banking. The platform utilizes predictive and generative AI applications to enhance efficiency, reduce fraud, streamline compliance, and maximize output. SymphonyAI provides a fundamentally different approach to AI by combining high-value AI capabilities with industry-leading predictive and generative AI technologies. The platform offers a range of solutions including transaction monitoring, customer due diligence, payment fraud detection, and enterprise investigation management. SymphonyAI aims to revolutionize financial crime prevention by leveraging AI to detect suspicious activity, expedite investigations, and improve compliance operations.

BotGPT

BotGPT is a 24/7 custom AI chatbot assistant for websites. It offers a data-driven ChatGPT that allows users to create virtual assistants from their own data. Users can easily upload files or crawl their website to start asking questions and deploy a custom chatbot on their website within minutes. The platform provides a simple and efficient way to enhance customer engagement through AI-powered chatbots.

Ramp

Ramp is a comprehensive platform offering Spend Management, Corporate Cards, and Accounts Payable Solutions. It provides easy-to-use corporate cards, bill payments, accounting, and more in one place. With features like Ramp Intelligence, Corporate Cards, Expense Management, Accounts Payable, Travel solutions, and Procurement tools, Ramp aims to streamline finance operations for businesses of all sizes. The platform is designed to save time and money for finance teams by automating processes and providing efficient solutions.

Zapro

Zapro is an AI-driven Vendor Management System and Procurement Tool that integrates AI technology to automate tasks, improve transparency, and enhance supplier performance. It offers features such as centralizing vendor interactions, end-to-end procurement streamlining, strategic sourcing optimization, contract management, spend analytics, AP automation, inventory management, and ERP integrations. Zapro empowers users in various roles, from Chief Procurement Officers to Chief Financial Officers, by providing actionable insights, seamless integrations, and collaboration-friendly solutions. The platform helps businesses make data-driven decisions, optimize vendor relationships, and streamline procurement processes for efficiency and cost savings.

Skann AI

Skann AI is an advanced artificial intelligence tool designed to revolutionize document management and data extraction processes. The application leverages cutting-edge AI technology to automate the extraction of data from various documents, such as invoices, receipts, and contracts. Skann AI streamlines workflows, increases efficiency, and reduces manual errors by accurately extracting and organizing data in a fraction of the time it would take a human. With its intuitive interface and powerful features, Skann AI is the go-to solution for businesses looking to optimize their document processing workflows.

Weave.AI

Weave.AI is an AI-powered decision management tool designed to adapt to diverse challenges, from compliance and risk management to investment and sustainability. It offers a comprehensive solution for automating risk management, compliance, and due diligence at various levels, such as document, company, industry, sector, portfolio, or supply chain. Weave.AI leverages advanced AI technologies to provide dynamic insights, real-time data integration, and tailored actionable guidance for proactive crisis prevention and smarter decision-making. The tool features a Knowledge Graph, Agentic AI with self-learning agents, context-aware neuro-symbolic AI, and insights-to-action capabilities. With a focus on governance, risk, compliance, and sustainability, Weave.AI aims to empower enterprises with high-agency AI that anticipates and adapts to complex workflows.

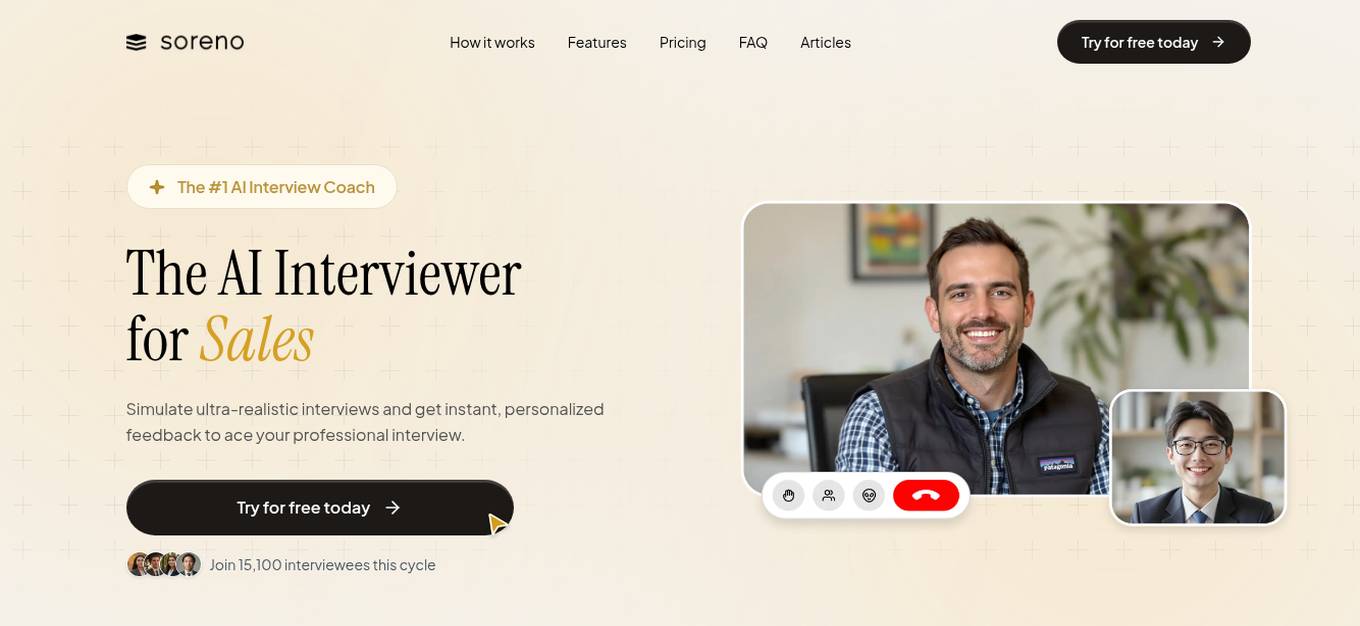

Soreno

Soreno is an AI Interview Coach application designed to help finance and consulting applicants prepare for their job interviews. It offers ultra-realistic interview simulations with personalized feedback, skill-by-skill scores, and targeted drills for improvement. Soreno provides a complete practice library, AI interviewer that adapts to the user, detailed feedback after every session, and analytics to track progress. The platform covers various interview tracks such as consulting, finance, tech, and more, with specialized interview prep for different roles and industries.

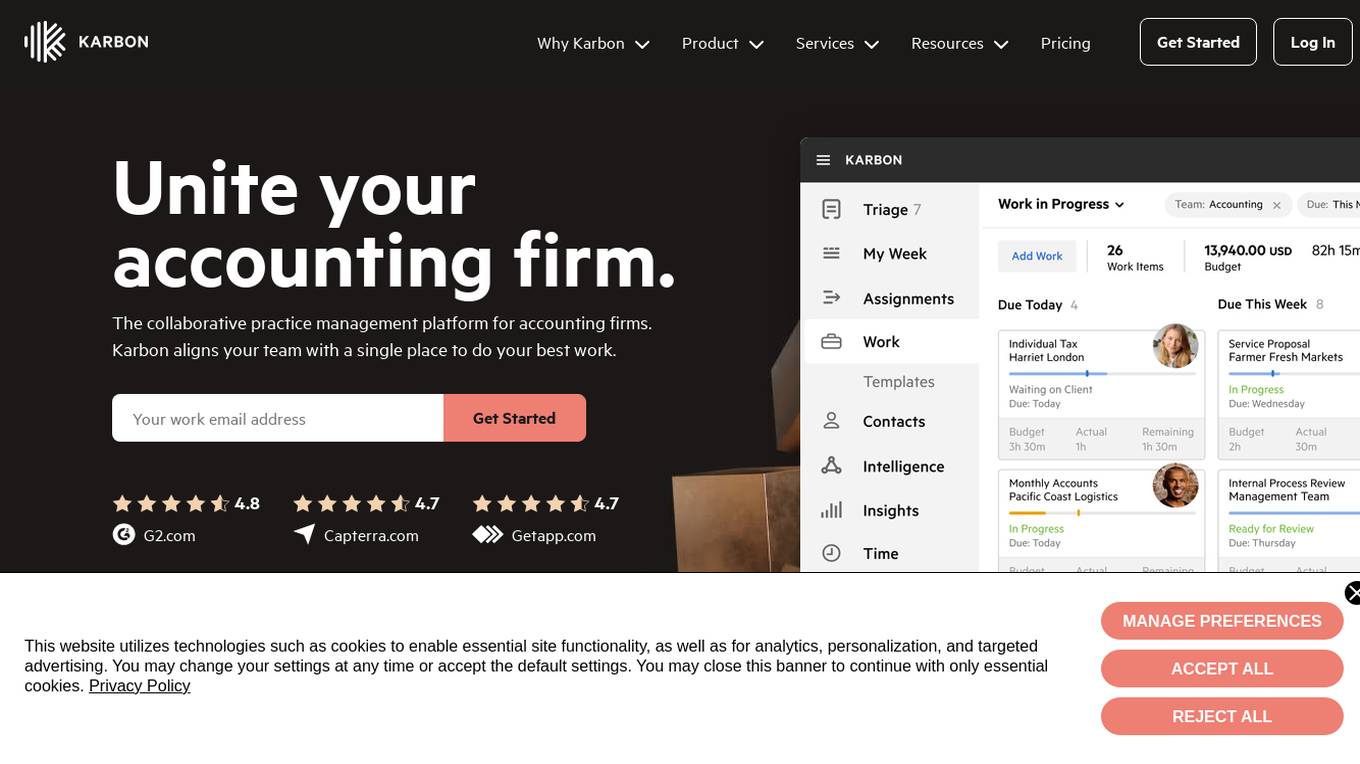

Karbon

Karbon is an AI-powered practice management software designed for accounting firms to increase visibility, control, automation, efficiency, collaboration, and connectivity. It offers features such as team collaboration, workflow automation, project management, time & budgets tracking, billing & payments, reporting & analysis, artificial intelligence integration, email management, shared inbox, calendar integration, client management, client portal, eSignatures, document management, and enterprise-grade security. Karbon enables firms to automate tasks, work faster, strengthen connections, and drive productivity. It provides services like group onboarding, guided implementation, and enterprise resources including articles, ebooks, and videos for accounting firms. Karbon also offers live training, customer support, and a practice excellence scorecard for firms to assess their performance. The software is known for its AI and GPT integration, helping users save time and improve efficiency.

Canoe

Canoe is a cloud-based platform that leverages machine learning technology to automate document collection, data extraction, and data science initiatives for alternative investments. It transforms complex documents into actionable intelligence within seconds, empowering allocators with tools to unlock new efficiencies for their business. Canoe is trusted by thousands of alternative investors, allocators, wealth management, and asset servicers to improve efficiency, accuracy, and completeness of investment data.

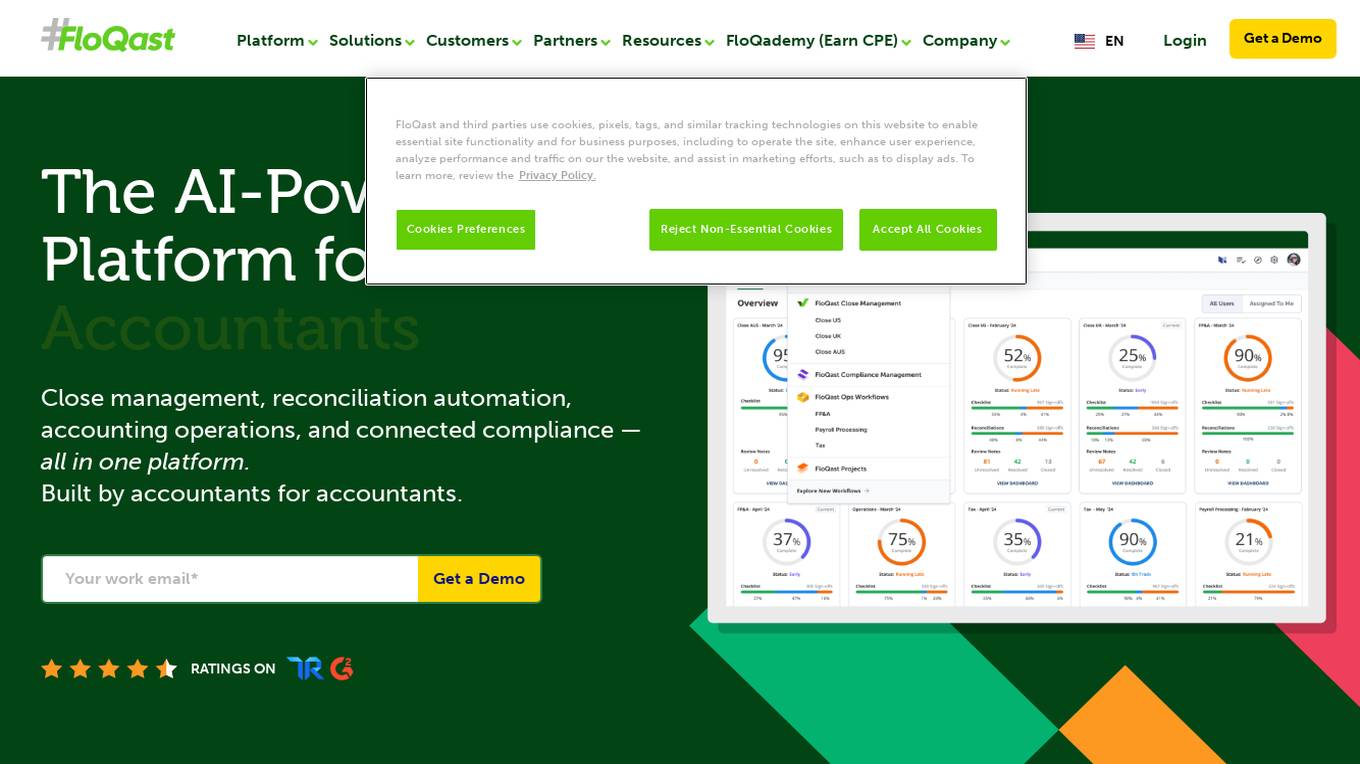

FloQast

FloQast is an AI-powered accounting workflow and close management software platform that offers solutions for reconciliation automation, connected compliance, and accounting operations. The platform aims to empower accountants by leveraging technology, specifically AI, to shift from preparers to reviewers. It unifies accounting teams, provides visibility, improves efficiency, and simplifies managing the close process. FloQast was built by CPAs for accountants, ensuring a user-friendly experience without the need for heavy IT involvement or constant troubleshooting. The platform also offers free CPE through FloQademy, featuring exclusive content and on-demand learning opportunities.

0 - Open Source AI Tools

20 - OpenAI Gpts

Debt Management Advisor

Advises on debt management strategies to improve financial stability.

Performance Controlling Advisor

Drives financial performance improvement via strategic analysis and advice.

Performance Measurement Advisor

Optimizes financial performance through strategic analysis and planning.

Personal Financial Advisor

This Open AI tool analyzes your financial data, budgets and cashflow and suggests areas of improvement and quick insights. Drop an XLS file here or copy/paste your financial data and get insights! (Your data remains private and creator of this ChatGPT has no access to it).

Credit Card Advisor

Expert on credit cards, offering advice on choosing and using them wisely.

Credit Card Companion

Balanced guidance on credit cards for young people, with a mix of formal and casual tones

Digital Assets @ FS

Consultant on digital assets in financial services, using a pricing study for insights.