Best AI tools for< Analyze Portfolio Performance >

20 - AI tool Sites

Mool Capital

Mool Capital is an AI-powered platform that offers elevated investing and high fidelity research capabilities. The platform provides revolutionary AI tools for analyzing vast datasets in seconds, trustworthy analysis for informed investing, and performant portfolios curated for optimal performance. Users can access the latest market analysis, investment ideas, and premium articles to enhance their investment decisions. Mool Capital aims to empower investors with AI superpowers to make better investment choices and navigate the complex world of finance with confidence.

Borea AI

Borea AI is an AI application that provides stock price predictions and stock ratings based on past market behavior and historical stock performance. It empowers users to unlock intelligent financial mastery by offering insights on popular stocks, market leaders, index ETFs, top movers, most tweeted stocks, and best-performing predictions. Borea AI serves as a personal financial assistant, but it is important to note that past performance is not an indicator of future results, and professional investment advice should not be substituted.

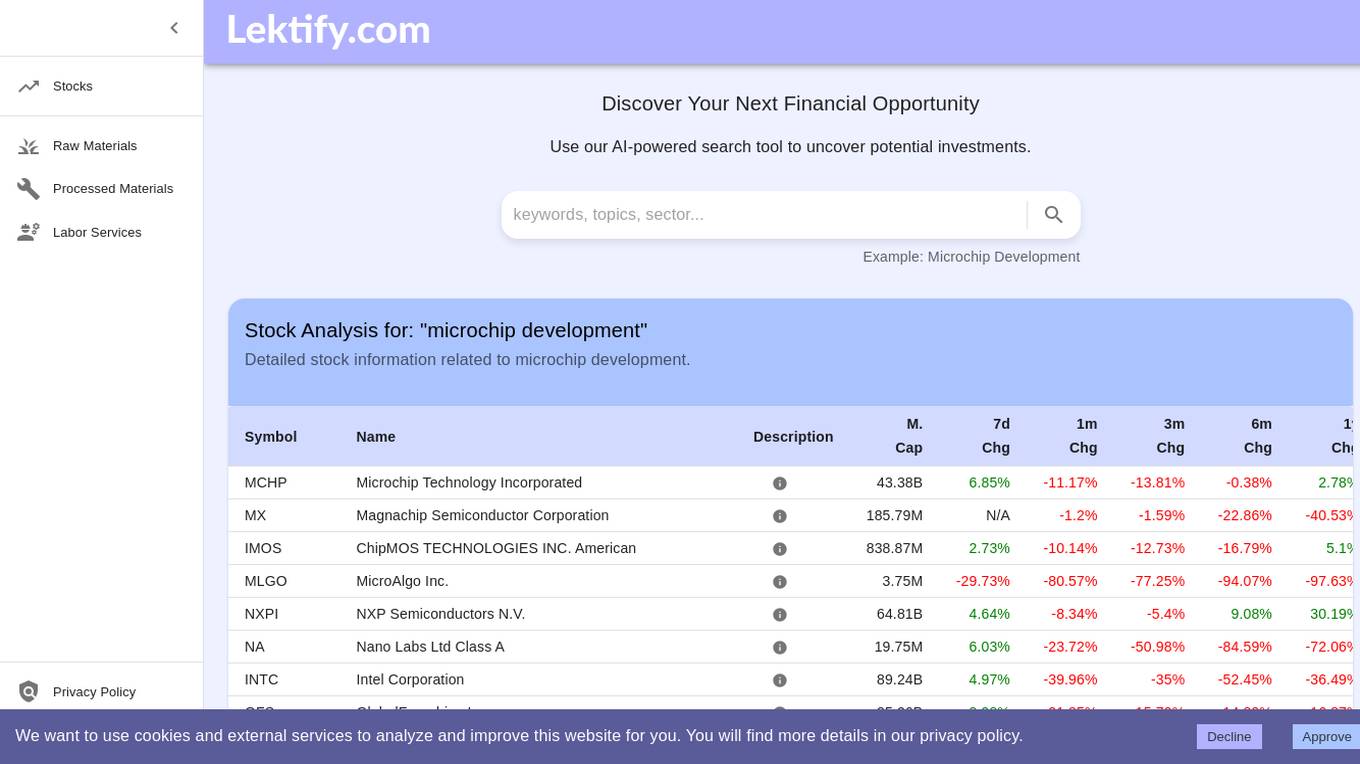

Lektify

Lektify is an AI-powered platform designed to revolutionize the way users manage their investment portfolios. By leveraging advanced artificial intelligence algorithms, Lektify helps users discover top-performing stocks and make informed investment decisions. The platform provides valuable insights and recommendations based on extensive data analysis, enabling users to optimize their investment strategies and maximize returns. With Lektify, users can stay ahead of market trends and enhance their portfolio performance with confidence.

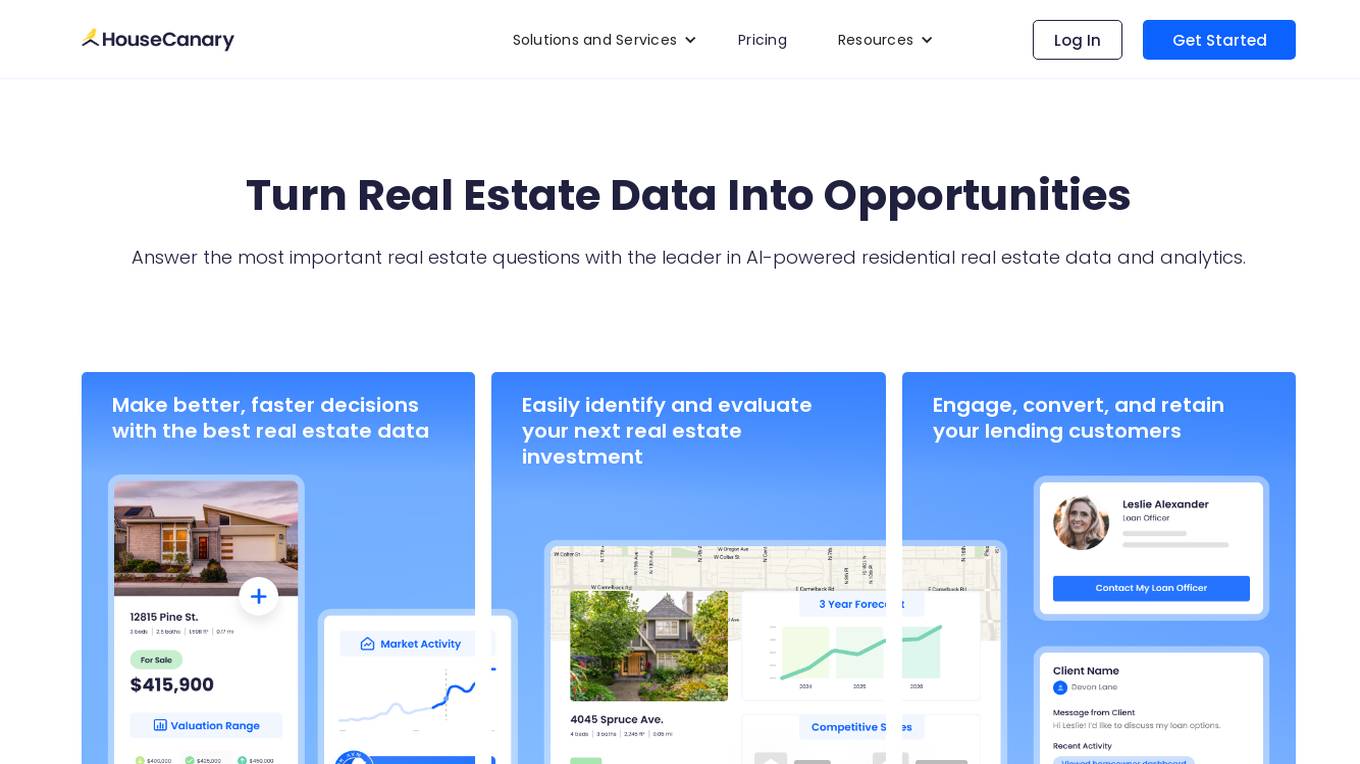

HouseCanary

HouseCanary is a leading AI-powered data and analytics platform for residential real estate. With a full suite of industry-leading products and tools, HouseCanary provides real estate investors, mortgage lenders, investment banks, whole loan buyers, and prop techs with the most comprehensive and accurate residential real estate data and analytics in the industry. HouseCanary's AI algorithms analyze a vast array of real estate data to generate meaningful insights to help teams be more efficient, ultimately saving time and money.

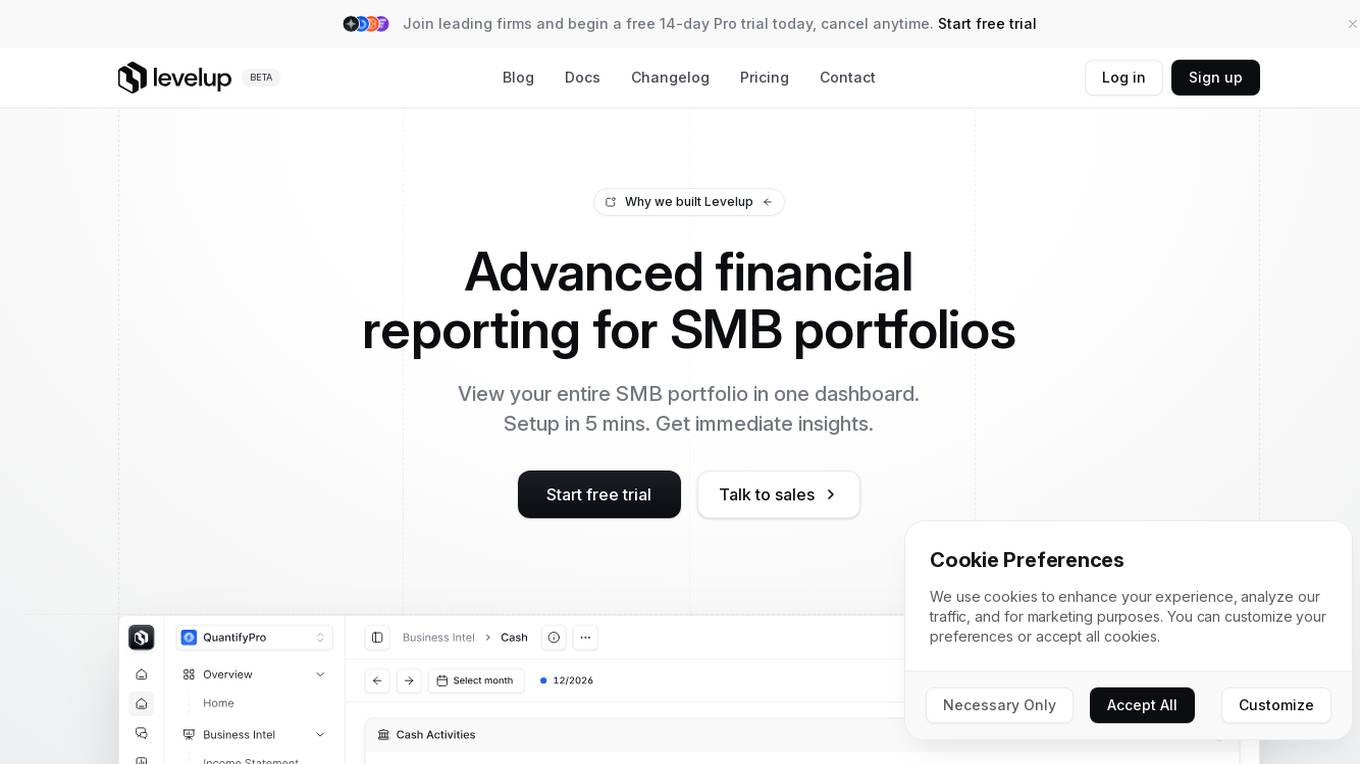

Levelup Intelligence

Levelup Intelligence is an advanced financial reporting tool designed for SMB portfolios. It provides a comprehensive dashboard to view and analyze financial data, offering real-time insights and customizable KPIs. The tool integrates with major accounting platforms, such as Quickbooks and Xero, to streamline data organization and analysis. With AI-powered standardization, Levelup ensures financial transparency and accuracy, making it a valuable resource for accounting firms and financial institutions.

AnalyStock.ai

AnalyStock.ai is a financial application leveraging AI to provide users with a next-generation investment toolbox. It helps users better understand businesses, risks, and make informed investment decisions. The platform offers direct access to the stock market, powerful data-driven tools to build top-ranking portfolios, and insights into company valuations and growth prospects. AnalyStock.ai aims to optimize the investment process, offering a reliable strategy with factors like A-Score, factor investing scores for value, growth, quality, volatility, momentum, and yield. Users can discover hidden gems, fine-tune filters, access company scorecards, perform activity analysis, understand industry dynamics, evaluate capital structure, profitability, and peers' valuation. The application also provides adjustable DCF valuation, portfolio management tools, net asset value computation, monthly commentary, and an AI assistant for personalized insights and assistance.

Stocked

Stocked is an AI-powered stock advisory service that provides monthly stock recommendations to help investors build a portfolio that outperforms the S&P 500. The service uses machine learning models to analyze terabytes of data and identify stocks with the highest potential for growth. Stocked is designed for buy-and-hold investors who are looking to significantly grow their portfolio over long periods of time.

WallStreetZen

WallStreetZen is an AI-powered stock market analysis platform designed for serious part-time investors. The platform offers stock screening, top analyst ratings, Zen ratings, and premium services to help users make informed investment decisions. With a focus on analyzing 115 proven factors, Zen Ratings identifies stocks with high potential to beat the market, providing users with historical performance data and recommendations. By harnessing the power of artificial intelligence algorithms, WallStreetZen helps users avoid weak stocks and discover investment opportunities with top-rated stocks and analyst recommendations.

Decode Investing

Decode Investing is an AI-powered platform that helps users automate their stock research process. The platform offers a range of tools such as an AI Chat assistant, Stock Screener, Earnings Calls analysis, SEC Filings analysis, and more. Users can easily find and analyze stocks by simply entering the stock name or ticker. Decode Investing aims to simplify the investment process by providing valuable insights and data to make informed decisions. The platform is designed to cater to both novice and experienced investors, offering a user-friendly interface and comprehensive features.

Reportify

Reportify is an AI platform for investment research that provides detailed analysis and insights on various companies, filings, transcripts, reports, and news. Users can explore financial data, performance metrics, and market trends to make informed investment decisions. The platform offers a comprehensive view of the investment landscape, including company histories, financial reports, and industry analysis.

Valuemetrix

Valuemetrix is an AI-enhanced investment analysis platform designed for investors seeking to redefine their investment journey. The platform offers cutting-edge AI technology, institutional-level data, and expert analysis to provide users with well-informed investment decisions. Valuemetrix empowers users to elevate their investment experience through AI-driven insights, real-time market news, stock reports, market analysis, and tailored financial information for over 100,000 international publicly traded companies.

EarningsCall.ai

EarningsCall.ai is an AI-powered tool that provides stock earnings call summaries and insights, saving users hours of reading transcripts. It allows users to compare competitors, analyze trends, and generate their own insights. The tool is designed for business leaders, financial professionals, consultants, and advisors to track competitor earnings, assess market trends, and optimize investment strategies.

Pantarai

Pantarai is an AI-powered adaptive investment platform that offers an intelligent system to interpret financial markets in real time. The platform's proprietary AI expert system, Cartesio, manages daily ETP allocation supervised by real humans. Pantarai's adaptive investment strategy adjusts to shifting market conditions, aiming to deliver consistent returns with smoother volatility across a wide range of market outcomes. The platform invests in stock, bond, commodity, and cash proxy indices via low-cost ETFs, with a focus on multi-asset investing, systematic and AI-powered processes, tactical asset rotation, and resilience in market outcomes.

Monexa

Monexa is a professional-grade financial analysis platform that offers institutional-grade market insights, news, and data analysis in one powerful platform. It provides comprehensive market analysis, AI-powered insights, rich data visualizations, research and analysis tools, advanced screener, rich financial history, automated SWOT analysis, comprehensive reports, interactive performance analytics, institutional investment tracking, company intelligence, dividend analysis, earnings call analysis, portfolio analytics, strategy explorer, real-time market intelligence, and more. Monexa is designed to help users make data-driven investment decisions with a comprehensive suite of analytical capabilities.

STRProfitMap

STRProfitMap is an AI-powered tool designed for Short-Term Rental (STR) investors to make informed and profitable decisions in the Airbnb market. It provides reliable revenue data sourced from Airbnb and VRBO, detailed analytics, profit maps, and AI-driven buy boxes to streamline the investment process. The platform curates data from over 11,000 cities/markets, offering insights into occupancy rates, average daily rates, property values, and estimated Return On Investments. By focusing on reliable listings with proven performance, STRProfitMap aims to reduce noise and uncertainty in the market, helping users identify top-performing markets with confidence.

Moning

Moning is a platform designed to help users manage and boost their wealth easily. It provides tools for a global view of wealth, making better investment decisions, avoiding costly mistakes, and increasing performance. With features like AI Analysis, Dividends calendar, and Dividend and Growth Safety Scores, Moning offers a mix of Human & Artificial Intelligence to enhance investment knowledge and decision-making. Users can track and manage their wealth through a comprehensive dashboard, access detailed information on stocks, ETFs, and cryptos, and benefit from quick screeners to find the best investment opportunities.

Bhavv

Bhavv is India's first and most powerful AI platform for Nifty and Bank Nifty Options buying. The platform offers automated trade management, personalized risk management, integrated stop loss, and a user-friendly interface. Bhavv's AI algorithms continuously analyze market data to create and manage a diversified trading portfolio tailored to individual goals and risk tolerance. The platform aims to revolutionize trading by simplifying the process and making it more accessible and enjoyable for traders.

AMD AI Solutions

AMD AI Solutions is a leading AI innovation platform with a broad portfolio, open ecosystem, and cutting-edge technology for data centers, edge computing, and clients. The platform offers end-to-end solutions powered by CPUs, GPUs, accelerators, networking, and open software, delivering unmatched flexibility and performance. AMD enables accelerated AI outcomes, sustained AI success, and is recognized as a trusted AI partner. With a commitment to minimizing costs, prioritizing security, and staying flexible, AMD empowers businesses and consumers to scale AI deployments effectively and efficiently.

Delta3 AI

Delta3 AI is an AI-powered tool that offers advanced stock analysis and insights to help investors make informed decisions. The application leverages artificial intelligence technology to analyze market trends and identify stocks with breakout potential. Users can receive alerts on high-potential stock movements and expert analysis to guide their investment strategies. Additionally, Delta3 AI provides services such as investor relations support, investor presentations, message development, and analyst relations to enhance communication with investors and maximize shareholder value.

Trade Ideas

Trade Ideas is an AI-driven stock scanning and charting platform designed to meet the needs of active traders. It provides powerful tools such as real-time market scanning, AI-driven trade signals, customizable alerts, advanced charting capabilities, and time-saving data visualization. Trade Ideas offers users the confidence to make smarter trading decisions and the freedom to conquer markets anytime, anywhere. The platform also includes features like a trading simulator for practicing new strategies, Picture in Picture charts for visualizing multiple timeframes, and integration with leading brokers and trading platforms.

0 - Open Source AI Tools

20 - OpenAI Gpts

Family Asset Management

Guides asset allocation in family segments, focusing on investments.

Market Maven

An analyst versed in investment strategies and philosophies of financial icons.

Stock Market Analyst

I read and analyze annual reports of companies. Just upload the annual report PDF and start asking me questions!

Earnings Analyzer

I assist you in understanding the details of a company's financial results based on provided earnings data. If you have an earnings report you'd like me to analyze, feel free to share it, and I'll provide detailed insights and interpretations!

Tech Stock Analyst

Analyzes tech stocks with in-depth, qualitative and quantitative analysis

13F Research Assistant

Expert in 13F filings analysis backed by specific APIs and 13F Database

Value Investor's Stock Assistant

I assist in analyzing stocks with a detail-oriented, patient, data-driven approach, drawing from a wide range of expert authors.

Digital Assets @ FS

Consultant on digital assets in financial services, using a pricing study for insights.

Warren Wisdom

Echoing Warren Buffett's shrewd financial acumen including visual analysis of his latest portfolio.

Financial Sentiment Analyst

A sentiment analysis tool for evaluating management-related texts.