Best AI tools for< Analyze Portfolios >

20 - AI tool Sites

MDOTM Ltd

MDOTM Ltd is a global provider of AI-driven investment solutions for Institutional Investors. Founded in London in 2015, the company offers Portfolio Advisory and Asset Allocation services to various financial institutions. MDOTM's AI platform, Sphere, empowers asset and wealth managers with AI-driven insights, seamless portfolio rebalancing, and automated reports at scale.

Kavout

Kavout is an AI-powered financial research assistant that provides investors with data-driven insights and cutting-edge technology to help them make informed investment decisions. The platform offers a range of features, including natural language search, stock screening, portfolio analysis, and personalized recommendations. Kavout's AI algorithms adapt to each user's unique investment style, providing tailored insights and guidance.

FormX.ai

FormX.ai is an AI-powered tool that automates data extraction and conversion to empower businesses with digital transformation. It offers Intelligent Document Processing, Optical Character Recognition, and a Document Extractor to streamline document handling and data extraction across various industries such as insurance, finance, retail, human resources, logistics, and healthcare. With FormX.ai, users can instantly extract document data, power their apps with API-ready data extraction, and enjoy low-code development for efficient data processing. The tool is designed to eliminate manual work, embrace seamless automation, and provide real-world solutions for streamlining data entry processes.

Levelup Intelligence

Levelup Intelligence is an advanced financial reporting tool designed for SMB portfolios. It provides a comprehensive dashboard to view and analyze financial data, offering real-time insights and customizable KPIs. The tool integrates with major accounting platforms, such as Quickbooks and Xero, to streamline data organization and analysis. With AI-powered standardization, Levelup ensures financial transparency and accuracy, making it a valuable resource for accounting firms and financial institutions.

FINQ

FINQ is an AI-driven platform designed to help users build dynamic investment portfolios, follow model portfolios, and optimize investments effortlessly. The platform offers AI-based stocks portfolios with three distinct strategies to outperform the S&P. FINQ assesses financial product risk daily using a data-driven approach and provides users with 100% objectivity by eliminating biases. The AI engine monitors the market 24/7, ensuring users are aware of investment opportunities and offers risk-guided investing to match products with comfort levels.

Token Metrics

Token Metrics is an AI-powered crypto trading and research platform that provides users with real-time market trends, live trade alerts, and AI grades to help make informed investment decisions. With features like AI ratings, personalized research, and trading signals, Token Metrics aims to empower users to navigate the cryptocurrency markets effectively. Trusted by over 70,000 crypto investors, Token Metrics offers a comprehensive suite of tools and resources to enhance crypto investment strategies.

AI Investing Tools

AI Investing Tools is a curated directory of AI tools designed to help users automate their investing process. The platform offers a handpicked collection of AI investing tools that assist in making more money, developing trading strategies, automating investing, rebalancing portfolios, and analyzing markets. It aims to leverage AI technology to enhance trading efficiency, optimize portfolios, and eliminate emotional biases in investment decisions.

ficc.ai

ficc.ai is an AI application that revolutionizes municipal bond pricing by providing real-time, accurate AI technology for informed decisions, portfolio optimization, and compliance. The platform offers a user-friendly web app, direct API access, and integration with existing software or vendors. ficc.ai uses cutting-edge AI models developed in-house by market experts and scientists to deliver highly accurate bond prices based on trade size, ensuring valuable output for trading decisions, investment allocations, and compliance oversight.

STRATxAI

STRATxAI is an AI-powered quantitative investment platform that offers custom AI model portfolios tailored to clients' investment philosophy, risk tolerance, and objectives. The platform harnesses machine learning to deliver data-driven insights for security analysis, portfolio construction, and management. Powered by the proprietary investment engine Alana, STRATxAI processes over 8 billion financial data points daily to uncover hidden alpha beyond traditional methods. Clients benefit from smarter decision-making, better risk-adjusted returns, optimized portfolio management, and savings on resources. The platform is designed to enhance investment decisions for forward-thinking investors by leveraging AI technology.

Alchemyze

Alchemyze is an AI-driven investment platform that provides hedge fund quality insights and comprehensive stock analysis to empower investors with smarter investment strategies. The platform leverages cutting-edge technology and machine learning algorithms to democratize market intelligence, making top-tier insights accessible to all investors. Alchemyze offers powerful features such as comprehensive stock grades, advanced insights, total access to top-rated stocks, weekly picks, custom portfolios, market insights, and stock screener capabilities. With over 500 graded features and a unique Aurum Engine scoring system, Alchemyze enables users to make personalized and strategic investment decisions based on accurate data and tailored grading formulas.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

RockFlow

RockFlow is an AI-powered fintech platform that simplifies investing by offering AI-first trading experiences. The platform, powered by Bobby AI, allows users to build AI portfolios, execute trades, manage portfolios, and receive real-time trading opportunities. With features like Copy Trading, simplified options trading, and access to a wide range of investment products, RockFlow aims to empower users to make informed investment decisions effortlessly. The platform also prioritizes customer service and security, ensuring a safe and reliable trading environment for users.

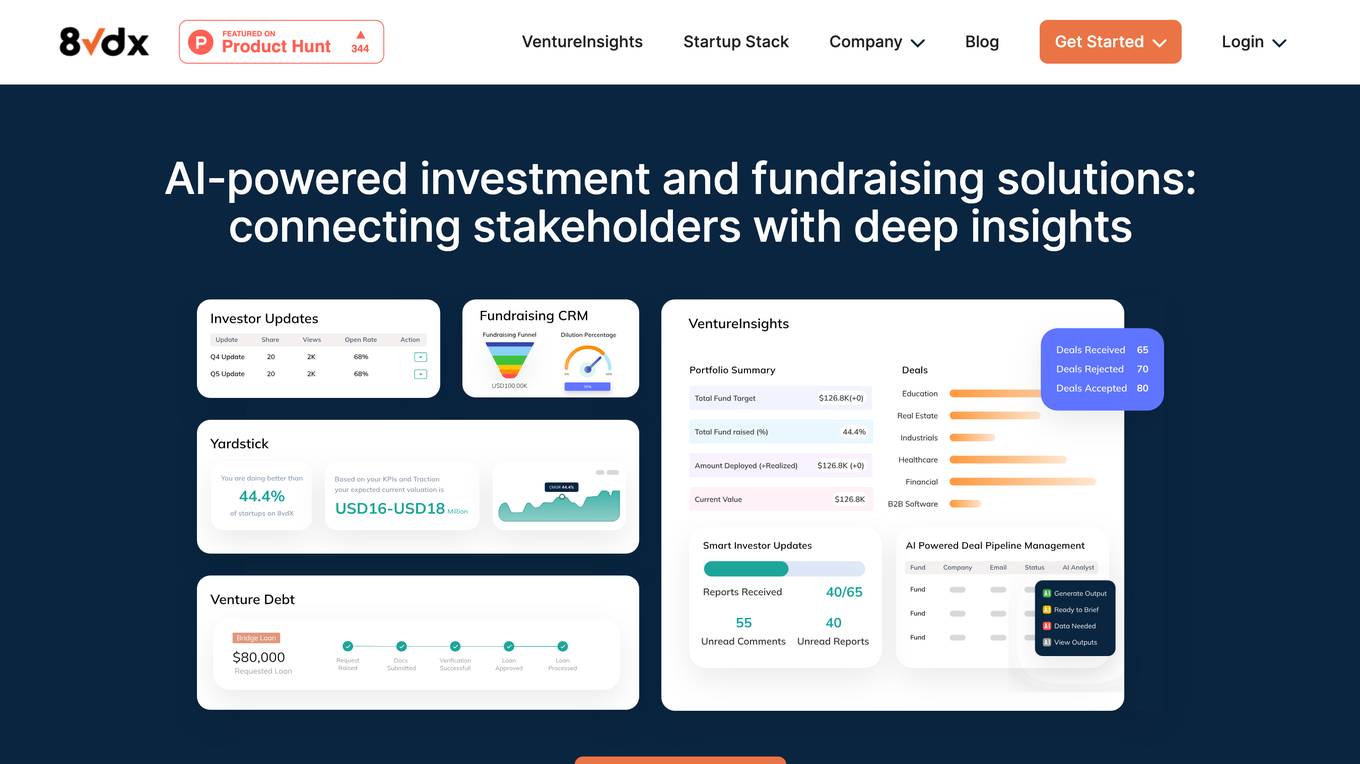

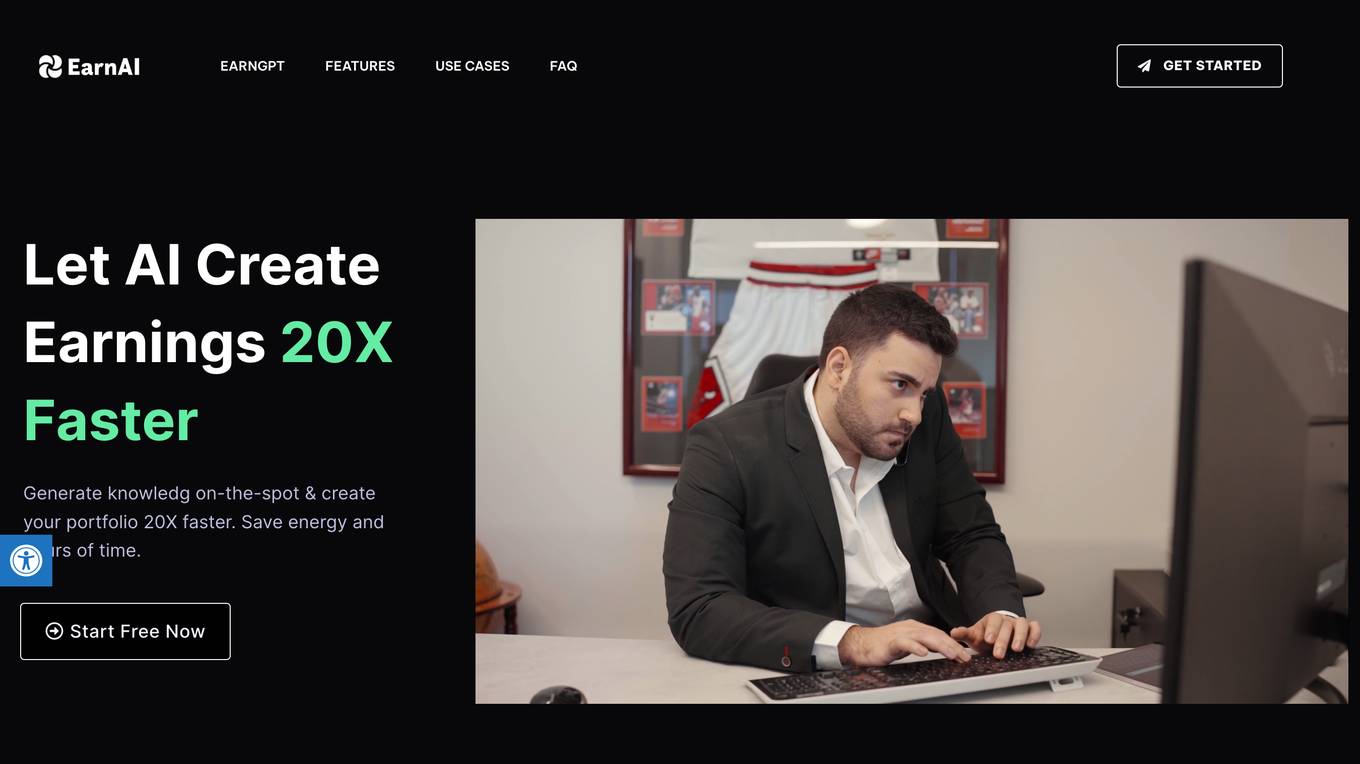

Realiste

Realiste is an AI-powered real estate investment platform that provides users with data-driven insights to help them make informed investment decisions. It offers access to a wide range of properties and markets worldwide. Realiste specifically focuses on market research, analytics, and real estate price forecasts based on data gathered by the AI algorithm. The platform uses advanced AI algorithms to process vast amounts of real estate data, combining machine learning, data analytics, and market research to generate investment insights and recommendations. Realiste aims to revolutionize how individuals perceive and engage with the real estate sector by providing accurate forecasts and objective decisions.

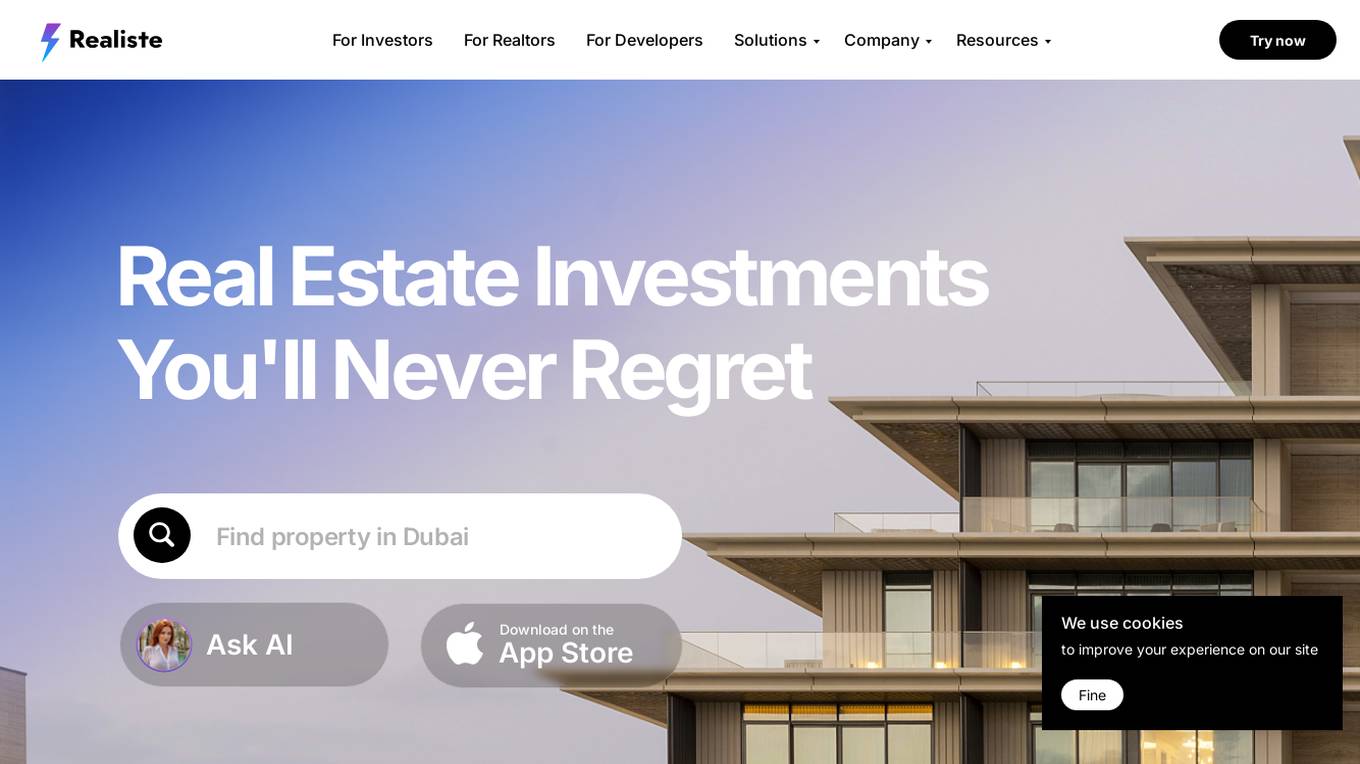

Ultralgo

Ultralgo is an AI-powered trading platform that provides users with a variety of tools and features to help them make more informed and profitable trades. The platform offers a range of features, including AI-powered market analysis, automated trading, and portfolio management. Ultralgo is designed to be easy to use, even for beginners, and it offers a variety of resources to help users learn how to trade. The platform is also highly customizable, so users can tailor it to their own individual needs.

EarnAI

EarnAI is an AI-powered platform designed to assist investors in optimizing their investment portfolios. It offers services like portfolio analysis, predictive market insights, personalized stock recommendations, and automated reporting. Whether you’re a beginner or a seasoned investor, EarnGPT provides actionable insights to enhance your investment decisions.

Three Sigma

Three Sigma is a quantitative hedge fund that uses advanced artificial intelligence and machine learning techniques to identify and exploit trading opportunities in global financial markets.

Nest AI

Nest AI is an autonomous DeFAI agent that utilizes artificial intelligence to provide advanced financial services. The platform offers automated investment strategies, portfolio management, and personalized financial advice to help users optimize their financial decisions. With cutting-edge AI algorithms, Nest AI aims to revolutionize the way individuals manage their finances by offering intelligent and data-driven solutions.

CityFALCON

CityFALCON is a financial and business due diligence platform that provides a range of solutions for the needs of a wide audience, including retail investors, retail traders, daily business news readers, brokers, students, professors, academia, wealth managers, financial advisors, P2P crowdfunding, VC, PE, institutional investors, treasury, consultancy, legal, accounting, central banks, and regulatory agencies. The platform offers a variety of features and content, including a CityFALCON Score, watchlists, similar stories, grouping news on charts, key headlines, sentiment content translation, content news premium publications, insider transactions, official company filings, investor relations, ESG content, and languages.

DeFi Lens

DeFi Lens is an advanced market insights platform that leverages Generative AI to provide users with valuable information and analysis in the decentralized finance space. By utilizing cutting-edge AI technology, DeFi Lens offers users a unique perspective on market trends, investment opportunities, and risk assessment in the rapidly evolving DeFi landscape. The platform is designed to empower users with actionable insights and data-driven decision-making tools, enabling them to stay ahead in the competitive DeFi market.

Investor Hunter

The website investor-hunter.com seems to be inaccessible, showing an 'Access Denied' message. It appears that the user does not have permission to access the content on the server. The error message references a specific server code, indicating a technical issue preventing access to the GoDaddy website for sale. The website may be related to domain investing or hunting for investment opportunities, but without access, the exact nature of the site remains unknown.

0 - Open Source AI Tools

20 - OpenAI Gpts

💹 EcoInvest Navigator

Your go-to AI for green finance! It offers tailored investment tips, market analyses, and sustainability insights to navigate eco-friendly portfolios. 🌱💰

Instructors in Global Economics and Finance

Multilingual support in Global Economics & Finance studies.

Capital Companion

A savvy guide for financial insights and strategies, including fundamental, technical, and sentiment analysis for investing and trading.

Token Analyst

ERC20 analyst focusing on mintability, holders, LP tokens, and risks, with clear, conversational explanations.

策略研报分析 Investment Strategy Research

专注于“投资策略”类型的研报分析总结,提炼对行业配置的核心观点 Focusing on the analysis and summary of research reports on the type of "investment strategy", refining core perspectives on industry allocation