Best AI tools for< Stock Market Analyst >

Infographic

20 - AI tool Sites

BigShort

BigShort is a real-time stock charting platform designed for day traders and swing traders. It offers a variety of features to help traders make informed decisions, including SmartFlow, which visualizes real-time covert Smart Money activity, and OptionFlow, which shows option blocks, sweeps, and splits in real-time. BigShort also provides backtested and forward-tested leading indicators, as well as live data for all NYSE and Nasdaq tickers.

Stock Market GPT

Stock Market GPT is an AI-powered investment research tool that provides investors with in-depth analysis and insights into global equities. It uses advanced AI models, including GPT-4, to help investors make better investment decisions. The tool offers a range of features, including stock comparison, live data, and growth-focused pricing.

AnalyStock.ai

AnalyStock.ai is a financial application leveraging AI to provide users with a next-generation investment toolbox. It helps users better understand businesses, risks, and make informed investment decisions. The platform offers direct access to the stock market, powerful data-driven tools to build top-ranking portfolios, and insights into company valuations and growth prospects. AnalyStock.ai aims to optimize the investment process, offering a reliable strategy with factors like A-Score, factor investing scores for value, growth, quality, volatility, momentum, and yield. Users can discover hidden gems, fine-tune filters, access company scorecards, perform activity analysis, understand industry dynamics, evaluate capital structure, profitability, and peers' valuation. The application also provides adjustable DCF valuation, portfolio management tools, net asset value computation, monthly commentary, and an AI assistant for personalized insights and assistance.

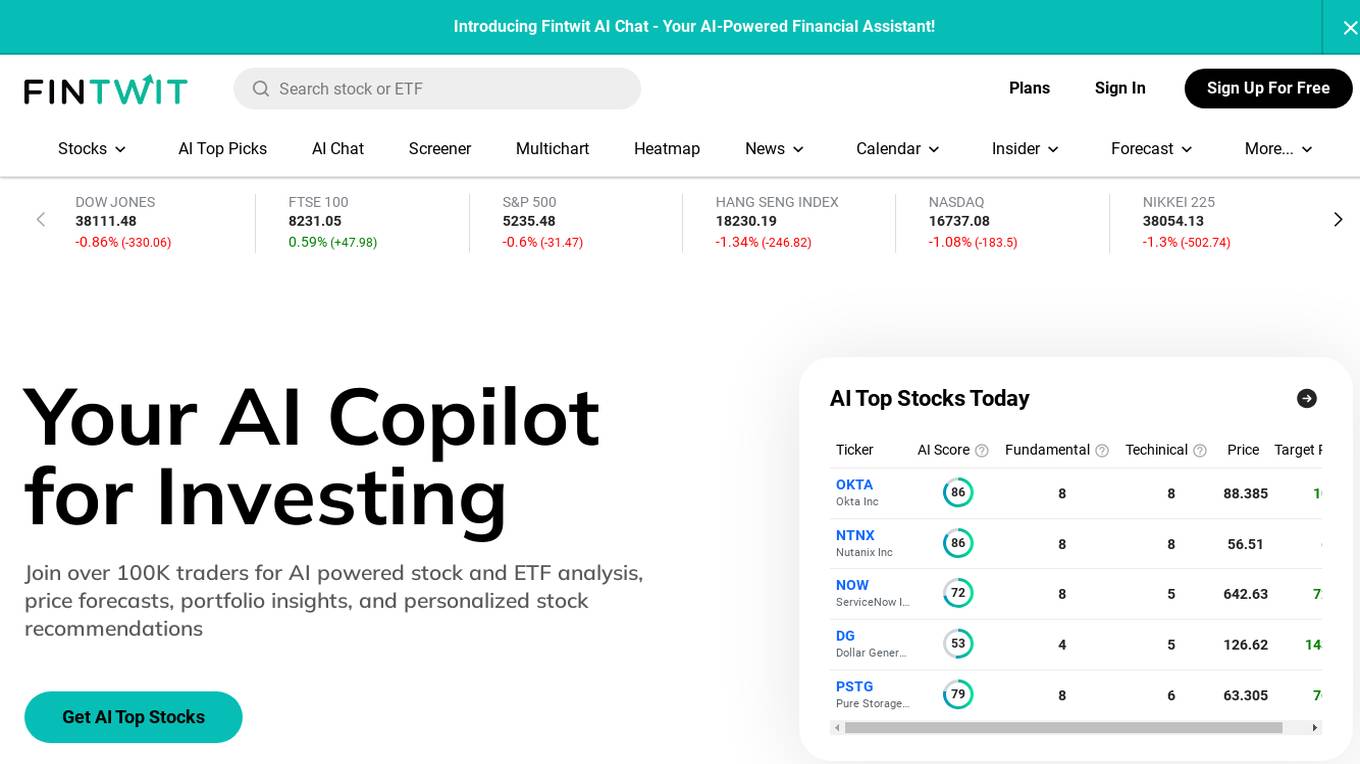

Fintwit

Fintwit is an AI-powered stock market analysis tool that provides users with stock market quotes, free screener, AI top picks, AI stock analysis, market news, and trading signals. The platform leverages artificial intelligence to offer valuable insights and recommendations to investors and traders. With Fintwit, users can access real-time data, make informed investment decisions, and stay updated on the latest market trends.

Chicago Bull AI Wallstreet Chatbot

Chicago Bull AI Wallstreet Chatbot is an AI application designed to provide users with real-time information and insights on the stock market. Users can interact with the chatbot to ask questions related to equities, crypto, or bond markets. The chatbot is not affiliated with the Chicago Bulls organization or the National Basketball Association. It aims to assist users in making informed investment decisions by providing market updates and analysis.

MarketGPT

MarketGPT is an artificial intelligence model trained to predict stock movements based on news items. It evaluates the news and decides how the company stock is going to be affected by it. Users can access the model through the MarketGPT website or mobile app to get stock predictions and picks. The model's performance can be viewed for different time frames such as 1 week, 1 month, and 1 year. However, users are advised that investing in stocks and derivatives carries a risk of financial loss, and past performance is not a guarantee of future performance. MarketGPT is designed to assist users in making informed decisions in the stock market.

Numerai

Numerai is a data science tournament platform where users can compete to build models that predict the stock market. The platform provides users with clean and regularized hedge fund quality data, and users can build models using Python or R scripts. Numerai also has a cryptocurrency, NMR, which users can stake on their models to earn rewards.

stockinsights.ai

stockinsights.ai is an AI-powered equity research assistant platform designed to enhance financial research capabilities for value investors. The platform allows users to deep dive into public company filings and earnings transcripts with AI-powered features. It covers US and India markets, providing insights from multiple datasets, generative AI-powered summaries, proactive notifications, and precision AI-based tags to streamline research. The platform is recognized by industry leaders and fintech innovators, offering custom solutions and API integration for personalized research needs.

Kavout

Kavout is an AI-powered financial research assistant that provides investors with data-driven insights and cutting-edge technology to help them make informed investment decisions. The platform offers a range of features, including natural language search, stock screening, portfolio analysis, and personalized recommendations. Kavout's AI algorithms adapt to each user's unique investment style, providing tailored insights and guidance.

Meyka Share Chat

Meyka is an AI-powered stock research tool that provides users with real-time stock data and analysis. Users can explore financial health, social sentiment analysis, earnings reports, comparison of financial statements, stock market news, DCF value, stock price forecasting, and recent grades for various stocks. The tool aims to assist users in making informed investment decisions by leveraging AI technology to analyze and predict stock market trends.

Tickeron

Tickeron is an AI trading platform that offers a variety of tools and features to enhance trading in the stock market. It provides AI predictions for stocks, ETFs, forex, and other assets, empowering users with accurate stock predictions and trend insights. The platform includes AI robots for virtual accounts, trend predictions, pattern search engines, and real-time patterns. Additionally, Tickeron offers tools for traders and investors, such as stock portfolio wizards, active portfolios, model portfolios, and 401(k) portfolios. Users can also explore the marketplace for trading and investing tools, join trader and investor clubs, and access educational resources to improve their trading skills.

Tradytics

Tradytics is an AI-powered platform that simplifies complex trading data, making it accessible and actionable for every trader. With expertise in AI, Tradytics mines data that only Wall Street professionals have access to, providing a one-stop shop for all traders. The platform combines news for every stock, summarizes them with AI, and offers high-quality data worth millions to retail traders. Tradytics is available on all platforms, including Web, iOS, and Android, with lightweight mobile apps. The platform also offers Discord integration through bots for data access within Discord servers.

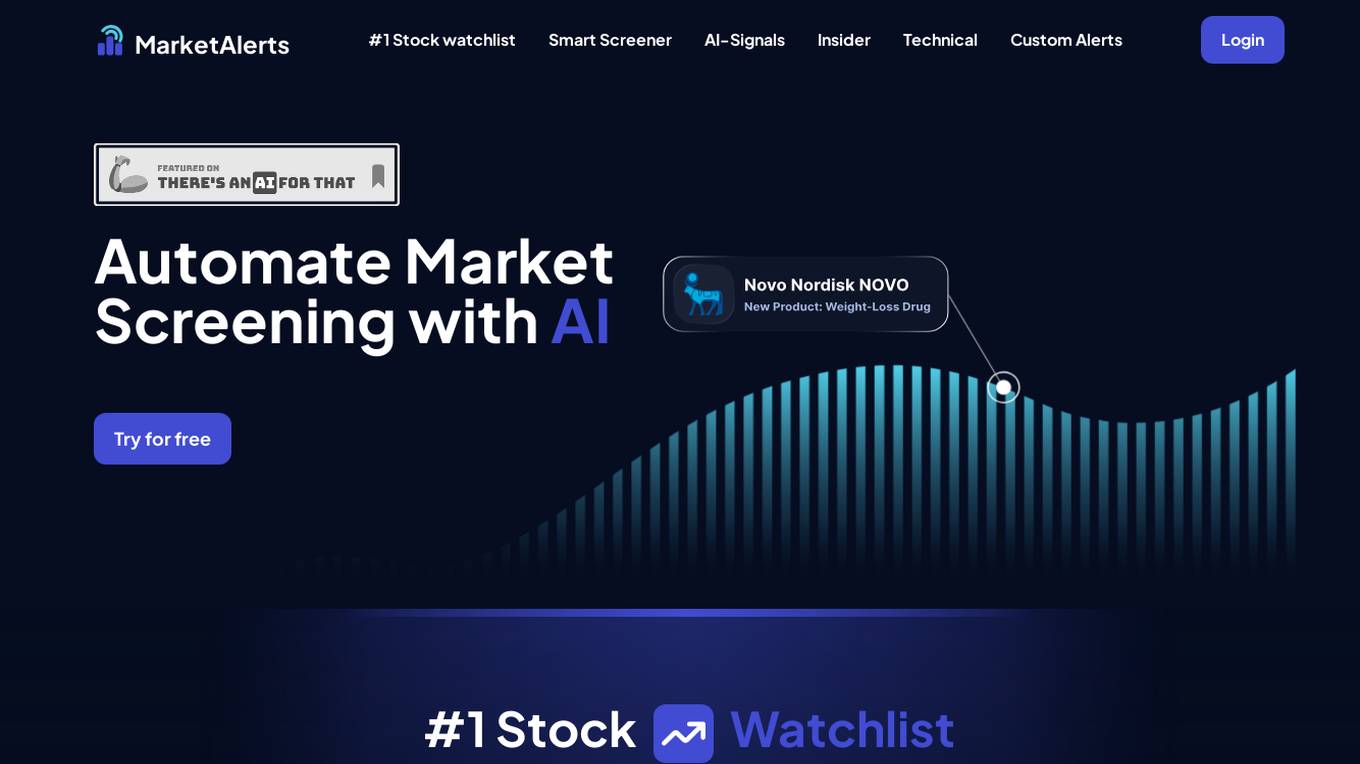

MarketAlerts

MarketAlerts is an AI-powered stock signals and analytics platform that offers users the ability to monitor stock market activities, receive personalized alerts, and make informed investment decisions. The platform utilizes artificial intelligence to analyze market data, identify trends, and provide real-time insights to help users stay ahead in the stock market. With features like smart screener, insider technical analysis, custom alerts, and AI-powered signals, MarketAlerts is designed to cater to both novice and experienced investors seeking to optimize their trading strategies.

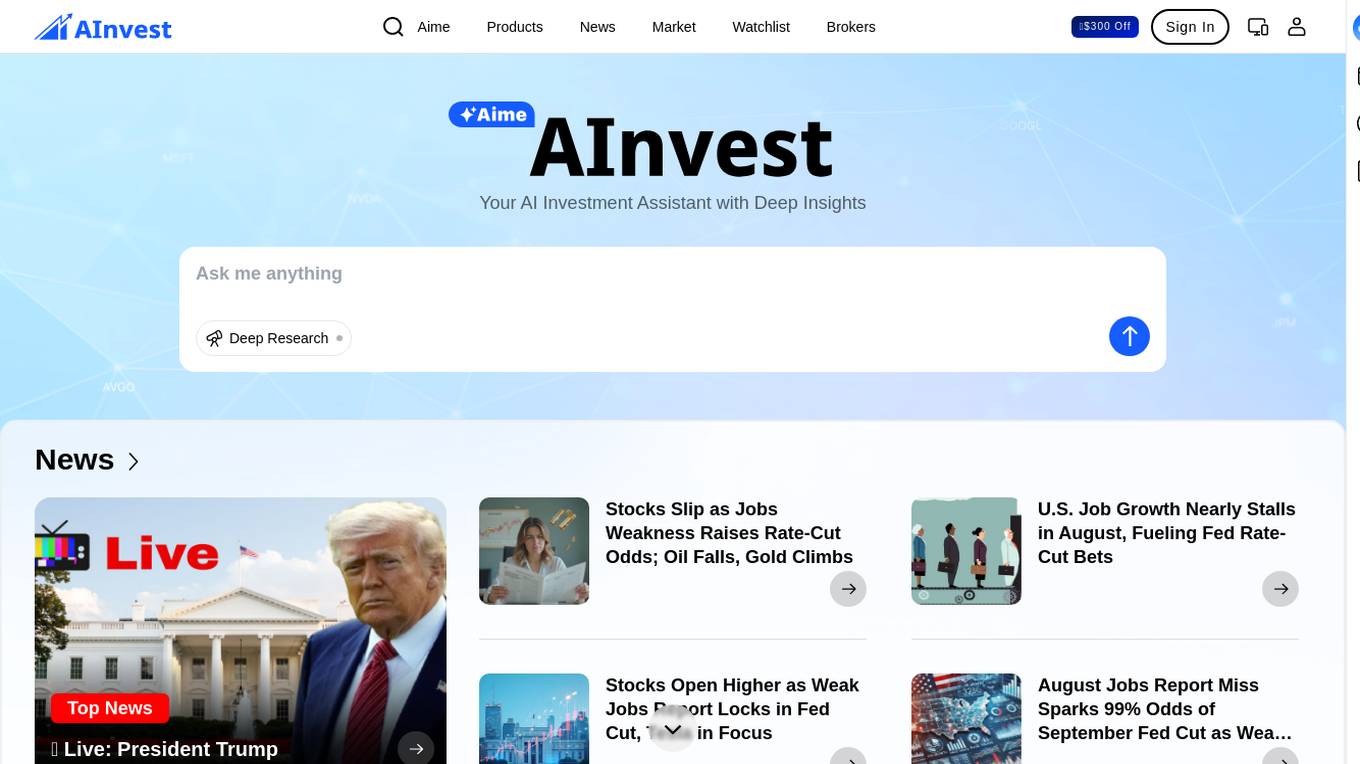

AInvest

AInvest is an AI-powered stock analysis platform that provides users with comprehensive insights, news, and tools for making informed investment decisions. The platform utilizes advanced AI algorithms to analyze market trends, identify investment opportunities, and offer personalized recommendations to users. AInvest aims to empower investors with deep research, real-time news updates, and market analysis to help them navigate the complexities of the stock market effectively.

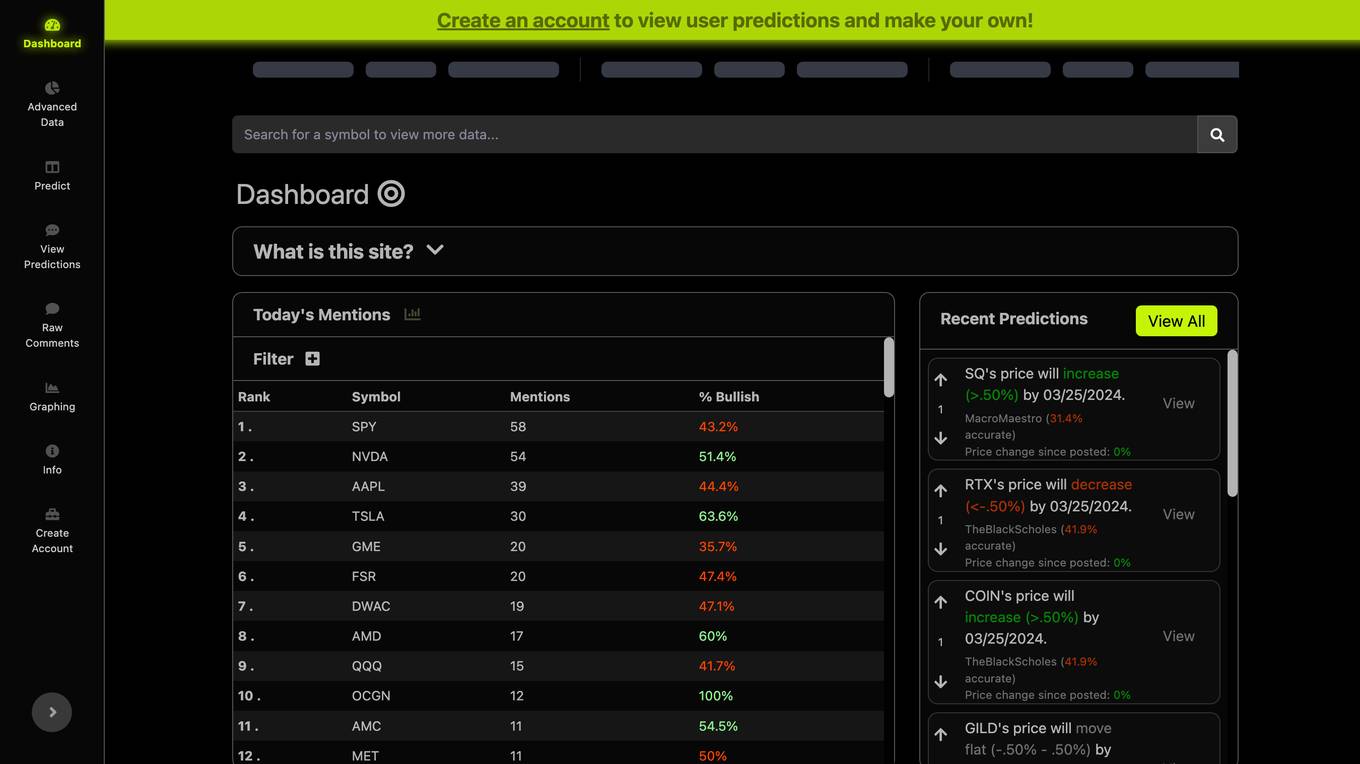

MonkeeMath

MonkeeMath is an AI tool designed to scrape comments from Reddit and Stocktwits containing stock tickers. It utilizes ChatGPT to analyze the sentiment of these comments, determining whether they are bullish or bearish on the outlook of the ticker. The data collected is then used to generate charts and tables displayed on the website, providing insights into the sentiment surrounding various stocks.

Stockpulse

Stockpulse is an AI-powered platform that analyzes financial news and communities using Artificial Intelligence. It provides decision support for operations by collecting, filtering, and converting unstructured data into processable information. With extensive coverage of financial media sources globally, Stockpulse offers unique historical data, sentiment analysis, and AI-driven insights for various sectors in the financial markets.

RockFlow

RockFlow is an AI-powered fintech platform that simplifies investing by offering AI-first trading experiences. The platform, powered by Bobby AI, allows users to build AI portfolios, execute trades, manage portfolios, and receive real-time trading opportunities. With features like Copy Trading, simplified options trading, and access to a wide range of investment products, RockFlow aims to empower users to make informed investment decisions effortlessly. The platform also prioritizes customer service and security, ensuring a safe and reliable trading environment for users.

Meyka

Meyka is an AI-powered real-time stock and crypto news platform that provides investors with historical data to make informed decisions. The platform offers features such as AI chat, signals screener, market trending news, business executive trades insights & guides, investing education, and technical indicators. Meyka aims to transform how users analyze, research, and trade stocks by combining advanced machine learning with real-time market data.

StockHero

StockHero is a highly-rated stock trading bot that allows users to trade intelligently with a high win rate. The platform offers preset bots from the Marketplace for users to deploy in minutes, automating trades on leading brokerages. StockHero caters to users of all levels, from beginners to experienced traders, providing features like TradingView integration, Strategy Designer, and advanced indicator settings. The platform also offers a White-Glove Service for personalized guidance, paper trading for risk-free practice, and an AI ChatBot for financial queries. With a focus on risk management and user satisfaction, StockHero aims to enhance the trading experience for all users.

Intellectia.AI

Intellectia.AI is a powerful AI platform designed to provide smarter investment insights for investors across stocks, ETFs, and cryptocurrencies. The platform offers advanced technical analysis, tailored stock analysis, and quick insights on market trends. With over 100 supported indicators, Intellectia.AI empowers investors with actionable insights derived from AI-driven analysis. The platform also features a dedicated news section summarizing financial news using AI, ensuring users stay informed about events affecting stock movements. Intellectia.AI aims to democratize financial information intelligence through AI, making it accessible to investors of all levels, from individuals to large institutions.

0 - Open Source Tools

20 - OpenAI Gpts

Stock Market Analyst

I read and analyze annual reports of companies. Just upload the annual report PDF and start asking me questions!

StockTrends

A Stock analyst who finds daily most active gainers and losers, reporting the reasons behind their price fluctuation

Stock Market Assistant

Your go-to stock market guru. feel free to upload your charts aswell.

Finance Wizard

I predict future stock market prices. AI analyst. Your trading analysis assistant. Press H to bring up prompt hot key menu. Not financial advice.

Forex Rates - Free Version

ForexGPT's free version pulls real-time rates for forex pairs & prices for finance symbols such as bitcoin and stock market indices (i.e. SPX500, NAS100, BTCUSD, EURUSD), performs market forecasts and analysis, w/ prompt-generated chart links to our custom TradingView charts. Not financial advice.

Market Maven

An analyst versed in investment strategies and philosophies of financial icons.

股票预测分析专家 | A股 | 实时数据

一款基于深度神经网络预测给出中国A股股票买入建议的智能投资顾问 An intelligent investment advisor based on deep neural network for predicting buy recommendations for Chinese A-share stocks.