Best AI tools for< Quantitative Data Analyst >

Infographic

20 - AI tool Sites

Web3 Summary

Web3 Summary is an AI-powered platform that simplifies on-chain research across multiple chains and protocols, helping users find trading alpha in the DeFi and NFT space. It offers a range of products including a trading terminal, wallet study tool, Discord bot, mobile app, and Chrome extension. The platform aims to streamline the process of understanding complex crypto projects and tokenomics using AI and ChatGPT technology.

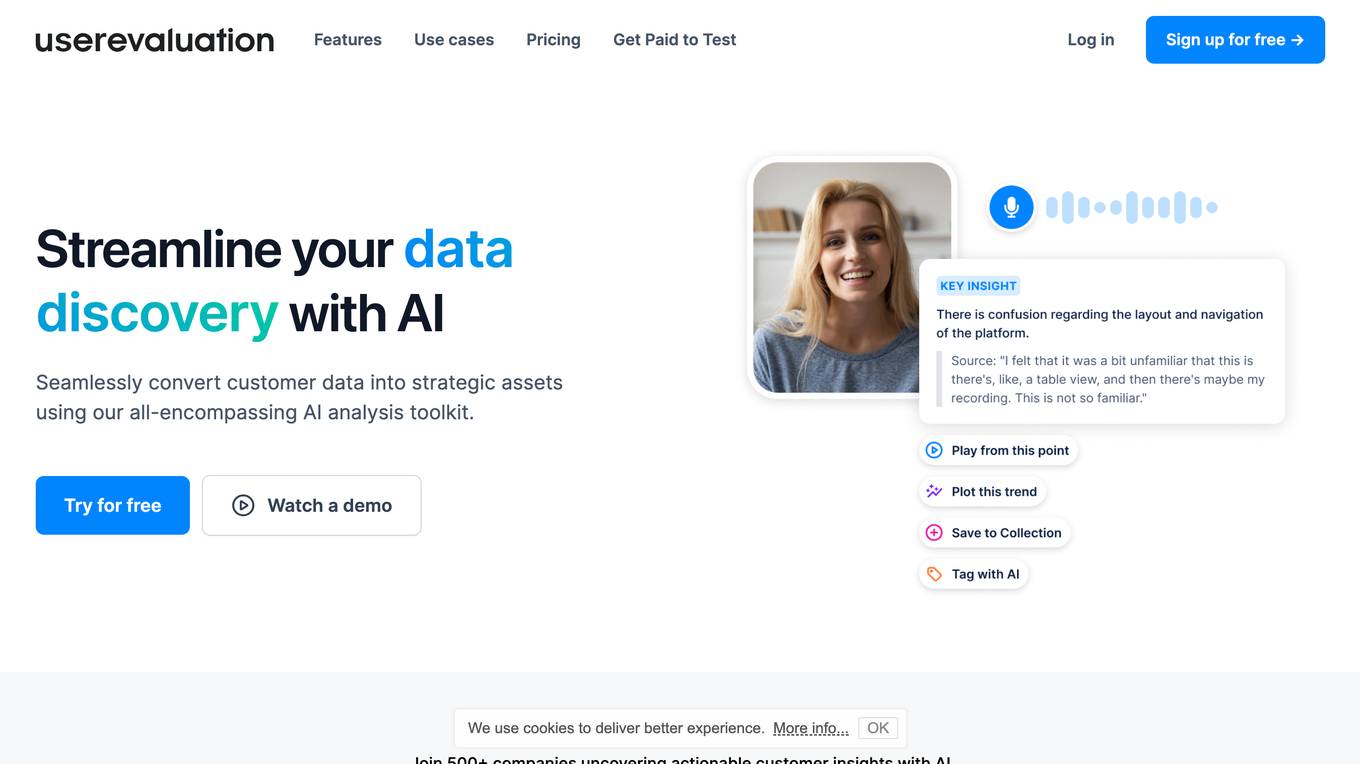

User Evaluation

User Evaluation is an AI-first user research platform that leverages AI technology to provide instant insights, comprehensive reports, and on-demand answers to enhance customer research. The platform offers features such as AI-driven data analysis, multilingual transcription, live timestamped notes, AI reports & presentations, and multimodal AI chat. User Evaluation empowers users to analyze qualitative and quantitative data, synthesize AI-generated recommendations, and ensure data security through encryption protocols. It is designed for design agencies, product managers, founders, and leaders seeking to accelerate innovation and shape exceptional product experiences.

Personno.ai

Personno.ai is an AI-driven market research platform that provides businesses with access to a pool of AI-generated respondents. These respondents are designed to mimic the behavior and characteristics of real human respondents, allowing businesses to conduct research studies quickly and cost-effectively. Personno.ai's platform includes a range of features that make it easy to create and manage research studies, including the ability to create custom audiences, conduct real-time interviews, and collect both qualitative and quantitative data.

WhyHive

WhyHive is an AI-powered data analysis tool that helps users find and code key themes in their data, then visualize their findings with beautiful, shareable charts. It is designed to be easy to use, even for those with no prior experience with data analysis. WhyHive can analyze thousands of rows of data in minutes, saving users hours of manual coding time. It can also be used to analyze both quantitative and qualitative data, making it a versatile tool for a variety of research projects.

SocialGuard.co

SocialGuard.co is a website that currently faces an issue with an invalid SSL certificate, causing an error code 526. The website is hosted on Cloudflare and provides information on the SSL certificate error. Users visiting the site are advised to wait a few minutes if they encounter the error. For website owners, the error indicates a problem with the SSL certificate validation, possibly due to expiration or incorrect configuration. The site recommends contacting the hosting provider to resolve the issue.

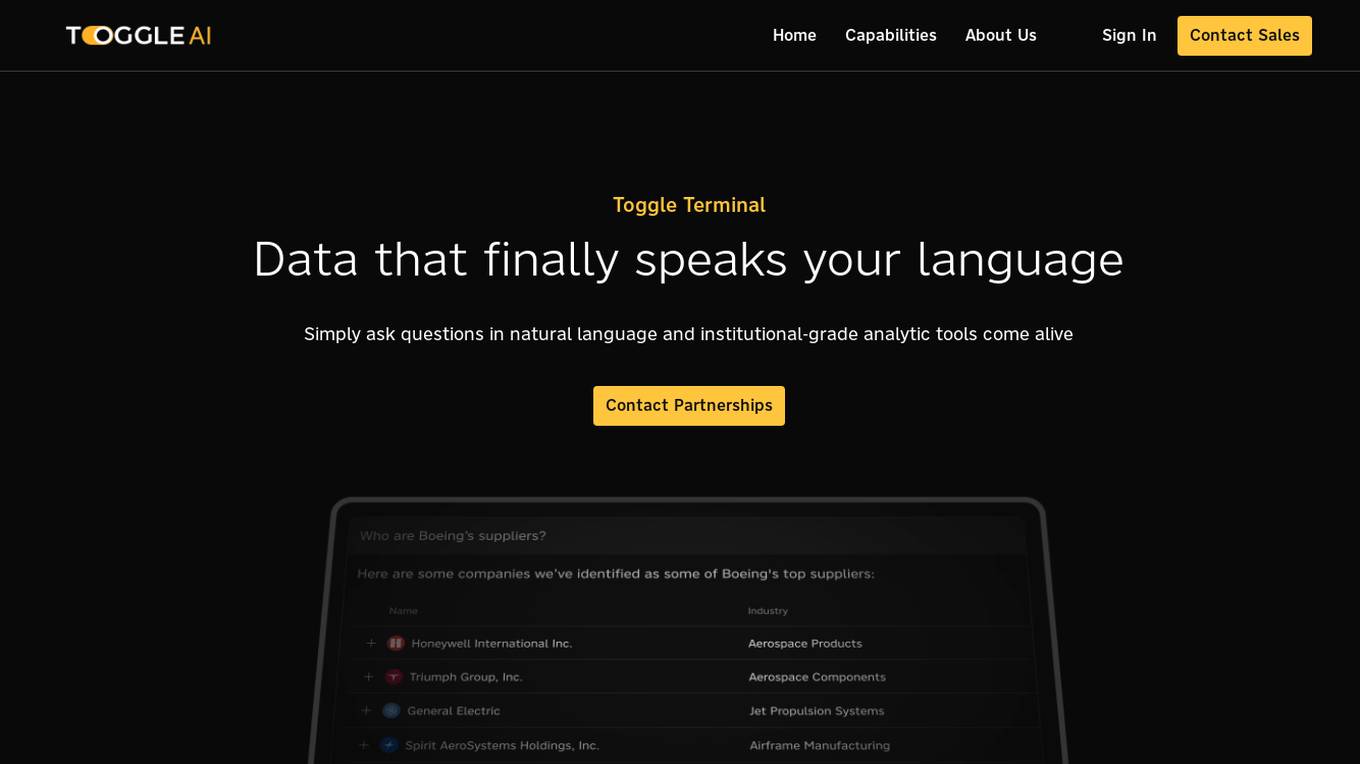

Toggle Terminal

Toggle Terminal is an AI-powered platform that brings data to life with natural language. It offers a suite of award-winning analytic tools wrapped in an accessible, natural language-based user experience. Users can ask questions in plain language and receive immediate, data-backed answers without the need for coding or spreadsheet manipulation. Toggle Terminal provides institutional-grade analytical tools for scenario testing, asset intelligence, chart exploration, and idea discovery. It helps users connect data, test market hypotheses, screen securities, and explore hidden relationships between organizations. Additionally, Toggle AI offers customized AI solutions and integrations for institutional investors in asset management and capital markets.

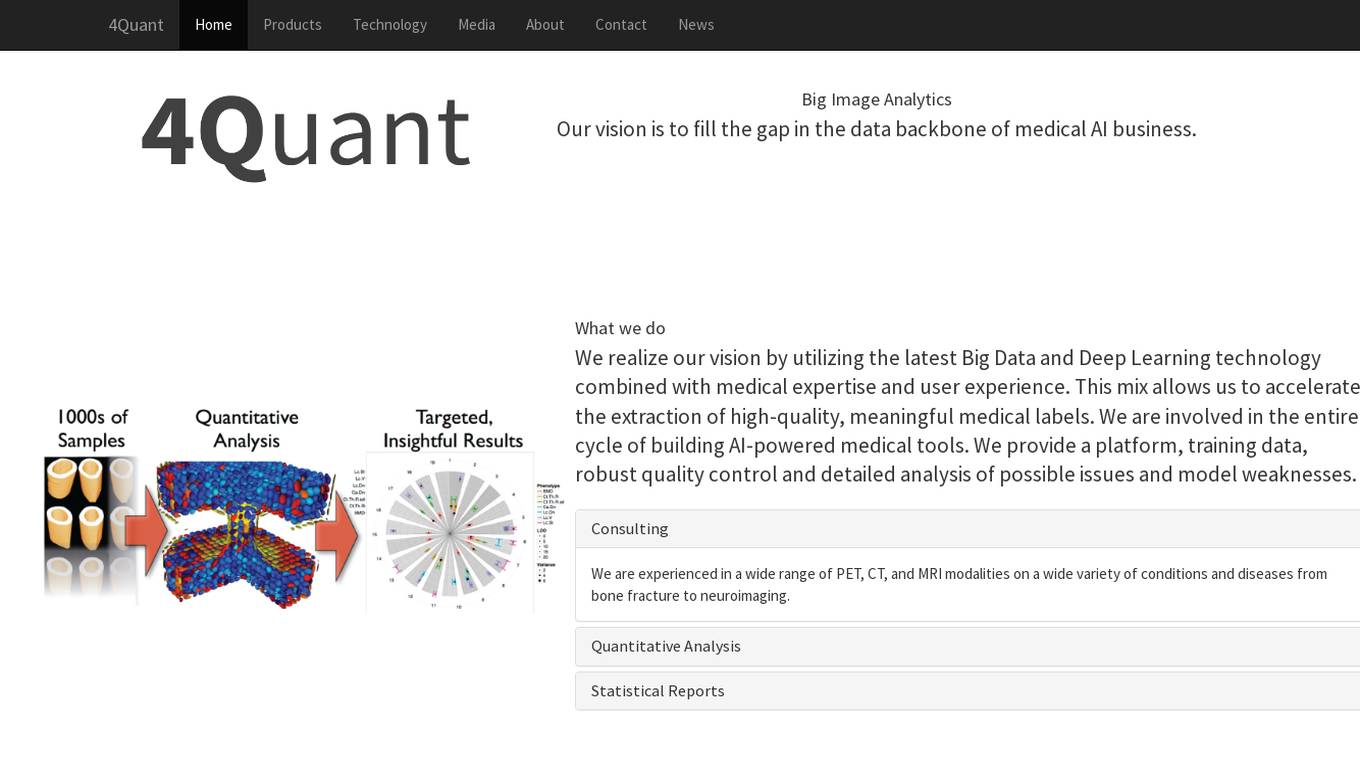

4Quant

4Quant is an AI-powered medical imaging platform that utilizes Big Data and Deep Learning technology to accelerate the extraction of high-quality medical labels. The platform offers a range of tools for image analysis, annotation, and data analytics in the medical field. 4Quant aims to provide scalable solutions for medical imaging analysis, statistical reporting, and personalized training in image analysis. The platform is built on the latest Big Data framework, Apache Spark, and integrates with cloud computing for efficient processing of large datasets.

Deepcell

Deepcell is a company that develops technology for single-cell analysis. Their REM-I platform combines label-free imaging, deep learning, and gentle sorting to leverage single cell morphology as a high-dimensional quantitative readout. This allows researchers to gain insights into cells' phenotype and function to address important research questions across biology.

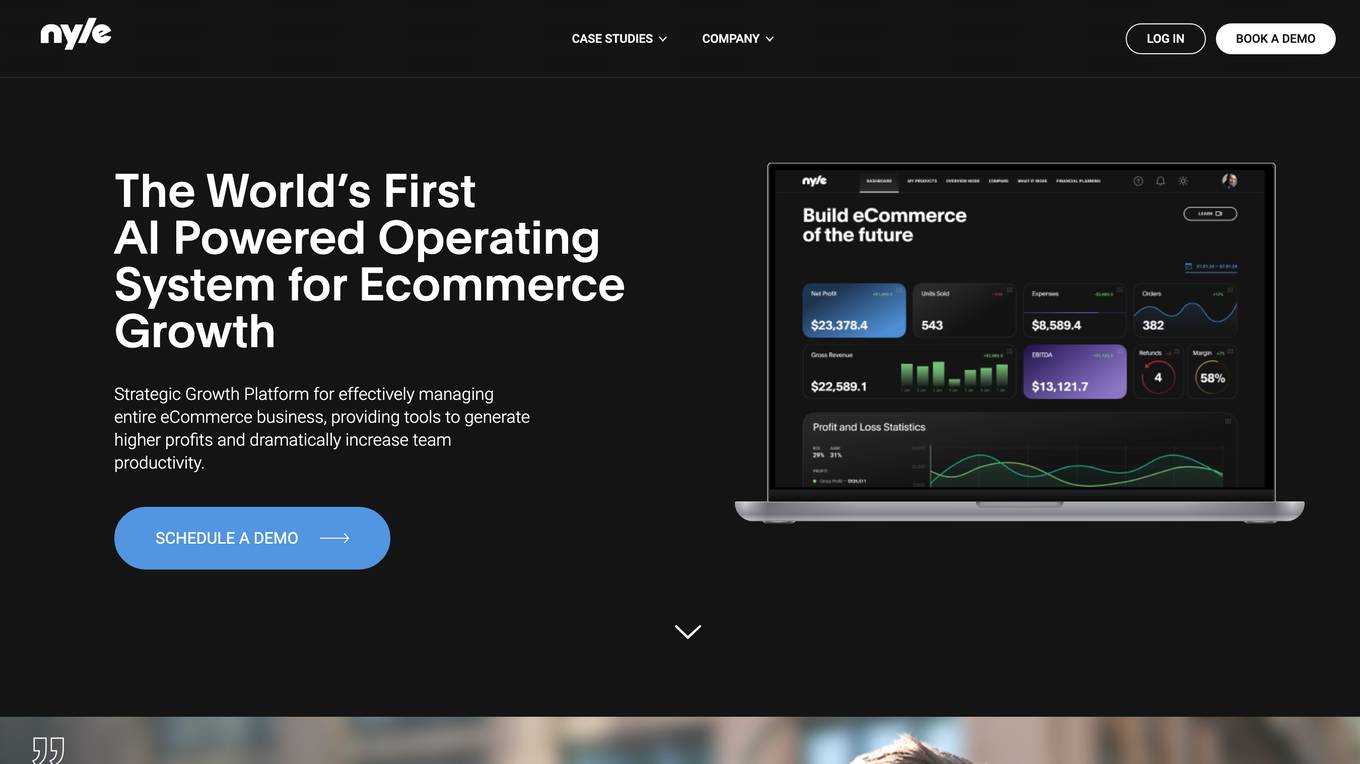

Nyle

Nyle is an AI-powered operating system for e-commerce growth. It provides tools to generate higher profits and increase team productivity. Nyle's platform includes advanced market analysis, quantitative assessment of customer sentiment, and automated insights. It also offers collaborative dashboards and interactive modeling to facilitate decision-making and cross-functional alignment.

Stockpulse

Stockpulse is an AI-powered platform that analyzes financial news and communities using Artificial Intelligence. It provides decision support for operations by collecting, filtering, and converting unstructured data into processable information. With extensive coverage of financial media sources globally, Stockpulse offers unique historical data, sentiment analysis, and AI-driven insights for various sectors in the financial markets.

Three Sigma

Three Sigma is a quantitative hedge fund that uses advanced artificial intelligence and machine learning techniques to identify and exploit trading opportunities in global financial markets.

STRATxAI

STRATxAI is an AI-powered quantitative investment platform that offers custom AI model portfolios tailored to clients' investment philosophy, risk tolerance, and objectives. The platform harnesses machine learning to deliver data-driven insights for security analysis, portfolio construction, and management. Powered by the proprietary investment engine Alana, STRATxAI processes over 8 billion financial data points daily to uncover hidden alpha beyond traditional methods. Clients benefit from smarter decision-making, better risk-adjusted returns, optimized portfolio management, and savings on resources. The platform is designed to enhance investment decisions for forward-thinking investors by leveraging AI technology.

TrendEdge

TrendEdge is an AI-driven platform that revolutionizes investment strategies by providing comprehensive insights through the analysis of real-time social trends and alternative data sources. It offers exclusive data access, AI-powered stock signals, and personalized recommendations to help users make informed and confident investment decisions. The platform integrates diverse data sources, including social media sentiment, technical indicators, and fundamental analysis, to provide a nuanced market view and uncover hidden trends.

Tradytics

Tradytics is an AI-powered platform that simplifies complex trading data, making it accessible and actionable for every trader. With expertise in AI, Tradytics mines data that only Wall Street professionals have access to, providing a one-stop shop for all traders. The platform combines news for every stock, summarizes them with AI, and offers high-quality data worth millions to retail traders. Tradytics is available on all platforms, including Web, iOS, and Android, with lightweight mobile apps. The platform also offers Discord integration through bots for data access within Discord servers.

Avanzai

Avanzai is a workflow automation tool tailored for financial services, offering AI-driven solutions to streamline processes and enhance decision-making. The platform enables funds to leverage custom data for generating valuable insights, from market trend analysis to risk assessment. With a focus on simplifying complex financial workflows, Avanzai empowers users to explore, visualize, and analyze data efficiently, without the need for extensive setup. Through open-source demos and customizable data integrations, institutions can harness the power of AI to optimize macro analysis, instrument screening, risk analytics, and factor modeling.

Sagehood

Sagehood is an AI-driven platform that provides real-time market intelligence for investors in the finance sector. By harnessing AI-driven insights, Sagehood helps users stay ahead in the dynamic world of finance by offering intelligent analysis, deep-dive analysis, strategic execution, and intelligent synthesis. The platform aims to optimize investment strategies and enhance decision-making by leveraging AI technology to analyze vast amounts of data and provide actionable insights. With advanced features for informed decision-making and a focus on minimizing bias while maximizing insight, Sagehood offers tailored intelligence to help users make data-driven investment decisions.

AI Signals

AI Signals is an AI trading application that provides cutting-edge AI trading tools and signals for a diverse range of crypto pairs. The platform offers advanced AI algorithms that ensure precise and timely signals for trading, enhancing trading performance and delivering consistent long-term success. With a focus on accuracy, reliability, and user satisfaction, AI Signals stands out as the ultimate choice for traders seeking to maximize gains and minimize risks in the cryptocurrency market.

Token Metrics

Token Metrics is an AI-powered crypto trading and research platform that provides users with real-time market trends, live trade alerts, and AI grades to help make informed investment decisions. With features like AI ratings, personalized research, and trading signals, Token Metrics aims to empower users to navigate the cryptocurrency markets effectively. Trusted by over 70,000 crypto investors, Token Metrics offers a comprehensive suite of tools and resources to enhance crypto investment strategies.

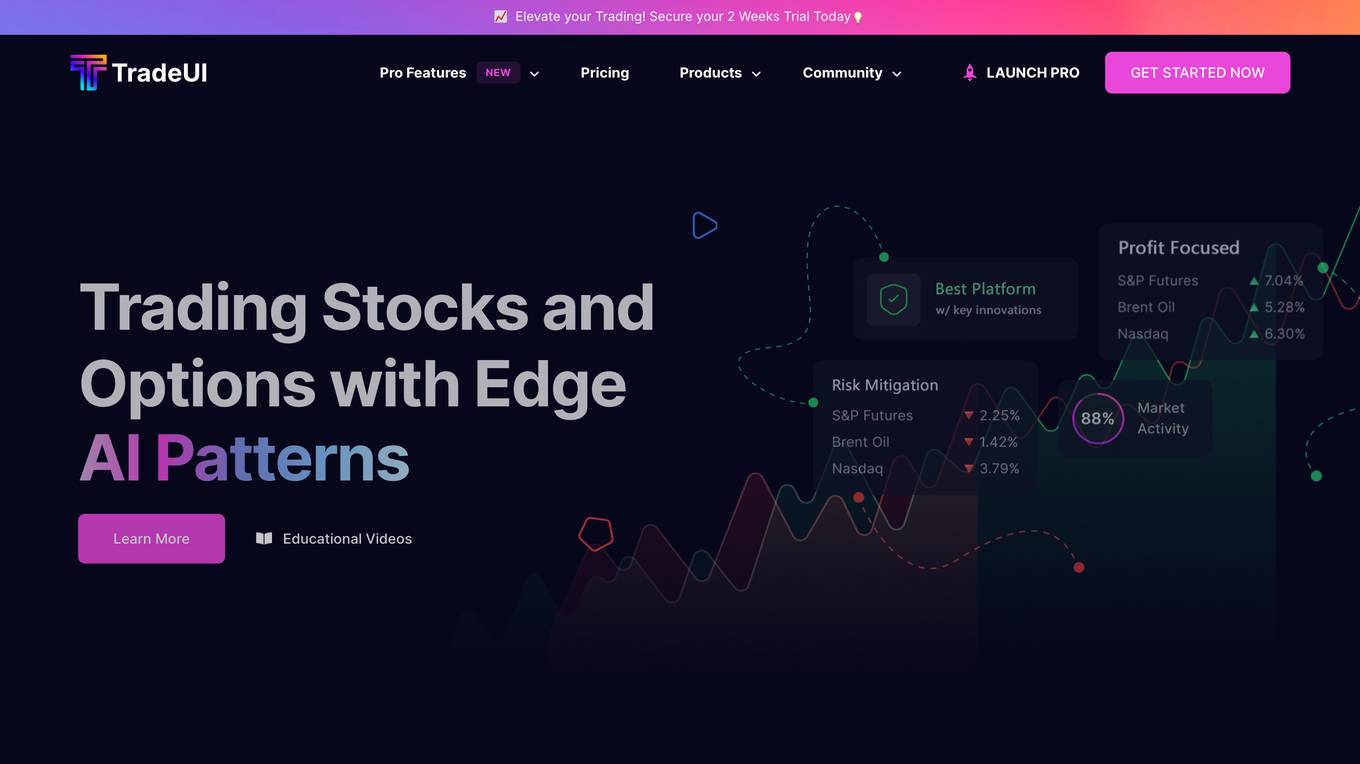

TradeUI

TradeUI is a comprehensive trading platform that provides advanced tools and resources for stock and options traders. It offers a range of features powered by artificial intelligence (AI), including AI sentiment analysis, option flow analysis, and AI pattern recognition. These tools help traders make informed decisions and identify potential trading opportunities. TradeUI also provides educational videos, a vibrant community, and a unified ecosystem for traders to connect and share knowledge.

Dark Pools

Dark Pools is a leading provider of AI-powered solutions for the financial industry. Our mission is to empower our clients with the tools and insights they need to make better decisions, improve their performance, and stay ahead of the competition. We offer a range of products and services that leverage AI to automate tasks, optimize workflows, and generate actionable insights. Our solutions are used by a wide range of financial institutions, including hedge funds, asset managers, and banks.

0 - Open Source Tools

20 - OpenAI Gpts

Quant Jiang

"My quantitative, my math specialist. Look at him, you notice anything different about him? Look at his face."

MilaexGPT

Mila-ex: Your solution to seamless data and price retrieval across cryptocurrency exchanges, through our unified and simple RESTful API.

Math Mentor XL

Expert math tutor and problem solver with online research and data analysis skills.

How to Measure Anything

对各种量化问题进行拆解和粗略的估算。注意这种估算主要是靠推测,而不是靠准确的数据,因此仅供参考。理想情况下,估算结果和真实值差距可能在1个数量级以内。即使数值不准确,也希望拆解思路对你有所启发。

Nimbus

Expert in CFA, quant, software engineering, data science, and economics for investment strategies.

VaultCraft Trainer

VaultCraft trains users to create automated yield strategies using the VaultCraft VCI & SDK